Melbourne lockdown: Consumer spending plummets as restrictions bite

It’s only been a few days and already it looks like Melbourne’s lockdowns could cost at least $5bn with consumers closing their wallets, even outside Victoria.

Well that didn’t take long. Data from just a few days of Melbourne’s new lockdown has revealed the huge economic impact it’s having.

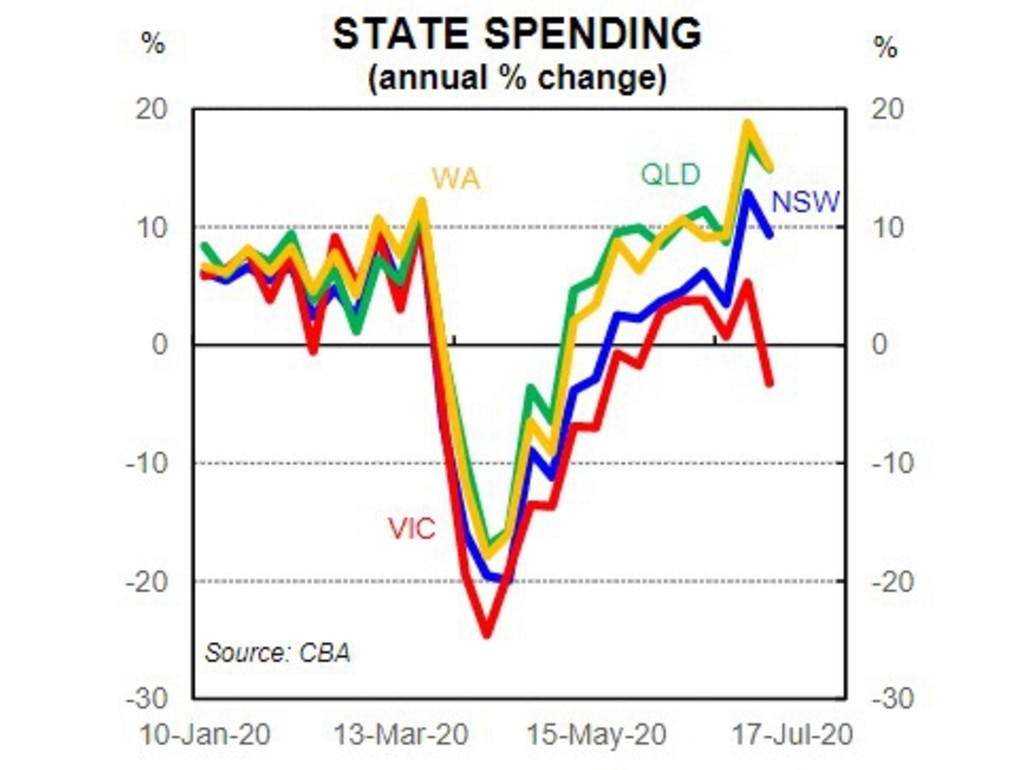

And the indications aren’t good. Not only did consumer spending in Victoria plummet in the run up to and during the beginning of the stage three restrictions, it looks like consumers elsewhere have also started closing their wallets fearful they will be next to go into lockdown.

However, spending in pubs has almost returned to 2019 levels. Which may explain some of the huge queues seen outside Sydney bars.

New data released from Commonwealth Bank has shown Victoria’s economy tanking last week. It could take an almost $860m weekly hit from the restrictions – that’s a more than $5bn slump over six weeks.

“Spending growth turned lower in most states and territories last week,” Commonwealth Bank senior economist Kristina Clifton told news.com.au.

“Coronavirus cases rising in Victoria has shown that this isn’t necessarily over and that’s put a dampener on overall consumer sentiment.”

The bank has further revised down national economic growth forecasts which it has said is directly attributed to the Melbourne lockdown.

RELATED: Follow our live coronavirus coverage here

CBA looked at credit card spending up to the end of last week which included several days of the Melbourne wide restrictions as well as the earlier lockdown in individual suburbs and public housing towers.

