The one Australian economic sector China cannot afford to target

The Chinese government’s attempts to punish Australia’s economy have been extensive – but there’s one key area it can’t afford to touch.

When the Chinese government started targeting Australian exports to China with punitive trade actions back in 2020, there were serious concerns that it could hit the Australian economy quite hard.

With everything from barley to wine targeted, there were precious few Aussie exports to China that didn’t find themselves in Beijing’s crosshairs.

Yet despite Beijing’s attempts to hit Australia’s economy where it hurt, for the most part different export destinations were found, and the blows to many industries were taken in their stride. In fact, the ban on imports of Australian coal ended up backfiring.

The high energy and generally cleaner coal Australia exports was swiftly picked up by other importers, such as India and Japan. Meanwhile China ended up paying high prices for poorer quality coal due to such a major disruption in the market.

But amid all of Beijing’s broad-cased trade actions against Australia, there have been some key exports they have steered well clear from being targeted – most notably iron ore.

A truly symbiotic relationship

Despite the Chinese government’s attempts to take a wrecking ball to elements of the Australian export economy in the same way it has to so many others in recent years, in one way the two nations share a deep reliance on each other.

In its path towards industrialisation and urbanisation, China has become the largest consumer of raw materials in the world. It was famously said back in 2003 that China consumed more concrete in two years than the United States did throughout the entire 20th century.

Today, China manufactures more steel than the rest of the world combined, accounting for 53 per cent of the global total in 2021. Its next largest rival is India, which accounted for 6 per cent of global output.

Despite having the third largest domestic iron ore production levels in the world, China is heavily reliant on imports to feed its enormous industrial economy.

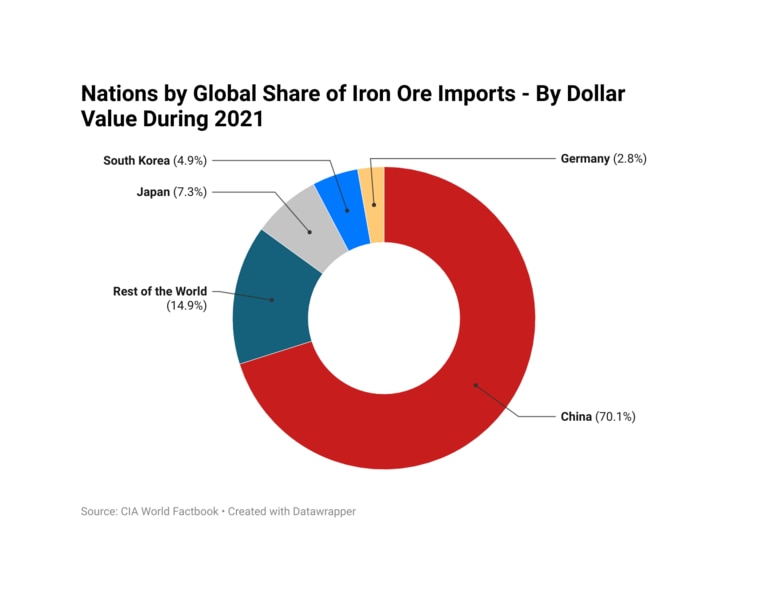

During 2021, China accounted for 70.1 per cent of all global iron ore imports, with its nearest rival, Japan, accounting for just 7.3 per cent by comparison.

