‘Paying for it’: Crushing ‘double shock’ coming for Aussies in late 2025

An alarming change is now just months away – and it could have a devastating impact on the already fragile Australian economy.

ANALYSIS

At first glance, linking Australia’s energy woes to house prices appears a long bow.

But it depends on how closely you look and whether you recognise how important cheap energy is to low interest rates.

Once that connection is made, the relationship between gas and house prices becomes critical.

The great housing bubble

Everybody knows Aussie house prices are stupid.

Supported by government guarantees for cheap mortgages, mass immigration and constrained supply-side policies, Aussie dwellings have long since stopped being a market.

They are a quango. A publicly supported asset class to make homeowners feel wealthy.

Therefore, those who are looking for, or hoping for, lower prices shouldn’t be looking at the failed market for price signals; they should be looking at how long policy can support the bubble.

MORE: Huge prediction for Aussie house prices

Over various economic traumas, policy supports have proven up to the task. A combination of interest rate cuts and fiscal stimulus has been enough.

So much so that Aussie households are some of the most indebted in the world, and nearly all of it is for mortgages.

And Australia’s leading bank, the Commonwealth Bank of Australia, is priced as richly as US technology stocks, despite having no profit growth.

Housing bubble meets gas pin

But nothing lasts forever, and a convergence of international forces with local policy mistakes is about to stick a pin in the celebrated bubble.

From the end of 2025, the east coast of Australia will, for the first time, import liquefied natural gas (LNG) to meet its gas needs.

MORE: Home loan trap taking years to escape

This will fully connect Australian gas prices to international prices, as the Queensland gas export cartel reduces supply to ensure local prices rise to import parity.

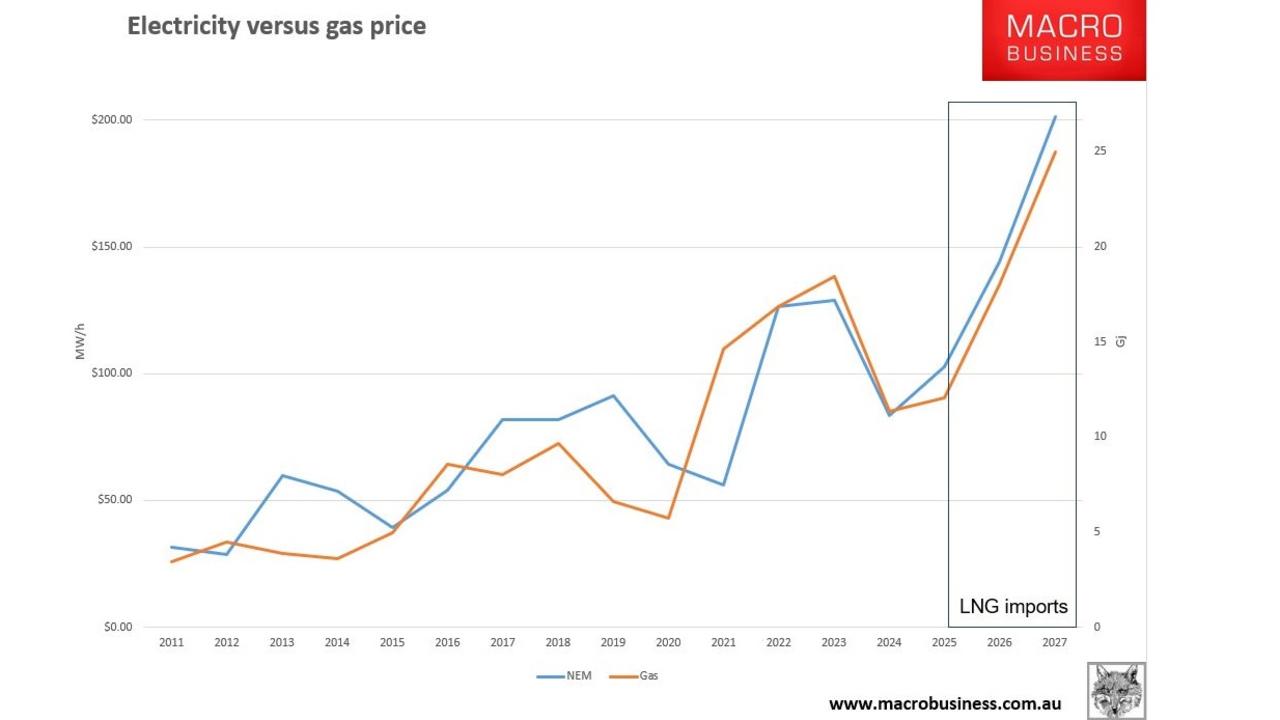

Australia grew rich on $3 per gigajoule (GJ) gas. Since the gas export cartel opened, the price has risen to $13.74GJ.

Once gas imports start, that price will rise to … wait for it … around $25GJ.

In 10 years, we will have delivered ourselves an 830 per cent increase in gas prices for no reason other than sending profitless gas to China.

Moreover, gas-fired power sets the marginal cost of electricity on the east coast, which comprises one-third of your bill, so the LNG import scenario is the equivalent of a 273 per cent rise in power bills as well.

So far, you have been spared the worst of this shock because state and federal governments combined to rebate your power bills in the wake of the Ukraine war.

But you’re still paying for it in slow motion via higher taxes.

The perfect storm

The Albanese government has committed to extending these rebates. But the Dutton opposition says it will remove them and rely, instead, upon expanded gas supply.

But from whom? The east coast gas cartel already possesses all of the reserves. There’s no more gas to develop outside of the cartel.

If so, an LNP government will deliver a huge energy double shock to households, equivalent to Covid and the Ukraine war combined.

This will add 4-5 per cent to the consumer price index, and you can double it with inflationary spillovers into energy-hungry items like food and building materials.

But wait, there’s more.

The reason imported gas is so expensive is not just production costs and shipping. It is because we are buying US dollar-denominated gas with weak Australian dollars.

So, every time the Australian dollar weakens, gas and electricity prices will go up accordingly.

Whenever there is a global growth shock in the future a war, a financial crisis, a recession – Australian energy costs will skyrocket, limiting Reserve Bank easing.

Worse, if that shock also takes down the prices of bulk commodities, coal and iron ore, as it is right now in the Chinese crisis, energy prices will soar just as the budget is gutted as well.

That means both fiscal and monetary policy will simultaneously be trapped, energy rebates will become much more expensive and difficult to deliver, and the RBA will be completely cornered by energy inflation.

You might think that this is all fanciful pessimism, except for the fact that this is exactly the conditions already developing for 2026/27.

How to stop it

It’s very easy to prevent this economic calamity. We need our state and federal governments to get together and declare a coast-to-coast 15 per cent domestic reservation policy for gas.

We should add a national gas export levy that takes taxes 100 per cent of every dollar above $7GJ that is sold overseas. This will crater the local price to $7GJ and make us $10 billion while we’re at it.

But your pollies aren’t interested in this sense. They are too busy hiding under their desks from the oil and gas lobby comprised of multinationals and Asian customers.

If your wealth relies on property, I suggest you write to your local MP with some urgency and demand they fix the gas price.

David Llewellyn-Smith is Chief Strategist at the MB Fund and MB Super. David is the founding publisher and editor of MacroBusiness and was the founding publisher and global economy editor of The Diplomat, the Asia Pacific’s leading geopolitics and economics portal. He is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second Garnaut Climate Change Review.