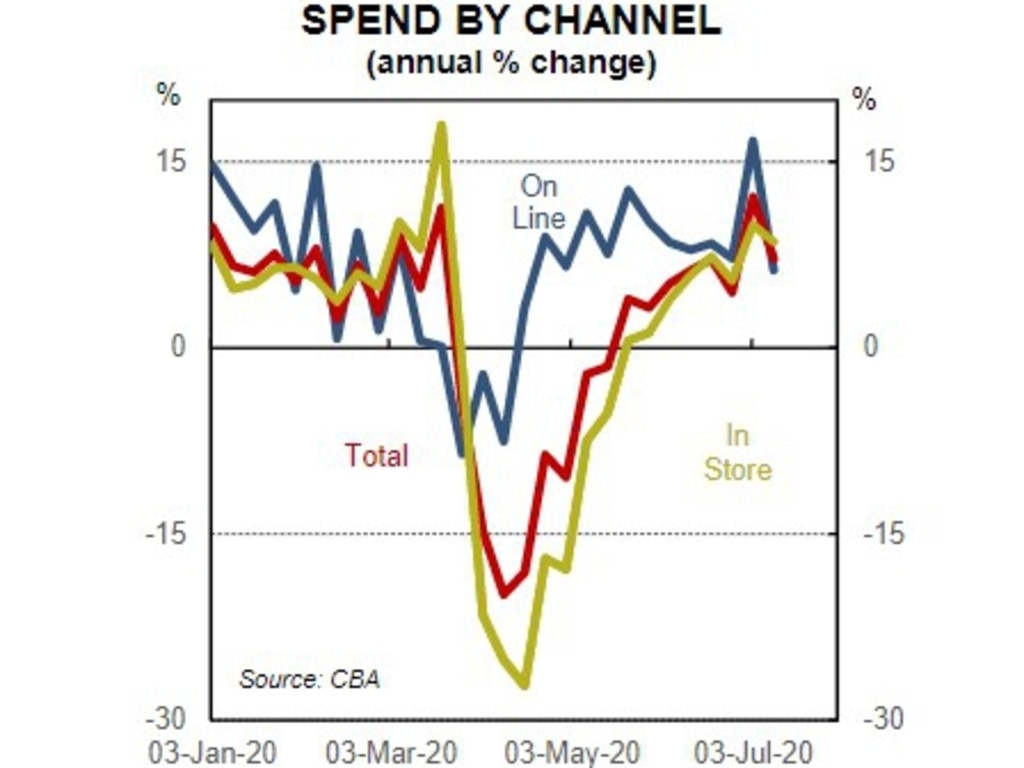

Nationwide, total spending last week was seven per cent higher year-on-year. Which sounds good, until you realise that the week before it was up by a healthier 12 per cent.

In Victoria, spending went into negative territory last week, with residents putting three per cent less on their cards than in 2019.

“It’s hard to spend if you can’t go to movies, you can’t take the kids to Luna Park or go to all those places you would normally go to,” said Ms Clifton.

In mid-April when we were all staying at home, spending fell off a cliff, slumping to around 20 per cent less than in 2019.

The ACT also saw spending go negative last week, down by one per cent, but almost everywhere else purchases fell from the week before.

In New South Wales, which has been easing back on restrictions but has also seen a cluster of cases in a south western Sydney pub, overall spending fell from 13 per cent to nine per cent above last year’s levels within a week.

RELATED: What stage 4 restrictions in Victoria could look like

Even Queenslanders, who have few restrictions upon them, purchased slightly less than the week before with spending at 15 per above 2019 levels. It was a similar case in other states.

Only shoppers in the Northern Territory bucked the trend, going from a 13 per cent to a 16 per cent rise within a week.

Ms Clifton said it wasn’t just the news coming out from Victoria, the uptick in cases in the US has also made people more wary about tapping their cards. This is on top of the general grim economic picture.

“It will take quite a number of years for the labour market to recover to where it was before coronavirus hit and so it’s safe to assume people are more cautious about spending in that environment.”

ALMOST $1 BILLION PER WEEK

CBA didn’t put a dollar figure on how much the Victorian economy will contract by, but the bank has said it expects at least a 10 per slide in gross state product (GSP).

With Victoria’s GSP at almost $450 billion annually, a 10 per cent downturn would equal a $860 million blow per week or a $5.2 billion fall over the time frame of the six-week lockdown.

That’s not far off Treasurer Josh Frydenberg’s statement last week that the Victorian shutdown could cost the country $1 billion for every week it’s in place.

However, if the economies of the other states begin to lose steam as well, that figure could creep higher.

CBA had predicted the Australian economy would contract by 3.2 per cent in 2020 due to COVID-19. But, with the new lockdown, it has said a 3.8 per cent slump is now more likely. Victoria accounts for around 23 per cent of Australia’s overall economy.

