Reason millionaires are flooding into Australia

Australia has reclaimed the title of attracting more net millionaires than any other country – and there’s a big reason they’re all here.

ANALYSIS

Recent data from the Australian Treasury, real estate professionals, property portal Juwai IQI, and PropTrack all show that overseas demand for Australian housing is surging.

NAB’s latest Residential Property Survey of real estate professionals reported that the proportion of Australian homes sold to foreign buyers has increased sharply since Australia’s borders were reopened in late-2021:

Overseas searches on realestate.com.au, reported by PropTrack, also show that foreign buyer interest in Australian housing has hit record highs, led by China:

Meanwhile, the Australian Treasury this month reported that approvals for foreign purchases of Australian homes increased by 40 per cent in the last quarter versus the previous year, with buyers from mainland China, Hong Kong, Taiwan, and Vietnam leading the way.

Property portal Juwai IQI has ranked Australia as the number one choice for Chinese buyers.

Chinese buyer inquiries through Juwai surged 158 per cent in the third quarter, which was the second consecutive quarter with double-digit growth.

Juwai spokesperson David Platter told The Australian Financial Review (AFR) in September that the firm had “been working with a lot of Chinese ever since the borders opened. Presumably as flights continue to increase we will see buying increase”.

“These people are upper-middle-class and wealthy from a Chinese standpoint. They are buying townhouses, houses and large apartments at $1.5 million, $2 million, $2.5 million and up”, he said.

Juwai’s observations have been supported by local agents working predominantly with Chinese buyers.

Peter Li, general manager of Plus Agency, told The AFR that foreign buyer inquires have quadrupled from last year, and sales have doubled. He also expects sales to rise further.

“International buying will definitely increase during the next year. There is more activity in terms of flights, so it’s increasingly easier to get in and out of Australia”, he said.

Likewise, Toorak buyer’s agent, Alex Bragilevsky, said that he has “facilitated $135 million of real estate deals [in Toorak] in the past six months”, with 90 per cent of his clientele from China.

“They come to Melbourne on a private jet, and I’ll meet them at the airport with a nice car. Then we go out and look at real estate”, he said to The AFR.

Finally, David Morrell, director of Morrell and Koren, described the foreign buyer situation to news.com.au as “nuts”.

“We are seeing jumps of $2-3 million dollars on properties”, he said.

“We have a market place that is disproportionately being sold to Chinese buyers, relative to the rest of the population”.

“What’s happening in Toorak is only a look at what is happening under the blankets, across the country”, he said.

