Signs Australia’s luck is finally running out as brutal recession looms

Australia has been able to dodge a technical recession for almost three decades – but alarmingly, our luck could be about to run out.

In the years since the 1990-1991 recession, Australia’s economy has become the envy of the world, as the Lucky Country managed to dodge a technical recession for almost 30 years.

The Covid-19 pandemic arriving on our shores in March of 2020 changed all that, but one would be hard pressed to consider that economic event with the recessions of days gone by.

In the years during and following the 1981 recession, the nation’s unemployment rate jumped by 5.1 per cent and didn’t return to a pre-recession level until 2004.

It was a similar story with the 1990-1991 recession, with unemployment rising by 5.4 per cent and then a 14-year wait until it reached the pre-recession rate once more.

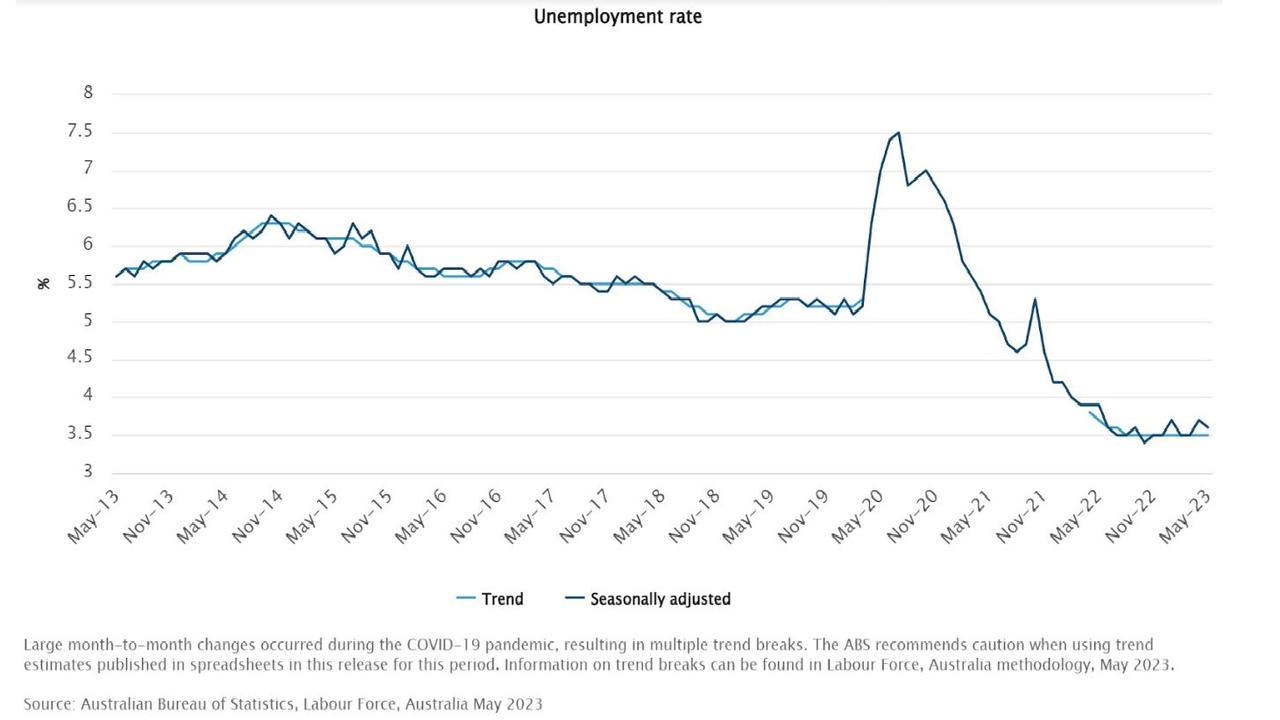

During the pandemic, unemployment swiftly rose by 2.4 per cent, but instead of the number of jobless Australians continuing to rise like past recessions, the unemployment rate instead began falling until it hit a 49-year low of 3.4 per cent.

The Covid-19 recession was the first recession in modern Australian history after which a far larger proportion of Australians were employed than were before.

In recent weeks, the outlook for the Australian economy has turned decidedly more stormy, as commentators and even some of the big four banks see an increasingly likely possibility of a recession on the horizon.

A recent note by the Commonwealth Bank suggested that the economy entering a recession was a 50-50 call.

Considering that mortgage-holding households have experienced the largest relative increase in interest repayments since at least 1959 and inflation-adjusted consumption growth has seemingly ceased to exist for age demographics under 55, it’s perhaps understandable why CBA is increasingly downbeat on the nation’s economic prospects.

But this isn’t the first time that Australia has found itself in a highly challenging position amid a backdrop of a faltering global economy.

Back in 2008, when much of the world was struck by the Global Financial Crisis, it seemed inevitable to many that Australia would follow the rest of the developed world into a recession.

