Stingy nation: Can money equal happiness?

IT’S a known phenomenon that as we become richer, we become stingier. In fact, if Australians gave more in the right places, it could leave us all better off.

IT’S a known phenomenon that as we become richer, we become stingier.

Wealthy people need social connections less, so they become more individualistic and self-interested.

But some argue that if we give to the right places, our society will become richer, both economically and in terms of happiness.

Pro Bono Australia suggests that if just 10 per cent of working Australians made a payroll donation of $5 a week, the Australian community would benefit by more than $260 million each year.

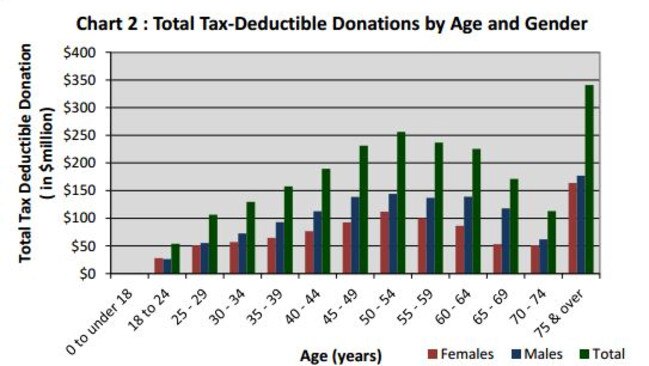

In the past few years, Aussie wages have risen, but our charitable giving has dropped from a high in 2007-08. Just over a third of us donate to tax-deductible organisations, and the average donation is a mere 0.37 per cent of income for women and 0.31 per cent for even thriftier men.

Australia’s philanthropic sector is described as “decidedly disjointed” in a new report by the Centre for Global Prosperity.

“If you look at just tax-deductible giving, we’re behind the UK, Canada and the US,” says Professor Myles McGregor-Lowndes, director of the Queensland University of Technology’s Centre for Philanthropy and Non-profit Studies.

Worse, the money we do give often disappears into a black hole. One of the most popular and respected international charities, the Red Cross, was embroiled in scandal this month after it was revealed that it had botched its chance to help the people of Haiti after the devastating earthquake.

Domestically, we barely know what’s going on. Australian charities have only had to register nationally since 2012, and they will report on their finances for the very first time this month.

“In October this year, the ACNC will publish its second Charities Report which will have a really detailed picture, for the first time, of the combined revenue of the charitable sector,” a spokesperson for the Australian Charities and Not-for-profits Commission said. “At the moment, donors can find much of this information on an individual level by searching the Charity Register.

“Since we started in December 2012, we’ve had over 1300 complaints and concerns, which have resulted in nearly 100 investigations. We’ve revoked the status of 11 charities on compliance issues and that of 5500 charities for not reporting to us for two years.”

With 54,500 charities registered in Australia alone, this hardly makes things less confusing.

In the US, independent organisations rate charities on how they use your money. According to Give Well, tagline “Real change for your dollar”, your cash is best spent with the Against Malaria Foundation, which buys $5 bed nets; charities that support de-worming treatments; and GiveDirectly, which distributes funds straight to poor individuals in Kenya and Uganda.

But Prof McGregor-Lowndes calls the rankings “misleading and inappropriate”.

Helping the largest number of people with your dollar is important, but more expensive programs can have a greater long-term impact.

Flawed metrics can include CEO wages, fundraising tactics and administration costs. Admin might be more if a charity is providing teaching staff, for example. A charity called Invisible Children spends 80 per cent of its budget on publicity — but that’s because its mission is to raise awareness of the use of child soldiers in Uganda.

“There’s no one-size-fits-all measure,” said the ACNC’s spokesperson. “We encourage educated decisions. The ACNC publishes factsheets and provides guidance to help potential donors interpret financial information and make informed giving decisions.”

That’s not as easy as it sounds. While some suggest only giving to charities that spend less than 30 per cent on fundraising, “Australia doesn’t have a common standard of what is fundraising, so a charity can tell an accountant what they’d like it to be,” Prof McGregor-Lowndes said. He wants to see clearer accounting standards so we can “compare apples with apples”.

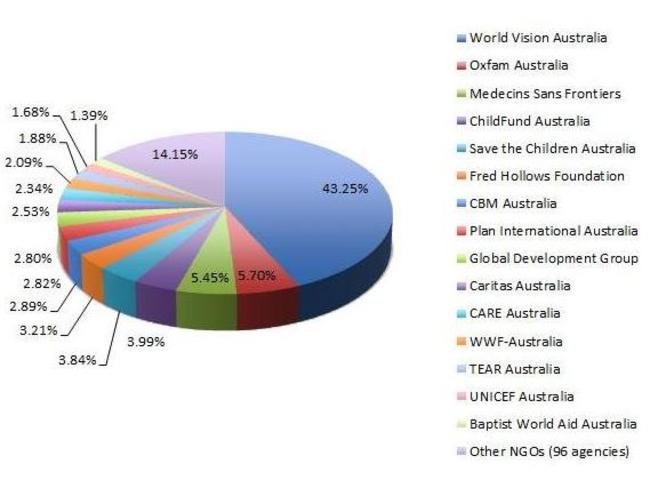

Most Australians who give to charity choose ones where they have a personal connection, or a trusted overseas organisation, but in the case of the Red Cross, that trust appears to have been misplaced.

Prof McGregor-Lowndes says our employers could make it far easier for us to contribute in an effective way.

“There’s a great opportunity for payroll giving,” Prof McGregor-Lowndes said. “It costs a bit for an employer to set up but the rewards are increased morale and dedication, particularly from younger workers.

“Any number of studies show the psychological benefits to non-selfish, altruistic behaviour.”

We have a long way to go before we make sense of Australia’s messy charitable landscape, but there are steps you can take now to ensure your donations go to the right place:

● Don’t wait to be asked: Give as generously as you can afford without forcing the charity to spend on fundraising.

● If you have a charity in mind, look it up on the international or domestic register

● Check the financial report and explanatory notes: Has the money been well spent?

● Ask if you can give through payroll: Some companies offer pre-tax workplace giving, and may match your donation

● If you can’t afford to give, volunteer your time with a local organisation, encourage your employer to arrange team events or ask about a skilled volunteering secondment

● Ask telemarketers and street fundraisers if they work directly for the charity, rather than a commercial organisation that takes a commission

● Be cautious of charity dinners and balls, which may spend most of your money on the event.