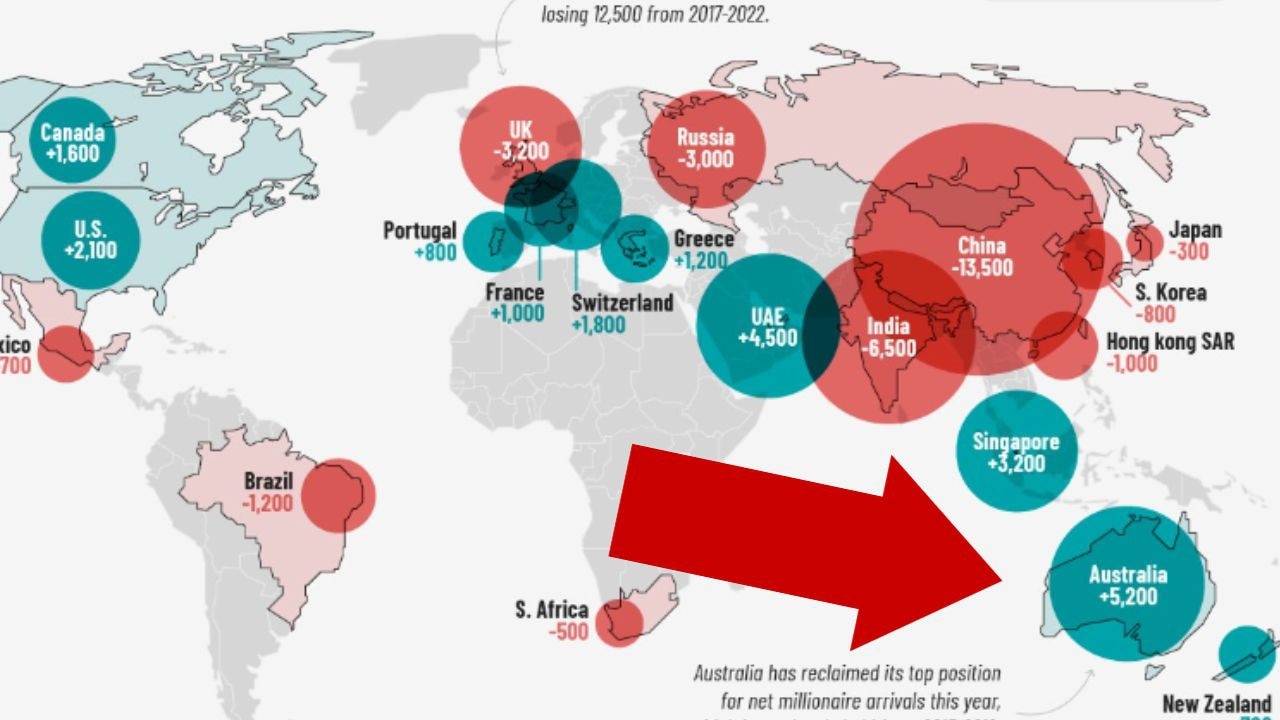

A recent map by The Visual Capitalist on the migration patterns of the world’s millionaires forecast that Australia will this year experience the highest influx of millionaire migrants (+5,200), while China will suffer the greatest loss (-13,500):

Clearly, a fair chunk of these migrant millionaires have found their way to Australia.

How did we get here?

Several forces have converged to make Australian housing a honeypot for foreign buyers.

First, the former Rudd Government made the shortsighted decision in 2009 to allow temporary migrants to purchase established housing.

The subsequent boom in temporary migration – in particular, international students (the largest share of whom come from China) – has boosted demand for Australian homes.

Second, Australia has some of the weakest anti-money laundering (AML) laws in the world, which has made Australian housing the go-to conduit for laundering dirty money.

In 2003, Australia agreed to implement comprehensive ‘Tranche 2’ global AML rules covering so-called real estate gatekeepers: accountants, lawyers, and real estate agents.

These rules have been continually postponed by the federal government amid strong pushback from the same industries that would be subject to the regulation.

The global AML regulator, the Paris-based Financial Action Taskforce (FATF), issued a warning in 2015 that large sums of money were being laundered through Australian residential housing, mostly from China.

The FATF urged Australia to implement AML regulations to bring real estate gatekeepers under regulatory scrutiny, which fell on deaf ears.

FATF again warned before the Covid pandemic that large sums of money were “suspected to be laundered out of China into the Australian real estate market”.

The Australian Transaction Reports and Analysis Centre (Austrac) likewise warned that “laundering of illicit funds through real estate is an established money laundering method in Australia”.

It is estimated that billions of dollars have been laundered through Australian homes over the past two decades, primarily by Chinese nationals.

Third, money laundering has also been facilitated by the ‘golden ticket’ visa, which was introduced by former Labor Treasurer Chris Bowen in 2012 and has operated for 10 years with near zero rejections.

Chinese citizens make up 90 per cent of successful applicants. And over 20,000 Chinese have been approved for the Significant Investor Visa scheme, which requires a $5 million minimum commitment.

These ‘golden ticket’ visas grant automatic permanent residency in Australia, and unlike other visa classes, no English language proficiency is necessary.

Anti-corruption campaigners have long lobbied for these visas to be abolished, claiming that corrupt officials are using them to enter Australia and launder funds.

Australia’s Productivity Commission has also called for the ‘golden visa’ program to be axed, noting they are conduits for laundering ‘dirty money’ into Australia.

Other developed countries have already discontinued similar ‘golden ticket’ visa programs which, combined with Australia’s lax AML rules, has made our homes a honeypot for laundering funds.

Time to close the loopholes

Like Groundhog Day, the Albanese government is undergoing another industry consultation process on the Tranche 2 AML laws.

Implementation of these rules could result in more than 100,000 real estate gatekeepers being subject to AML regulation, which has caused another round of fierce pushback from the impacted industries.

These vested interests defeated similar stakeholder consultations in 2008, 2010, 2012, 2014, and 2017. And there is the concern that they will be successful again, delaying the implementation of the global AML rules first agreed by Australia in 2003 into the never-never.

The Albanese government needs to break the 20-year cycle of stonewalling and implement the Tranche 2 AML rules once and for all.

More Coverage

The government should also follow the Productivity Commission’s recommendation to scrap the ‘golden ticket’ visa program, as well as ban temporary migrants from purchasing established Australian homes.

Otherwise, locals will continue to be priced out of housing by foreigners, and Australian housing will remain a global magnet and shelter for dirty laundered money.

Leith van Onselen is co-founder of MacroBusiness.com.au and Chief Economist at the MB Fund and MB Super. Leith has previously worked at the Australian Treasury, Victorian Treasury and Goldman Sachs.