In the end, against all odds, the economy dodged the bullet, largely due to the largest peace time stimulus program in the nation’s history up until that time, and a huge stimulus program launched by the Chinese government, which saw demand for Australian commodity exports soar to new record highs.

But can the Lucky Country’s economy dodge yet another recession? And are the conditions that made the Aussie economy’s Matrix-like economic bullet dodging in 2008 still be there in 2023?

High immigration

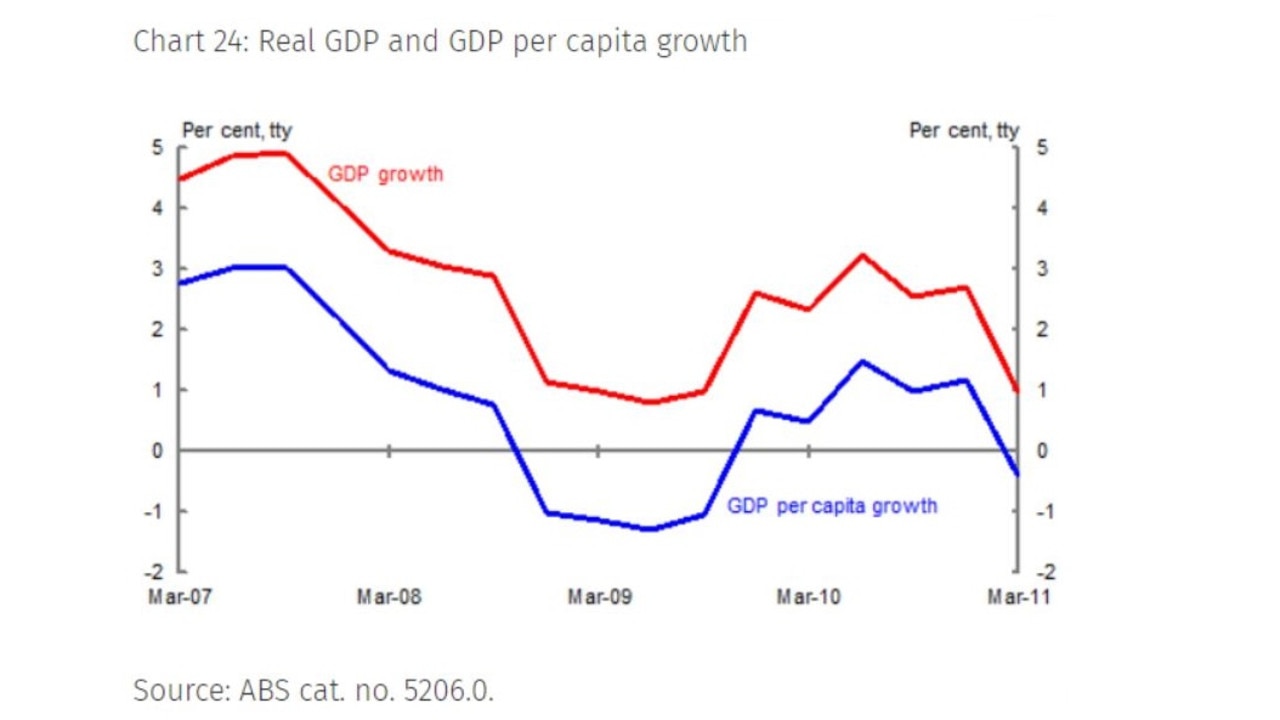

In a 2012 paper produced by the Federal Treasury, the authors concluded that the economy was heavily supported by population growth during the GFC, which was heavily driven by historically high rates of immigration.

“Population growth added close to 1.6 percentage points to cumulative GDP growth over the September quarter 2008, December quarter 2008 and March quarter 2009 — the three quarters of global contraction,” the Treasury paper stated.

In technical terms, Australia avoided a recession because it did not experience two quarters of negative quarter on quarter headline GDP growth. But in terms of GDP per capita, the economic output per person, the economy actually had a recession.

By raising the net migration intake to what was a record high in 2008 and 2009, the Rudd government significantly reduced the chance of the economy having a technical recession.

Fast forward to 2023, the Albanese government has followed in the footsteps of its predecessors.

The federal budget pencilled in net overseas migration of 400,000 in 2022-23 and 315,000 in 2023-24. The total for 2022-23 is 33 per cent higher than the prior record high and for 2023-24, 5 per cent higher.

Once again, high levels of population growth may help to prevent a technical recession, even though the federal budget forecasted that GDP per capita would fall.

China to the rescue?

During the GFC, the explosive growth of the Chinese economy driven by huge stimulus programs saw demand for Australia’s mineral exports skyrocket, coming at just the right time to keep the Aussie economy out of a recession.

