The commodity crash: Three ways it’s going to personally target you and make your life worse

THE Australian share market plunged to it’s lowest level in 2 years yesterday. Even if you don’t have shares you’re going to be affected. Here’s how.

THERE is a certain amount of enjoyment to be had in a market implosion. All those dismayed finance professionals on TV with, what, six computer monitors? Have they never heard of alt-tab? Why do they need so many screens?

They may be grimacing but you know they go home in a Porsche and cry into their 1984 Chateau Lafite.

The stock market is in a spin as the prices of iron and coal and copper drop. On Tuesday billions in value just evaporated. It was the sort of day you only get every few years — except we’ve had two like that in the last two months.

The schadenfreude is a blast, for a while. But even if you don’t own shares, a serious crash in the commodities market has a way of coming to get you.

Here’s three ways we all feel the sting.

1. Lower than expected pay cheques

The price of iron ore might not seem that important to our day to day lives, but in the interwoven world of global capitalism, it matters plenty.

The weaker price of commodities hurts economic growth — knocking it down by 1 percentage point in some commodity exporting countries, according to brand new research by the IMF.

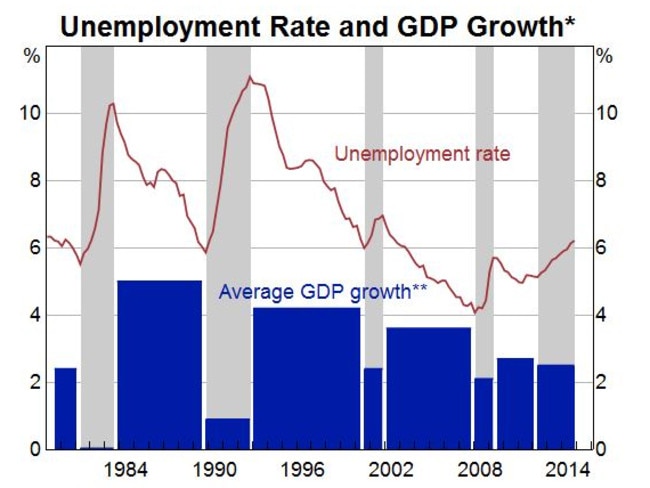

As this graph shows, Australia needs economic growth of around 3 per cent a year to keep unemployment steady. If we fall to 2 per cent growth or less, unemployment increases.

When there’s lots of people looking for work, the only person smiling is the head of HR. They’re going to be handing out a lot fewer pay-rises.

2. Talking politics

Guess what they’re going to be talking about at the pub? Politics.

At the park? All the dog walkers will be chatting politics.

At the shops, the fruit shop man and the trolley collectors will all be discussing politics.

It’s all because of the rise in unemployment. We’re at 6.2 per cent now and it could go higher. That means the government wants to do something — anything — to steady the ship. Experts reckon we can avoid the worst if we tweak a few business regulations and change up our tax system.

It’s starting this week, with Malcolm Turnbull hosting a summit on “reform” on Thursday.

Change is coming (maybe on GST, superannuation, negative gearing) and that means politics is going to get ugly! Whenever anyone from any party suggests even the slightest change, the other side of politics will insist it’s Armageddon.

People will be whipped into a froth of fear and start raving about politics non-stop. Get ready.

3. Your retirement trip to Europe is cancelled

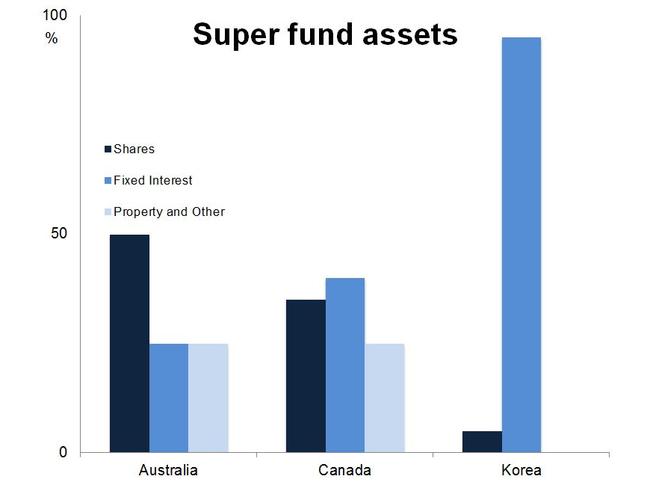

You might not personally have bought shares in Rio Tinto, the coal miner that has fallen in value by almost a quarter this year. But your super fund probably did. Ouch.

Australian super funds hold around 50 per cent of our investments in shares. That’s more than most other similar countries.

The UK has 40 per cent; Canada has 35 per cent and Korea has a very cautious 5 per cent, according to a 2014 report by the Financial Services Council. Korea has far more money in safer “fixed interest” investments.

Australian super funds will be hoping for a recovery in the market, fast, or their share portfolios will be a big problem.

A little bit of a market rollercoaster can be fun, but if the train gets stuck in a dip, things could get quite tiresome indeed.

Jason Murphy is an economist. He publishes the blog Thomas The Think Engine. Follow him on Twitter @jasemurphy.