Victoria housing market: Melbourne house prices may fall 20 per cent

A day after Victoria entered stage 4 lockdown, the pain is beginning to be realised in the housing sector as nearly all cities record losses.

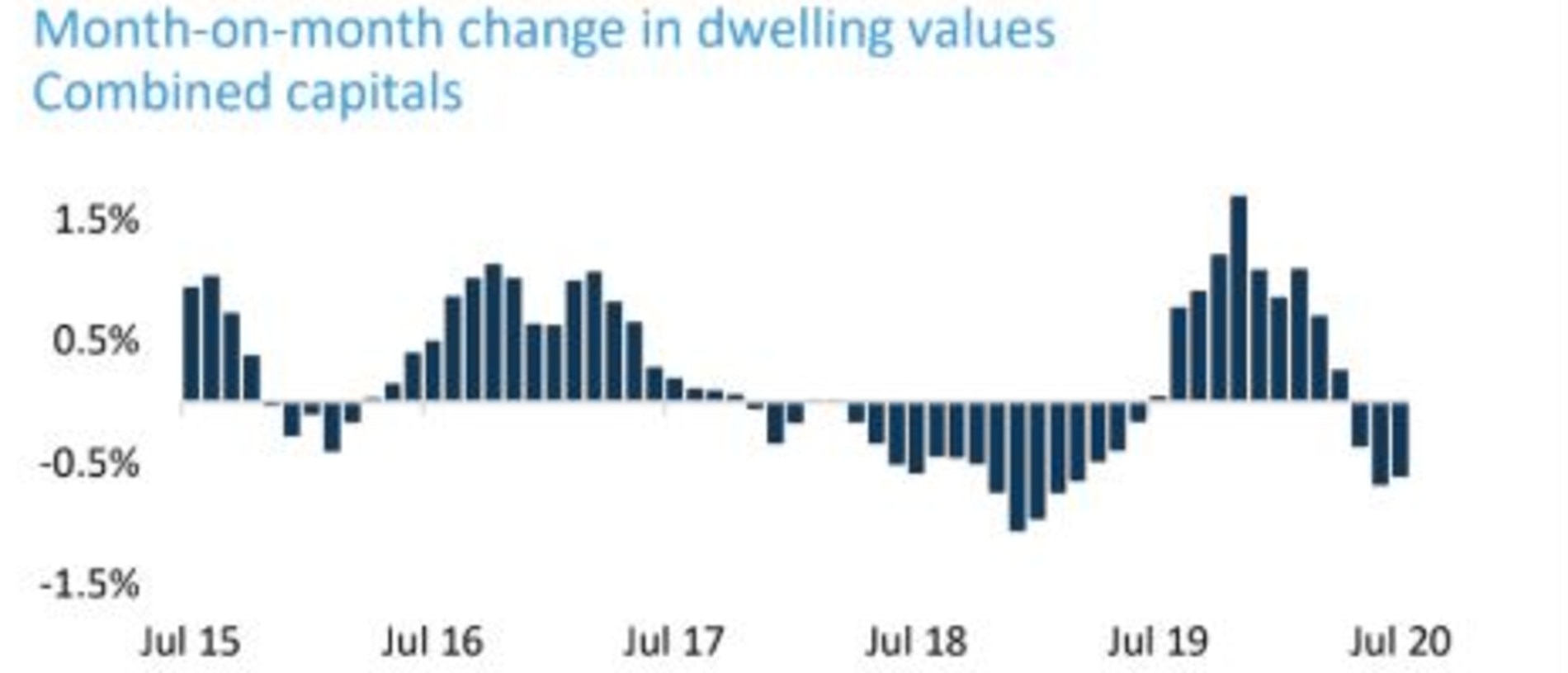

Melbourne property prices are shrinking at a rapid rate as national housing values recorded losses for the third consecutive month in July.

The Victorian capital lost 1.2 per cent over the month, according to the CoreLogic data released this morning, accelerating to a concerning annualised rate of 14.4 per cent.

Sydney prices fell 0.9 per cent while the losses in Perth, Brisbane and Hobart were more narrow, down between 0.6 and 0.2 per cent. The Adelaide and Canberra markets continue to buck the national trend though, rising 0.1 and 0.6 per cent respectively.

RELATED: Why record gold price a ‘sign of trouble’

RELATED: US urges Australia to join China push back

The data comes just a day after Victorian Premier Daniel Andrews announced stage 4 lockdown which will come at a significant cost to local business and the state’s economy.

The grim conditions will likely impact the property sector further as fiscal support packages dry up from October and the banks’ home loan holiday expires in March, CoreLogic head of research Tim Lawless said.

“Urgent sales are likely to become more common as we approach these milestones, which will test the market’s resilience,” he said.

“Similarly, the recent concerns of a second wave of the virus and the potential for renewed border closures and stricter social distancing polices are likely to further push consumer sentiment down.

“This is likely to weigh on both home buying and selling activity more broadly.”

The market has been shielded from heavier falls due to proactive government policy and favourable borrowing conditions, Mr Lawless said.

“Record low interest rates, government support and loan repayment holidays for distressed borrowers have helped to insulate the housing market from a more significant downturn,” he said.

“Increased demand driven by housing specific incentives from both federal and state governments, especially for first home buyers, have become more substantial.”

AMP Capital chief economist Shane Oliver said the current monthly pace of losses will continue before speeding up towards the end of the year when stimulus packages are removed.

The leading commentator has tipped the Melbourne market to fall between 10 and 20 per cent from its peak, while Sydney is tipped to lose between 10 and 15 per cent.

“Further falls in home prices are likely,” he said.

“High and still rising unemployment (with “true” unemployment absent government support measures estimated to be just above 11 per cent), the collapse in immigration which has reduced underlying dwelling demand by around 80,000 dwellings a year and the depressed rental market will likely combine to drive weak housing demand and increased forced sales.

“JobKeeper, increased JobSeeker, bank payment holidays and other support measures have so far helped head off a sharp collapse in prices but the market has still weakened anyway and we expect an acceleration in falls as support measures start to be tapered from the December quarter.

“Sydney and Melbourne are the most vulnerable given their higher dependence on immigration, higher debt to income ratios, higher house price to income ratios and greater investor penetration.”