The force holding your income back

IF YOU haven’t had a pay rise in a while, you’re not the only one. So why, if our economy is doing so well, aren’t we seeing the benefits?

QUITE some time has passed since your last pay-rise, and let me tell you, you’re not alone. Wages growth has been bad nationwide.

Skinny paycheques are spreading economic trouble, causing anaemic retail sales and falling overseas travel.

And yet. The new GDP figures were amazing. Australia actually grew as fast as China for a little while there (3.1 per cent growth in the last year and a startling 1.1 per cent in the last three months).

How on earth can that be?

Here’s the wages figures, just to remind you how tough times have become. Wages growth used to bubble along at 4 per cent — since 2012 it has been really falling and it is now around half that.

(When the minimum wage went up by just 2.4 per cent recently the chorus of moaning from employers was deafening.)

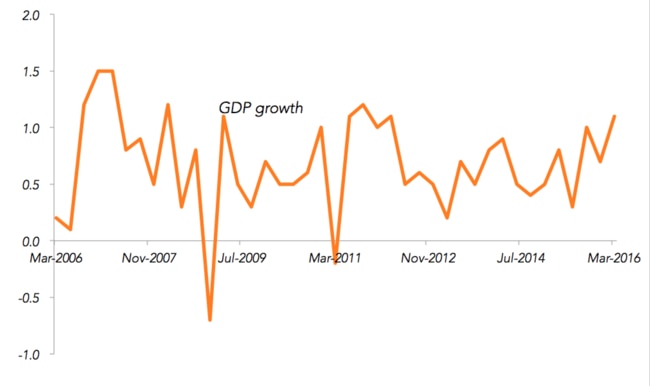

Here’s GDP, showing no such downtrend.

If anything, GDP has been trending up since 2012. So how come we are all buying Aldi groceries and saving our annual leave in this supposed boom time?

The answer is that GDP (how much we produce) is not exactly a measure of our income.

Here’s how economics strategy firm AlphaBeta explained it this week:

“In the simplest terms, if Australia was a cafe, we’d be making a lot more coffees but not taking much more money thanks to a price cut.”

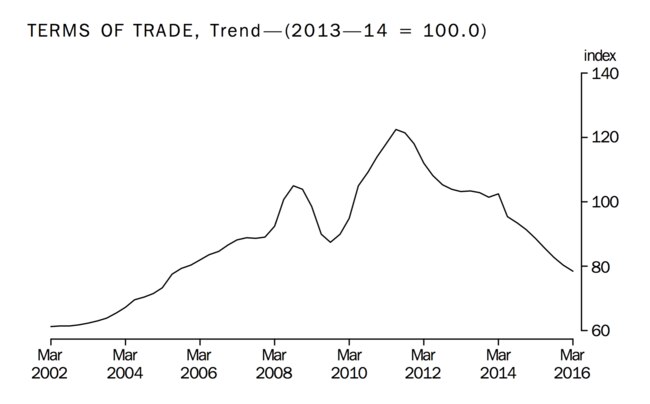

It’s not just you and me working harder for the same money. It’s the whole country. How can a whole country take a price cut? The answer is the terms of trade, or the price of what Australia sell vs. what we buy.

The good times rolled up till late 2011. (I had some very enjoyable overseas holidays around that time as the Aussie dollar was so high.)

Now we are on the other side, with those rotten global markets paying us less for our iron ore. The terms of trade started falling since late 2011 and they haven’t stopped.

How low can they go? It’s frightening to think.

We don’t need them to stop falling, if all we care about is GDP. But if we actually care about incomes, and we want them to go up, the terms of trade become pretty important.

The one thing we must do is sell products the world will pay top dollar for. As a nation we don’t just have to churn out coal as its value tumbles. The way to stop the rot in our terms of trade is to move to high-value exports — and fast.