“The shutdown on Victoria will have noticeable impact on growth figures,” said Ms Clifton.

PUB SPENDING ALMOST BACK TO 2019 LEVELS

Nationwide, the biggest sector to see a slump was services – such as restaurants, education and travel – which was down 10 per cent last week on 2019 levels, three times the decrease seen in the week before.

Queensland reopening its borders should boost travel but that will be offset by Victoria shutting its border. Today, South Australia said it would delay allowing in people from NSW, further pushing down demand.

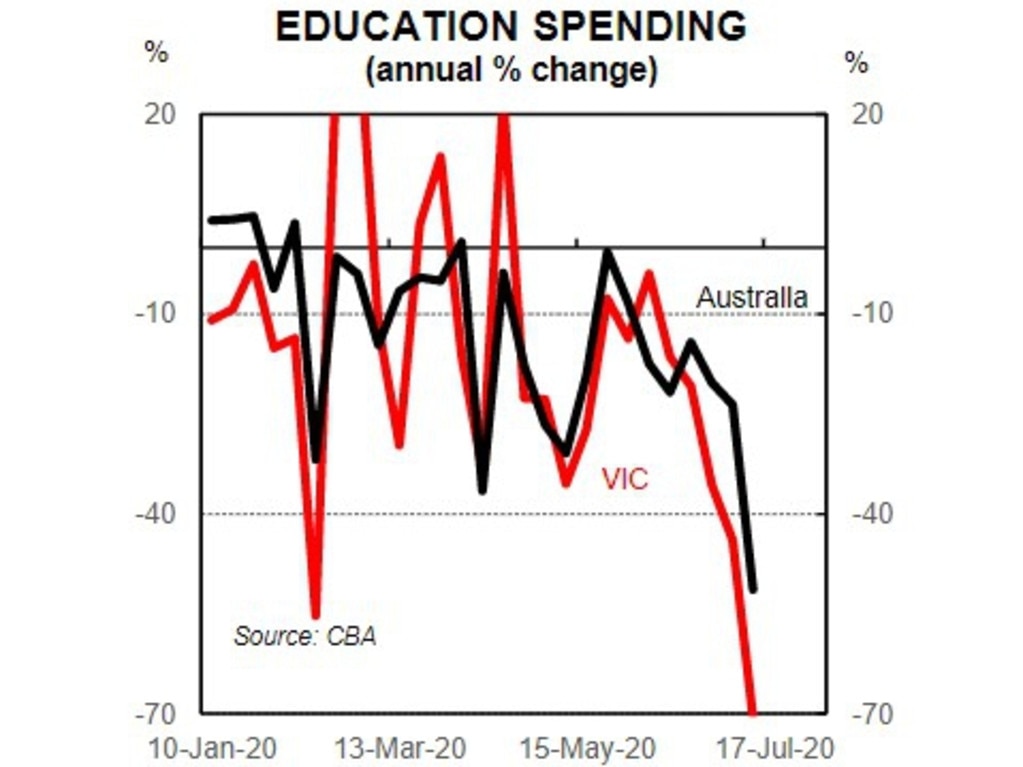

Breaking the spending figures down even further, the education sector is by far the biggest loser with a massive 51 per cent drop in spending on 2019 levels last week, double the drop the week before. In Victoria it fell off a cliff by 70 per cent.

We spent big on groceries, takeaway alcohol and household furnishings last week, a pattern seen through the pandemic. But even here we are dialling back on the amount we purchase.

Sales in cafes and restaurants are up 11 per cent on this time last year. Sales in pubs were down just three per cent on this time in July 2019 last week. That suggests nationwide we’re heading to the bar in huge numbers which almost makes up for Victorian venues being closed.

RELATED: UK pub installs electric fence to enforce social distancing

However, these figures included just a few days of Melbourne’s lockdown and before Sydney’s Casula Crossroads cluster – both of which are likely to depress demand even further.

Ms Clifton said a notable change in consumer behaviour had been a shift to saving which she put down to general worries about job certainty as well as September cut-off date for Jobkeeper and increased Jobseeker payments nearing.

“People are tending to save a fair bit of the payments rather than spending them as they don’t know when they will be able to find a job again.”

If NSW follows Victoria into lockdown, the impacts will be hugely exacerbated. The first state accounts for a third of the country’s total economy meaning a hit of more than $1bn a week can be expected.