In hindsight, many Chinese policymakers now consider the outsized stimulus response to the GFC a mistake. The approach to the construction sector and stimulus programs driven by local government borrowing has also changed significantly in the past 15 years.

However, as the reopening of the Chinese economy continues to perform significantly more poorly than Beijing and analysts expected, there are signs that policymakers may resume their habit of construction-driven stimulus in order to prop up the economy.

In recent days it was announced that Beijing would issue 1 trillion Yuan in special government bonds, with which to boost infrastructure at a local government level.

At first glance, this appears to be a return to the construction stimulus-driven growth of the days of old.

But once it’s put into the context of severely decreased local government revenue due to the ongoing collapse in land sales, one of the main revenue sources, it becomes obvious that things aren’t as clear cut as they initially appear.

In time, Beijing may end up throwing caution to the wind and see the downsides of a large construction-driven stimulus as the lesser of two evils, but the early evidence suggests that this potential scenario is quite a way down the road, if it were to come to pass.

Real wages growth

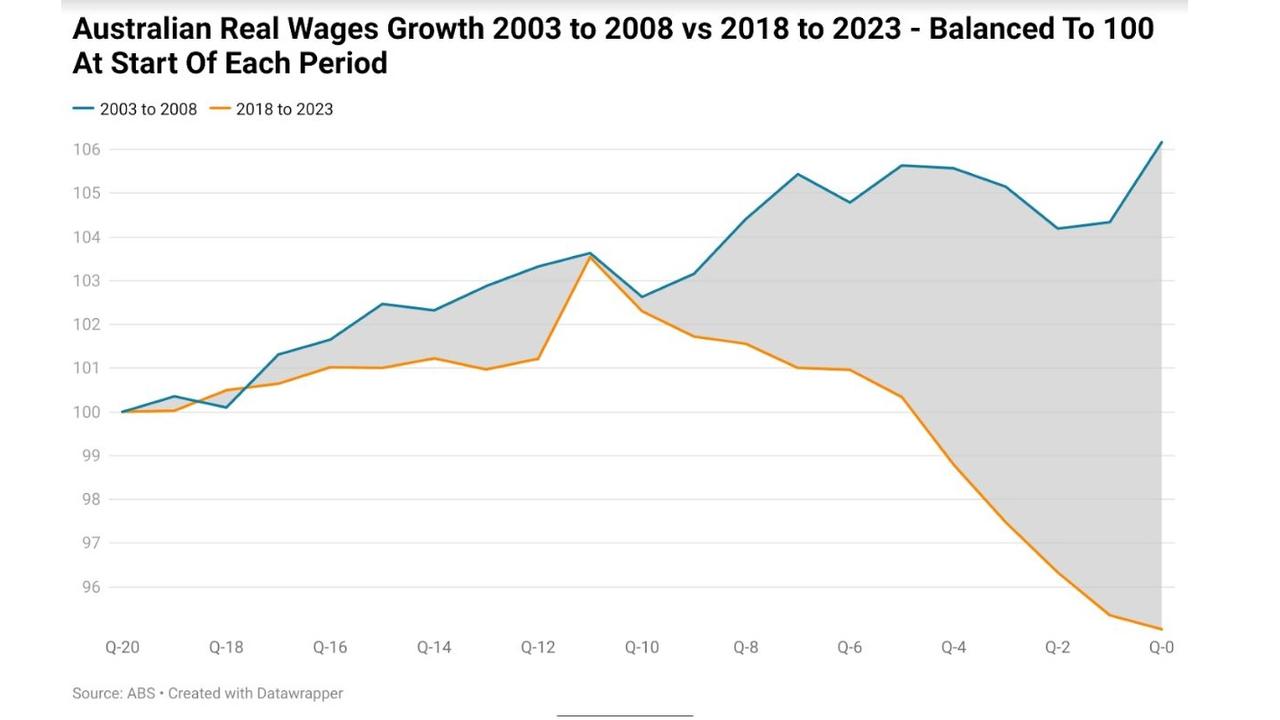

In the five years prior to the GFC, Australia enjoyed strong real wages growth, with total inflation-adjusted pay packets growing by 6.2 per cent.

In the five years prior to the latest wages growth data which covers up to the March quarter of this year, real wages declined by 5.0 per cent.

In the run up to the GFC, the robust wages growth seen in the years prior helped to insulate households from rising inflation and rising interest rates. At the time, the rate rise cycle seen in the years prior to the GFC was the largest single rate rise cycle in relative terms since comparable records began in 1959.

In the present there are some similarities – the relative rise in mortgage interest repayments is more than double the previous cycle, except this cycle has played out over 13 months, while the GFC era rate rise cycle occurred over six years.

On the other side of the coin, the destruction of real household purchasing power has left households far more vulnerable to higher interest rates and an economic downturn than they were back in 2008.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator