New CoreLogic data shows the property market’s downturn is losing steam

Despite the steady flow of positive news for the property sector, the market still lost value in the latest figures released today.

The pace of the nation’s property market decline slowed further in May, with expectations of a rate cut and reforms to mortgage serviceability requirements lifting sentiment.

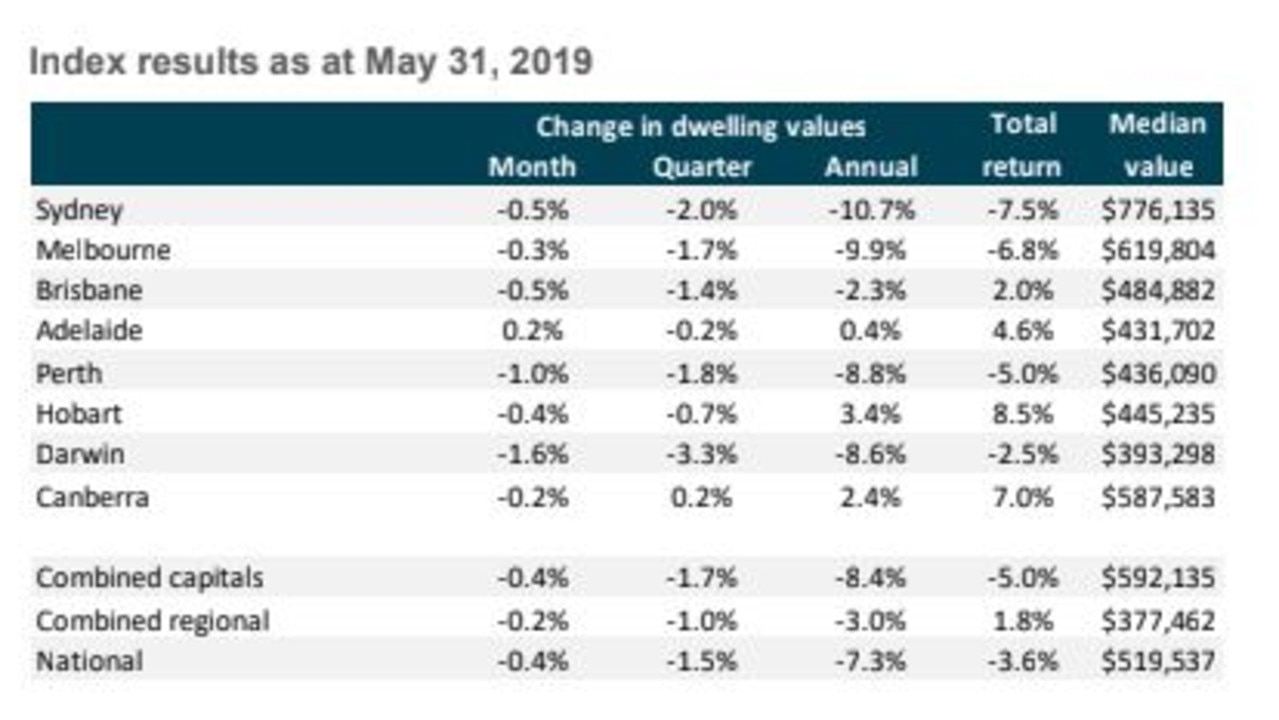

The monthly report card from data firm CoreLogic showed the drop in national dwelling values slowed from 0.5 per cent to 0.4 per cent in May, primarily driven by a slower rate of decline in Sydney and Melbourne.

CoreLogic head of research Tim Lawless said, while the housing market remained in a broadbased downturn, the outlook was more positive now than it was before the federal election.

The monthly decline in national prices has eased for five straight months since it was at 1.1 per cent in December, while auction clearance rates in Sydney and Melbourne have also begun to climb.

Nonetheless, Mr Lawless said the sector still faced a variety of headwinds, especially in the credit space.

“Although interest rates and serviceability tests are set to reduce, lenders are continuing to scrutinise incomes and expenses much more intensely,” Mr Lawless said.

“Comprehensive credit reporting is providing lenders with greater visibility around borrower finances and overall debt levels, and progressively, lenders are reducing their exposure to borrowers with high debt levels relative to their income.”

The RBA is tipped to move rates for the first time since August 2016 tomorrow, with the market already pricing in a new record low of 1.25 per cent.

Mr Lawless said policy makers would no doubt keep an eye on the housing market amid increasing concerns over prospects for economic growth and stubbornly low inflation.

