CBA says rates may stay on hold in February

A MOVE by the major banks to lift their interest rates higher than the central bank's rises may mean a pause to official rate hikes.

A MOVE by major banks to lift their interest rates higher than the central bank's rises may mean official rates are left on hold in early 2010, Commonwealth Bank of Australia (CBA) chief executive Ralph Norris says.

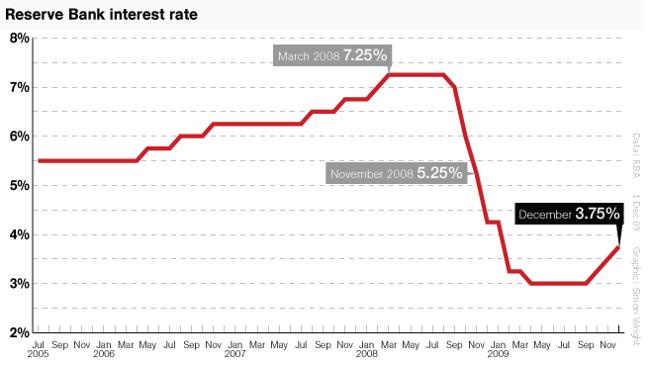

The Reserve Bank's 25 basis point rate rise to an official cash rate (OCR) of 3.75 per cent in December was followed by Westpac's controversial 45 basis point rate hike for home loan borrowers.

CBA lifted its standard variable rate on home loans by 37 basis points, ANZ lifted its rate by 35 basis points while National Australia Bank (NAB) matched the Reserve.

Mr Norris said the banks' controversial moves may result in the Reserve leaving rates on hold when it next meets.

"I think given the fact that there have been interest rate increases over and above the (official cash rate) then I think it is a possibility that we might not see an increase in February," he told Sky Business.

"I don't know whether they think that we're actually doing their work for them but I think they would obviously take into account the situation in regard to interest rates and current economic activity."

Expectations for higher interest rates have eased in the past week, following soft gross domestic product (GDP) figures and comments from the Reserve in its minutes for its December meeting.

"I think those minutes do indicate that it was very finely balanced," Mr Norris said.

"I think that what has obviously occurred over the last week or so will have an impact. But we'll just have to wait and see. It's purely speculation at this point."