The reason you can’t get a decent payrise

IF IT feels like ages since you got a decent payrise, you are not alone — so don’t blame your boss for being stingy just yet.

IF IT feels like ages since you got a decent payrise, you are not alone — so don’t blame your boss for being stingy just yet.

In a speech yesterday, the new Reserve Bank Governor Philip Lowe focused on how bad wages growth was in Australia at the moment.

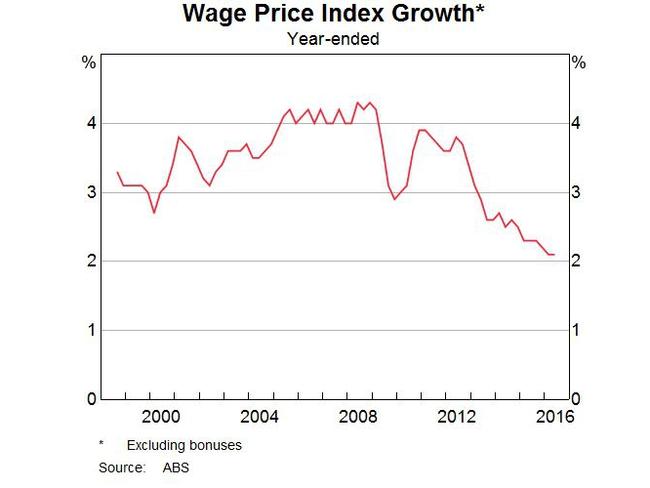

In the past year it only increased by just over 2 per cent, which is its slowest rate of increase since the wage price index began being collected in the late 1990s. It’s also a lot lower than the 4 per cent average workers enjoyed when the resources boom was in full swing 10 years ago.

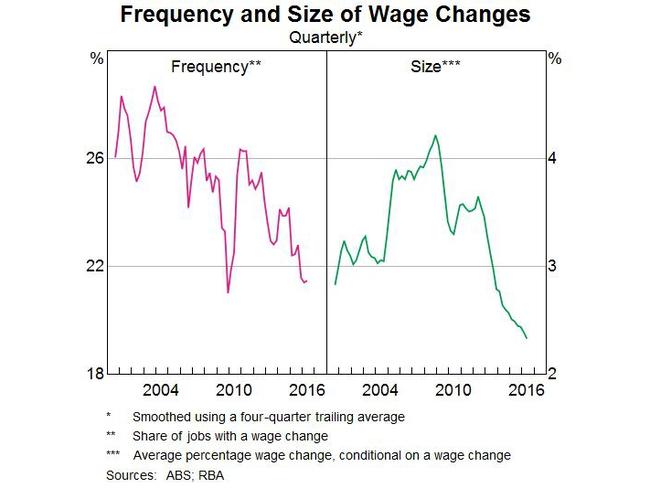

Mr Lowe said analysis done by the Reserve Bank and the Australian Bureau of Statistics found some interesting results.

“Over recent years, there has been a decline in the frequency of wage increases and, when wage increases do occur, the average size is lower,” Mr Lowe told Citi’s Australian & New Zealand Investment Conference.

For example, six years ago, almost 40 per cent of the 18,000 individual jobs being tracked by the ABS received a wage increase in excess of 4 per cent (Graph 7).

In contrast, over the past year, less than 10 per cent of jobs got this type of wage increase.

And almost half of the individual jobs tracked by the ABS had a wage increase of between 2 and 3 per cent.

Mr Lowe believes three main factors were to blame.

1. THERE ARE STILL NOT ENOUGH JOBS

While Australia’s economy has performed better than some others, Mr Lowe said the unemployment rate was still at 5.6 per cent. This is lower than what economists would consider full employment, which is about 0.5 percentage points higher.

“While this gap has narrowed over the past year, we do still have some spare capacity,” he said.

Meanwhile, underemployment had grown, not fallen.

“This largely reflects the fact that many of the people finding work recently have been employed in part-time jobs and report that they would like to work more hours.”

This is also the case in parts of Asia where there is “considerable overcapacity” in some manufacturing industries, which has reduced upward pressure on both prices and wages.

Mr Lowe said there was still some “economic slack” in the global economy and this was being reflected in low inflation around the world and in Australia.

“Economic growth has generally disappointed since the global financial crisis, weighed down by an overhang of debt,” Mr Lowe said.

“The result is that excess capacity exists in many parts of the global economy.”

2. FALLING PRICES

We are paying less for commodities such as oil and the fall in petrol prices is reducing our cost of living.

“Over the past two years, the price of petrol in Australia has declined by around 20 per cent,” Mr Lowe said.

“With headline inflation rates so low, many workers have agreed to smaller wage increases than would have otherwise been the case,” he said, adding this was especially the case when it was expected future inflation would also be low.

We are also getting less money for our commodities, with the value of the goods we are exporting falling by more than 50 per cent.

Mr Lowe said this was the main reason that growth in Australia’s national income had been weak over recent years.

3. GLOBALISATION

This comes back down to competition from overseas companies keeping prices low.

“Perhaps the strongest effect of globalisation is that it increases competition,” Mr Lowe said.

“Open markets and advances in technology mean that more businesses feel that if they put their prices up, they will not only lose market share to domestic competitors but to foreign competitors as well.”

For years workers in the manufacturing sector have felt the pressure of competition from international trade, and now many workers in the services sectors are also starting to feel this pressure.

“Faced with more potential competitors, workers — like firms — are less inclined to put their prices up,” Mr Lowe said.

For example, foreign retailers like Aldi have come to Australia and made a difference in the price of groceries and clothing.

“Over recent times, food price inflation has been unusually low and the prices of many goods have not risen as quickly as suggested by the conventional relationship with import prices,” he said.

This increased competition has forced existing retailers to find savings and lower their prices.

“Reflecting this, there has been a pick-up in the rate of productivity growth in the retail sector, which is good news for consumers,” he said.

“More broadly, though, many Australian workers are facing some of the insecurities that workers in other advanced economies are facing.”

The global financial crisis has also played a part because it created a lot of uncertainty and increased the value placed on job security.

“This increased value put on job security has made many workers less inclined to push for large wage rises.”

IS THERE ANY GOOD NEWS?

Mr Lowe said the factors holding down inflation were likely to continue for a while but this does not mean it would be permanent.

He said consumer demand in Australia was expected to strengthen gradually as the drag on the economy from the decline in mining investment came to an end.

As this happened, employment was expected to improve and excess capacity was likely to be wound back.

“Some pick-up in wages and prices could then be expected,” he said.

Commodity prices, after declining in the past four years, have also increased this year and if this continued, Mr Lowe said it would boost national income, and the falls in petrol prices would no longer have a big impact on headline inflation.

While pressure on prices and wages from increased competition was likely to continue for a while yet, Mr Lowe said it would reduce at some point as demand within Australia strengthened.

“Putting all this together, our central forecast remains that inflation in Australia will gradually pick up over the next couple of years, although it is still likely to be closer to 2 per cent than 3 per cent by the end of this period,” he said.