“If we see housing values surging higher on the back of increased stimulus measures, we may see macro-prudential or other policy levers being pulled in an effort to provide house price stability while at the same time supporting an improvement in economic activity,” Mr Lawless said.

National property prices have slid 7.3 per cent nationally over the past 12 months, including homes in the major capital cities dropping by 8.4 per cent in value.

AMP chief economist Shane Oliver says markets in capital cities would remain under pressure because of a tighter credit environment, record unit supply and reduced foreign demand in the months ahead.

But he says the looming rate cut, policy to support first homebuyers and the relaxation on the serviceability on mortgage rates will fast-track the recovery.

“The removal of the threat to negative gearing and the capital gains tax discount following the Coalition’s federal election victory point to house prices bottoming out by year end and at higher levels than we had been previously expecting,” he said in a note.

“In fact, Sydney property prices look to have bounced around 0.2 per cent since the election as they were down 0.7 per cent month-to-date up until May 17.

“So, after the election we cut our expected top-to-bottom fall for national capital city average home prices to 12 per cent (from 15 per cent) mainly due to upwards revisions to price forecasts for Sydney and Melbourne, which are now expected to have top-to-bottom falls of 19 per cent and 15 per cent respectively.

“But given still high house price to income ratios and poor affordability, still very high debt levels, tighter lending standards and rising unemployment as economic growth remains soft and below potential a quick return to boom time conditions is unlikely.

“After bottoming later this year, which we expect to leave capital city average prices down 12 per cent from their 2017 high, we see broadly flat house prices for 2020.”

May data from realestate.com.au showed the property market is at a shifting point with Sydney and Melbourne prices edging to the bottom of the cycle while the outperforming markets are beginning to plateau.

The country’s two major capitals were expected to weaken for another few months but voters slamming the door on Bill Shorten’s proposal to change negative gearing and capital gains concessions may have brought that recovery forward.

This, combined with the Australian Prudential Regulation Authority easing access to finance will stimulate the sector, realestate.com.au chief economist Nerida Conisbee said.

Sydney prices were flat in May, according to the site’s median property data, leaving the year-on-year loss at 7.5 per cent and a fall of 10.6 per cent from its peak in September 2017.

Melbourne lost 0.2 per cent for the month, falling 6 per cent over 12 months and a peak to trough weakening of 6.2 per cent.

Ms Conisbee said there are signs the worst of the Sydney downturn is in the past despite investor confidence being battered and bruised.

“It’s not going to be a massive recovery, the key is that we had boom-like conditions leading up until September 2017 when we had a couple of years of double digit growth,” she told news.com.au.

“It was quite extreme and I don’t think we’ll see that again.”

It was widely tipped the Brisbane market would struggle most over the last 18 months given the city’s oversupply of apartments, but its year-on-year fall was just 1.2 per cent after not changing in May.

Adelaide was also unchanged for the month and edged 0.2 per cent higher in the last 12 months, while Hobart’s period of sustained growth is at its peak.

The Tasmanian capital, which has been the darling of the nation’s property market over the last two years, rose 0.2 per cent in May and 1.2 per cent year-on-year.

“The issue is Hobart is expensive now,” Ms Conisbee said.

“There’s $1 million-plus suburbs in the city now so the affordability edge that it had is gone, so you’re not going to get the investor activity that was there.

“There’s still a lot of pressure on housing in Hobart, so that will keep things from falling because low rental vacancies and construction levels have been subdued for a long time.

“But that heat has now come out of that market.”

Ms Conisbee said the housing supply issues in Hobart could transcend the property market.

“People were moving to Hobart because there were jobs and there was affordable housing so it was a really nice combination,” she said.

Canberra rose 0.1 per cent for the month and 0.7 per cent over the last year, but is another stronger market closer to flattening out.

The nation’s capital was due to experience strong demand for housing with the expected change of prime minister.

But the city won’t get the influx of staff traditionally associated with a new resident at The Lodge.

“I can’t see the Scott Morrison Government rapidly increasing staffing levels, they certainly won’t need the consultants that the Labor Party would have needed to get the new government up and running,” Ms Conisbee said.

But, like the rest of Australia, the ALP’s loss brings more favourable conditions for property investors.

According to the figures, Perth and Darwin markets are both languishing having fallen 15.9 and 23.2 per cent respectively from peaks in 2014.

With AAP

Continue the conversation on Twitter @James_P_Hall or james.hall1@news.com.au