They swear the economy is improving — should you trust them?

WHILE we’re told the outlook for Australia’s economy is strong, there are indications bad news is looming that we can’t see.

AUSTRALIA’S central bank has a nice, sunny outlook. The Reserve Bank reckons things will get better, and it keeps telling us about it. Expect high growth and lower unemployment, it insists with a big smile.

But are they telling us the whole story?

The RBA says unemployment will fall — down to 5 per cent — and that growth will stay at a high level — about 3 per cent. Reserve Bank governor Philip Lowe has started bringing a bit of extra attention to these positive forecasts, mentioning them quite specifically when he announces the RBA rates decision.

So it’s worth pointing out something. When you see the forecasts you might expect it to be the average of all possible paths into the future. You might expect that it balances out the chance of good news and bad. But it is not that simple. If certain types of risk are high, the RBA forecast will not emphasise them.

Those who wish to learn more should eagerly rip open the sealed section below and devour its gratuitously nerdy contents.

SEALED SECTION

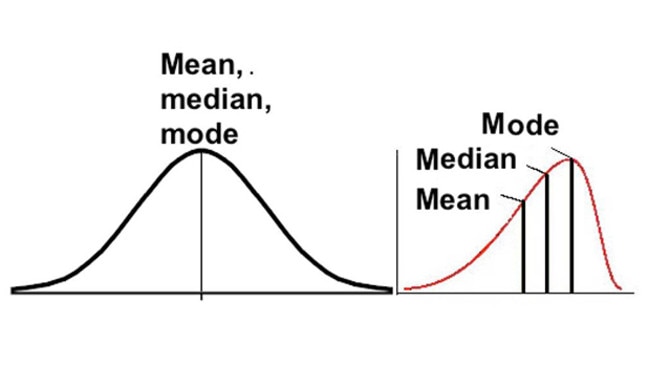

The RBA forecast uses the mode, not the mean. You may recall mean, median and mode from your mathematical education. They are different ways of measuring the middle of a bunch of numbers — and they can be very different.

The mode will be the same as the average in a bell curve, but if you look at the range of possible economic outcomes for Australia, they are very unlikely to form a neat bell curve.

If there is significant downside risk, the RBA’s forecast using the mode will not emphasise it. (To be fair, when there is significant upside risk, that would also be ignored.)

END SEALED SECTION

Imagine for a moment the range of possible outcomes for Australia’s economy is not a balanced, normal distribution. Imagine it has a long tail of possible horrible outcomes to the downside (maybe housing goes bad, our debt levels get painful, Trump gets impeached, America’s tech sector stops being so highly valued, China goes pop, or more than one of these at once).

If one of those tail risks comes into being then the lovely numbers the RBA governor likes to talk about are rather unlikely.

FORECASTING IS HARD

If you dive into the details, the RBA will readily admit its forecasts are not terribly accurate.

A 2012 research paper says “uncertainty about forecasts is high”. Because of that, the RBA puts less emphasis on forecasts. That was perhaps the case then, but that focus seems to be returning under the new governor, Philip Lowe.

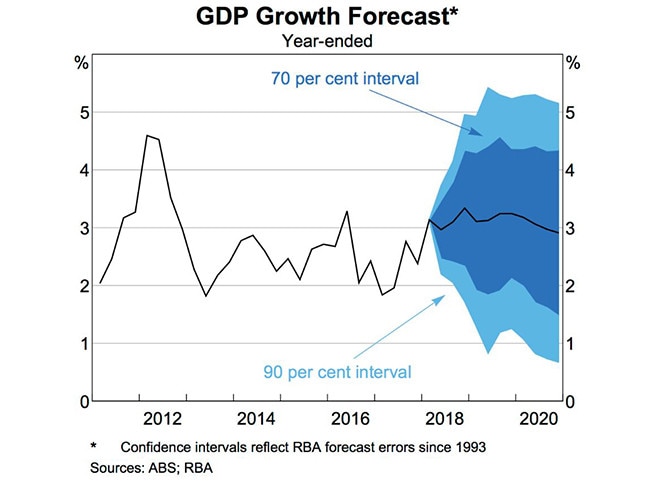

For transparency, the RBA also publishes this “fan graph”, which shows forecast and reality can diverge quite a bit. There’s a 30 per cent chance the reality could end up outside the dark blue area and a 10 per cent chance it could be outside the light blue area.

One impression you can get from that fan graph is that missing to the high side is as likely as missing to the downside. But the chart is made to look like that because they assume the forecast errors are symmetrical.

That might be the case sometimes, and even over a long period. But it is not necessarily the case if you fall into recession. Australia’s last recession was around 1991, and the data for the forecast errors starts in 1993.

The RBA also publishes a long list of risks to its forecasts several times a year in a document called the Statement on Monetary Policy. The latest one mentions America, China and household debt.

SO IS IT ALL DOOM AND GLOOM?

The downside risks are easy to imagine — so for fairness, let’s look at some things that could go well.

â— If the Aussie dollar falls, that will be very good news for our exporters, and could drive economic growth up.

â— Trump’s trade wars might play out well for us. If the US and China stop trading so much with each other, we could sell more to each side.

â— Wages growth could suddenly come roaring back. (Fingers crossed!)

â— Despite all the headlines — and yes, I’m responsible for a few — a crunch in Australian housing is not certain. First home buyers with big deposits saved up might keep entering the market and stop it from landing with a crash.

â— India is growing fast and is on track to become the next China.

PEAR-SHAPED

However in my humble opinion, there are more downside risks to the economy at the moment than upside risks. The RBA’s sense that growth will merrily continue and unemployment will gradually fall seems pretty close to a best-case scenario.

Dr Alex Joiner, chief economist from IFM Investors, agrees.

“Downside risks seem to be building, particularly globally,” he says. “But few if any upside risks present themselves.”

Dr Joiner argues the RBA’s job is to provide a sunny weather forecast, because doing so can create that bit of extra warmth.

“The RBA continues to put forward a glass-half-full assessment of economic conditions,” he says. “This is to be expected as the bank itself has readily asserted it should remain a source of confidence.”

But should we be so easily manipulated? If the future is uncertain — and that’s the one thing that is certain — we may prefer to make up our own minds.