Federal budget 2020: Australia posts record deficit in wake of coronavirus

The government says Australia will dig its way out of a record $214 billion budget hole – but it’s basing that prediction on a huge assumption.

Australia’s finances have gone from being “back in the black” for the first time in a decade to staring at a massive $200 billion deficit.

And in less than four years’ time, the country is likely to be saddled with an unprecedented trillion-dollar national debt.

With government responses to the coronavirus pandemic causing the worst economic crisis since the Great Depression, the Coalition has abandoned any hope of balanced budgets for the foreseeable future.

Instead, Treasurer Josh Frydenberg is opting for record spending and deficits to counter the “once-in-century” event.

The government is eager to stress that we’re well on the road to economic recovery, but its overly optimistic outlook hinges on some very big assumptions.

So far the cost of the COVID-19 response – including the JobKeeper wage subsidy paid to employers to keep their workers on the books while vast swathes of the private sector were forcibly shut down to “flatten the curve” of the virus – has totalled $299 billion.

Tuesday night’s Budget increases that figure to $507 billion, including the $74 billion five-year JobMaker program, designed to get young people off welfare and into work.

As a result, the Budget deficit in the 2020-21 financial year will reach a record $213.7 billion – having already exploded to $85.3 billion in 2019-20.

The balance on the national credit card will increase to a whopping $703 billion, equating to 36 per cent of gross domestic product.

“This is a heavy burden, but a necessary one to responsibly deal with the greatest challenge of our time,” Mr Frydenberg said in his Budget speech.

After years of obsessing about surpluses, the Coalition has “revised its fiscal strategy to reflect the changed economic circumstances”, with the country now in its first recession in nearly 30 years.

The first phase of the new strategy is “focused on supporting jobs, boosting business and consumer confidence and supporting growth throughout the economy” through a raft of big-ticket spending items, the Budget says.

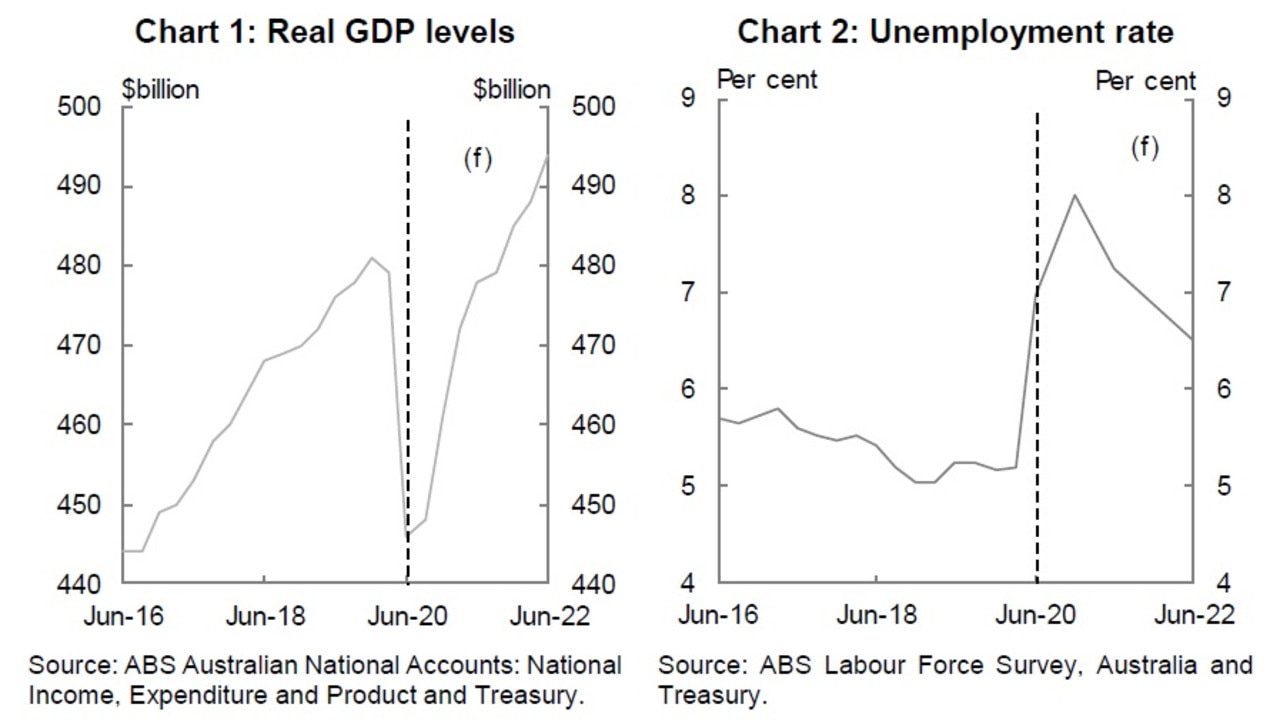

Unemployment is expected to come in at 7.25 per cent this year after reaching 7 per cent last year, before falling to 6.5 per cent in 2022, 6 per cent in 2023 and 5.5 per cent in 2024.