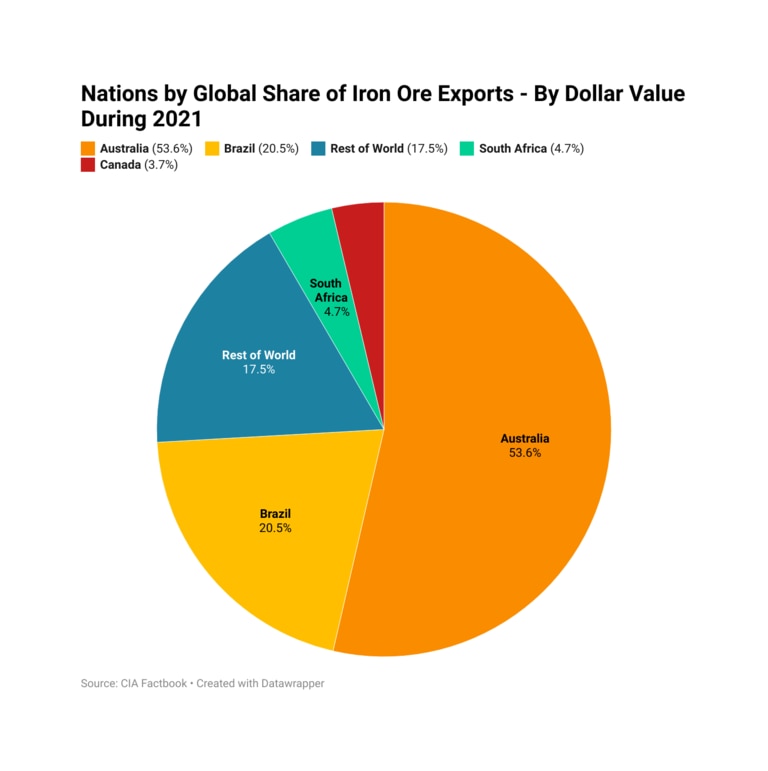

On the other side of the ledger, things are also very lopsided towards one nation, but not quite as much as within the realm of iron ore imports.

In 2021, Australia accounted for 53.6 per cent of global iron ore exports, followed by Brazil with 20.5 per cent and South Africa with 4.7 per cent.

This puts Beijing in a bit of a bind. If it wants to continue to power its enormous industrial economy, it needs Australian iron ore. There are no ifs or buts about it.

On the flip side, it means that the fate of Australia’s economy is linked to the fortunes of the Chinese property and infrastructure construction sectors.

Any ideas of India or Japan replacing Chinese demand to any meaningful degree in the event of a Chinese recession are unfortunately just not realistic. Even if Japan, for example, were to increase its imports of iron ore by 50 per cent, that would account for just 5.2 per cent of China’s annual demand.

During the 2019-20 financial year, iron ore was Australia’s single largest export, accounting for 21.6 per cent of the national total. This data was prior to the run-up in iron ore prices that occurred since the pandemic, and the nation’s economy has become even more reliant on it since then.

While China can’t act against Australia’s iron ore exports in the same way it has other sectors without significantly hurting its own interests, there are potential challenges that stem from this reliance on China on the road ahead.

Covid zero, a slowing China and flagging property sector

Since the latter half of last year, the woes of the Chinese property sector have been on display, but the issue has been one of a slow burn rather than a more explosive affair.

Despite the deteriorating fortunes of the Chinese property sector no longer gracing the front page as often as they once did, the issues have not gone away. They have, in fact, continued to worsen.

Behind the scenes, developers have continued to default on billions of dollars’ worth of debt and the restructuring of a number of mega-developers continues. Despite some predictions that the Chinese government would bail out the sector in order to stabilise the economy, so far that level of intervention has not materialised.

But amid all the turmoil in the property sector, fixed asset investment (aka infrastructure) has continued at pace, with spending growing by 6.2 per cent in the year to May. This has been one of the few bright spots for a Chinese economy still badly struggling from the pandemic and Beijing’s Covid strategy.

Yet this hasn’t been enough to support Chinese steel demand, and by extension iron ore prices. Currently, Chinese steelmakers are suffering from sector-wide losses as costs rise and inventories start to pile up.

Iron ore prices are roughly 50 per cent below where they were during their peak in May last year, and with other bulk metals falling, there are concerns they could continue to go lower.

Where commodity prices go from here in this highly volatile and sensitive market is anyone’s guess. Perhaps Chinese demand will surge on the back of renewed stimulus currently under consideration, or maybe iron ore will join other bulk commodities in falling rapidly as fears of a global recession continue to grow.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator