Federal Budget: How much you will get from tax cuts

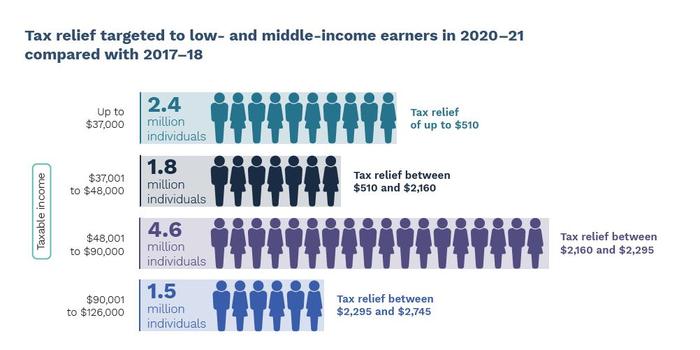

More than 11 million Australians will get a tax cut this year – and it’ll be backdated, meaning your tax-home pay will increase within weeks.

Eleven million workers will begin seeing more money in their pay packet within weeks, with fast-tracked tax cuts backdated to July 1.

In handing down the Budget on Tuesday night, Treasurer Josh Frydenberg confirmed that stage two of the Commonwealth’s tax reform plan will be immediately brought forward.

And in an unprecedented move, the Australian Taxation Office is poised to urgently adjust the withholding schedule that determines how much money an employer deducts in tax.

“Australians will have more of their own money to spend on what matters to them, generating billions of dollars of economic activity and creating 50,000 new jobs,” Mr Frydenberg said.

RELATED: Huge budget spending spree

RELATED: What the budget means for you

Once the ATO is confident that the plan is a done deal – either when it passes Parliament or if the Opposition indicates its support – it will activate the changes.

That means that unlike past Budgets, when planned tax cuts were felt when Australians completed their tax returns, an estimated 11.6 million workers will see their take-home pay increase.

There’s no firm date on when this will occur – it depends on the passage of legislation or Labor’s support of the package.

But the Commonwealth is determined it be sooner rather than later.

“More than seven million individuals are expected to receive tax relief of $2000 or more for the 2020-21 income year compared with 2017-18 tax settings,” Mr Frydenberg said.

RELATED: Budget winners and losers revealed

There had been some speculation that workers might receive some kind of ‘bonus’ to account for the time between July 1 and when stage two tax cuts come into effect.

But that won’t be possible and instead anyone who has paid too much tax in that time will be eligible for a refund at the end of the 2020-21 financial year when completing their return.

On top of the fast-tracked tax cuts, low and middle-income earners will receive an additional benefit.

A tax offset for those Australians was due to be removed with the commencement of stage two tax cuts, but it will remain in place for the 2020-21 financial year.

The one-off additional low- and middle-income tax offset is worth up to $1080 for individuals or $2160 for dual income couples.

Around 10.1 million individuals will be eligible for the offset in 2020–21.

That, coupled with tax cuts, means tax relief of up to $2745 for singles and up to $5490 for dual-income families.

“As a proportion of tax payable compared to 2017-18, the greatest benefits will flow to those on lower incomes – with those earning $40,000 paying 21 per cent less tax, and those on $80,000 paying around 11 per cent less tax this year,” Mr Frydenberg said.

Stage three of the government’s tax plan, which would essentially flatten thresholds and see 95 per cent of workers pay a marginal tax rate of 30 cents in the dollar, remain on track for 2024-25.

Tax relief is a key component of the Budget’s measures to fuel the country’s recovery form the economic crisis sparked by coronavirus.

“It will help local businesses to keep their doors open and hire more staff,” Mr Frydenberg said.

Treasury estimates that reducing the tax burden on workers will boost GDP by $3.5 billion this financial year and another $9 billion in 2021-22.

Over the next two years, Treasury forecasts that tax cuts will create an additional 50,000 jobs.