The great Australian problem

FORGET about government deficits and the “budget emergency”. There’s a bigger problem staring us in the face.

WHAT if Australia was being hunted down by a threat that nobody noticed?

That could be happening right now. A new leak of official information suggests Australia has barely paid attention to a problem that could bring the country to its knees.

A secret official report was leaked this week saying the debt held by Australian households before the GFC was so high there was likely to be a tidal wave of defaults. That could have seriously hurt Australian banks and maybe even caused a recession, according to analysts.

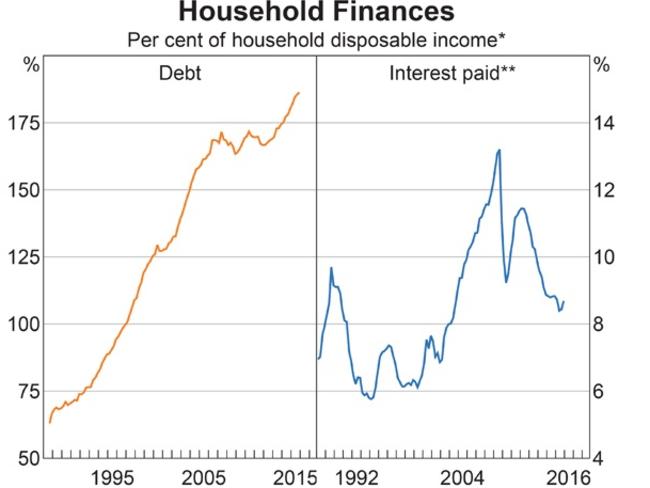

If household debt was big then, it is far greater now. Household debt has been building up for ages, and our regulator thinks our banks couldn’t handle a house price crash.

But almost nobody ever mentions that brand of debt. Instead, we argue non-stop about debt held by government: “The deficit,” “government debt,” “budget emergency”. I know I’m sick to death of hearing about them.

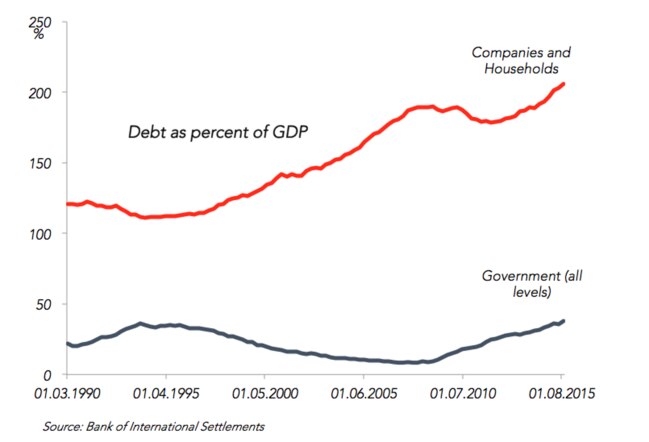

Yet government debt is tiny by comparison to private debt (which is owed by companies and households).

This graph makes me wonder if we are like minor characters in a Jurassic Park movie — bickering over something completely inconsequential, while an angry velociraptor sneaks up on us and prepares to tear us apart.

CAN IT REALLY HURT US?

In recent history, yes, government debt has been the bad guy. Think about Greece. The problem was the debt owed by government, not the private sector

But before that, there is a long, long history of private debt going on a rampage and destroying everything. First, debt creates bubbles. Then, bubbles burst, and finally, whole countries get caught up in the mess.

The US subprime mortgage crash is one example. Japan’s bubble in the late 1980s is another. Both caused massive problems for everyone — even people who thought they were insulated from the bubble. The end of a debt-splurge can cause banks to go broke, retirement savings to plunge, and the unemployment rate to shoot up.

IS OUR DEBT DIFFERENT?

The debt Aussie households have is partly on credit cards but mostly on mortgages. Which is good, because it means there is an actual asset backing up the debt.

But it also means that if the housing market so much as wobbles, there is a serious problem with all that debt.

If the housing market starts to wobble and your house is worth less than your mortgage, you probably just sigh and keep on living there, right?

But it’s different if it’s an investment property with an interest-only loan. In that case, you’re far more likely to realise your investment is a dud, and sell out. Which will also, thanks to the capital gains tax, get you a little tax saving.

Interest only loans have grown by 80 per cent in a three-year period recently. The high share of interest-only loans on investment properties is a big reason the housing debt stock is a worry.

Of course, private debt is not necessarily a bad thing. While debt is high, many Australians have been using this period of low interest rates to get ahead on their home loans. If all the debt can be paid for then we have literally nothing to worry about. Many experts think we’re going to be just fine, including the head of the banking association.

But then again, that’s what people always think just before the worst happens.

Jason Murphy is an economist. He publishes the blog Thomas The Thinkengine.

Follow Jason on Twitter @Jasemurphy