NSW forecast to record a deficit until 2027-28 due to $11.9bn GST rip off

NSW will record a further four years of deficits in an attempt to protect families and businesses following fallout from this year’s GST carve-up.

The NSW budget is forecasted to endure a further four years of consecutive deficits until the 2027-28 financial year due to the GST fallout, which will deliver a $11.9bn hit to the state’s bottom line.

Handing down the state budget on Tuesday, NSW Treasurer Daniel Mookhey will say the government “will absorb” the budget black hole through a deficit, instead of inflicting “austerity” measures like tax increases, or rampant spending cuts.

“Helping families is our most important mission during NSW’s worst cost-of-living crisis in a generation,” he will say on Tuesday.

“We refuse to respond to the Grant Commission’s absurdity by imposing austerity on NSW. That would lead to misery.”

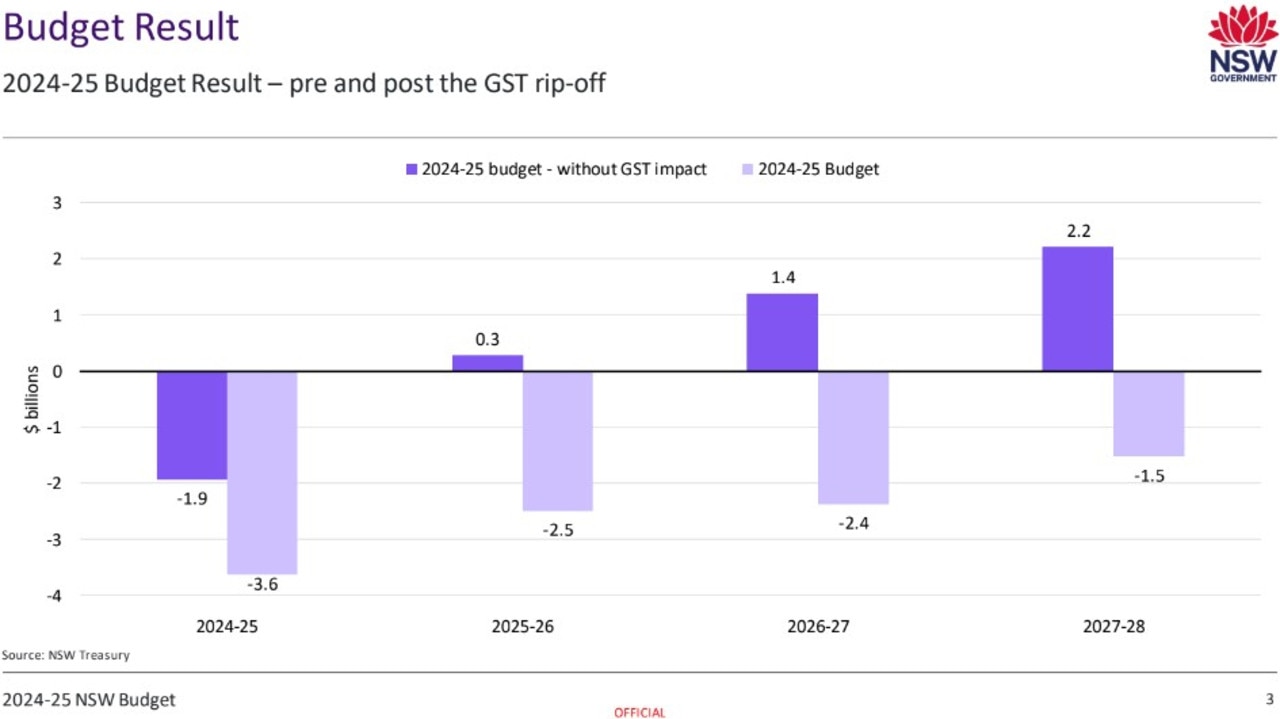

Prior to the Commonwealth Grants Commission (CGC) determination earlier this year, NSW was slated to record a $300,000 surplus in the 2025-26 financial year, which would grow to $2.2bn by 2027-28, Tuesday’s state budget will reveal.

Now, the deficit for the 2024-25 financial year will hit $3.6bn, from $1.9bn. NSW will remain in the red across forward estimates in the 2025-26 ($2.bn), 2026-27 ($2.4bn), and 2027-28 ($1.5bn) financial years as well.

However the government will carefully balance the reduced revenue without implementing new taxes – a Labor election commitment – and do so while easing cost-of-living pressures on families, reducing the budget black hole.

“Our careful spending will see the deficit fall from $9.7bn in 2023/24 to $3.6bn in 24-25. A $6bn improvement,” he will say.

“In 25-26 tight spending discipline will see the deficit fall again to $2.5bn. Then in 26-27, it is likely to be $2.4bn. Finally, in 27-28, it drops to $1.5bn.

“Overall, 8.6 billion better than 22/23.”

In January, Mr Mookhey said he would be petitioning his federal counterpart Jim Chalmers to reform how the CGC determines its GST split, calling for a per capita distribution method that would favour more populated states like NSW.

He said proposed changes should also increase transparency and accountability, and said states should share their data which are used to calculate the carve-up.