“Once the unemployment rate is comfortably below 6 per cent, the focus will shift to strengthening our fiscal position by stabilising and then reducing debt over time as a proportion of GDP through ongoing fiscal discipline and reforms that boost economic growth,” the Budget says.

Naturally, the Federal Government is keen to stress that things will bounce back.

Treasury forecasts that the deficit will be pruned back to $66.9 billion by 2024, with net debt that year peaking at $966 billion, or 36 per cent of GDP.

Annual interest payments on Australia’s debt are forecast to rise from $16.6 billion this financial year to $17.5 billion in 2024, meaning they will actually fall as a share of GDP from 0.9 per cent to 0.8 per cent – reflecting historically low interest rates.

“By comparison, Australia’s net debt as a share of the economy will peak at half of that in the United Kingdom, around a third of that in the United States and around a quarter of that in Japan today,” Mr Frydenberg said.

“Australia’s economy contracted by 7 per cent in the June quarter. By comparison, there were falls of around 12 per cent in New Zealand, 14 per cent in France, and around 20 per cent in the United Kingdom.”

Australia’s GDP is expected to fall by 1.5 per cent this year, but Treasury then forecasts the economy to come roaring back to life next year with 4.75 per cent growth, followed by 2.75 per cent and 3 per cent in the two years after.

This recovery will be driven by “further easing of containment measures, improving business and consumer confidence”, according to the Budget.

Obviously there is an enormous asterisk hanging over the rosy outlook – illustrated by V-shaped graphs charting Australia’s post-COVID recovery – including the possibility of reimposed restrictions “substantially” reducing economic activity.

“There remains substantial uncertainty around the global and domestic outlook, including around the spread of the virus, future outbreaks, as well as timing and efficacy of vaccines and other medical treatments,” the government warns.

“Until a vaccine is developed and widely deployed, significant uncertainty remains. Through this phase, the government will maintain flexibility to respond to the circumstances as they evolve.”

The Budget lays out a series of assumptions about the progression of the pandemic, warning that “outcomes could be substantially different to the forecasts, depending upon the extent to which these assumptions hold”.

‘POPULATION-WIDE VACCINE’

Firstly, Treasury’s modelling assumes that while there will be “material localised outbreaks” of COVID-19 over the forecast period, they will be “largely contained”.

By late 2021, a “population-wide” vaccination program is “assumed to be fully in place”.

Until a vaccine is fully available, general social distancing restrictions are assumed to continue.

The second wave in Victoria, which led to the introduction of draconian Stage 4 restrictions, has been blamed for shaving around 2 percentage points from national GDP growth in the September quarter.

The Federal Budget numbers assume that restrictions in Victoria will gradually lift over the remainder of the year “in accordance with the Victorian Government’s road map for reopening”.

“The lifting of restrictions is subject to preconditions that require case numbers to fall,” The Budget says. “These forecasts assume that the preconditions are met.”

By the end of this year, Victoria’s restrictions are assumed to “broadly converge” with those in other states.

On borders, the Budget assumes that all state border restrictions will be lifted by the end of the year with the exception of Western Australia, which is assumed to open from April 1 next year.

“A gradual return of international students and permanent migrants is assumed through the latter part of 2021, with small, phased pilot programs beginning to return international students from late 2020,” the Budget says.

“Inbound and outbound international travel is expected to remain low through the latter part of 2021, after which a gradual recovery in international tourism is also assumed to occur.”

Net overseas migration, historically a major contributor to Australia’s economic growth, has been thrown into reverse by the international travel restrictions and weaker labour markets both in Australia and globally.

After bringing in around 154,000 people in 2019-20, Australia is expected to actually lose 72,000 by the end of this financial year.

If all goes to plan, Treasury forecasts net overseas migration will gradually increase over the next four years before reaching 201,000 in 2023-24.