Labor’s negative gearing changes will raise rent costs by nearly $5000 in Brisbane

A property market analyst forecasts rental prices will rise and the property market will fall further if Bill Shorten wins the upcoming federal election.

Renters could face a hike of nearly $5000 a year if Labor win the election and follow through with proposed changes to negative gearing, a new report claims.

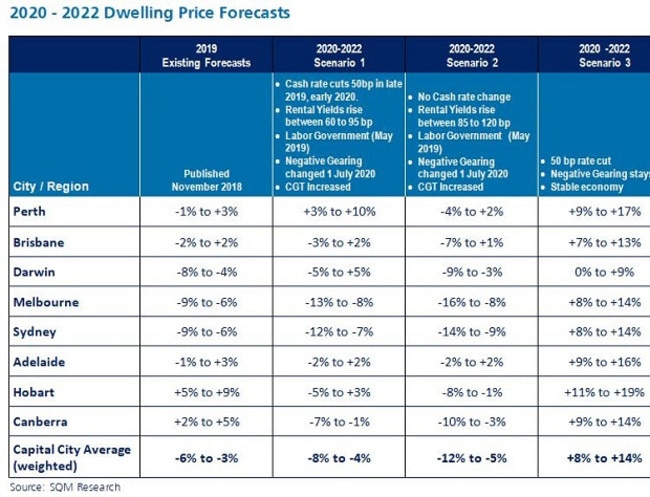

Data from property market analysts SQM Research also says the property market will fall further, losing between 5 and 12 per cent nationally by 2022 if a Bill Shorten government ditches the concession for existing properties and halves capital gains tax discounts to 25 per cent.

• House prices falling faster than during global financial crisis

• Westpac becomes first major lender to predict rate cut

• Apartment glut adds further pain to property market

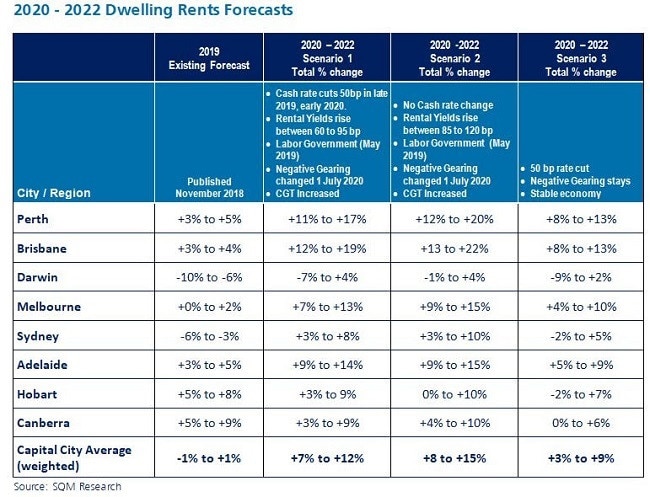

Rental prices would remain stable but begin to rise from the end of next year, SQM’s founder and analyst Louis Christopher said.

“There is likely to be upward pressure from 2021 due to the current slump in building approvals which will be aggravated by the loss of negative gearing,” he said in a report.

“The slump in approvals has now fallen below underlying demand requirements which may create a shortage of dwellings from late 2020.

Based on the forecast, Brisbane renters will cop the sharpest rise with a potential lift of 22 per cent.

This would equate to more than $90 a week, or about $4700 a year, for a median two-bedroom unit, Treasurer Josh Frydenberg said.

SQM Research reports Perth rentals could jump 20 per cent, Melbourne and Adelaide 15 per cent, while Sydney, Canberra and Hobart may rise 10 per cent.

The already struggling Melbourne and Sydney housing market will fall 16 and 14 per cent respectively, the report says.

“This is the latest in a string of reports warning against Labor’s housing taxes,” Mr Frydenberg said in a statement.

“Labor need only look at their last failed attempt at changing negative gearing in 1985, which SQM found resulted in a 23.7 per cent fall in housing commencements nationally and rent increases in the majority of capital cities.

“Bill Shorten must stop ignoring the warning signs.”

Shadow treasurer Chris Bowen slammed SQM’s modelling as being confused and “all over the shop”.

“Labor’s housing affordability reforms enjoy the support of many independent economists and think-tanks like the Grattan Institute and Saul Eslake, as well as international economic agencies like the International Monetary Fund,” he said.

Mr Bowen repeated details of his policy, saying the changes won’t impact those who already use negative gearing and will still be available for new constructions.

“Labor is reforming negative gearing to put young first homebuyers on more of a level playing field with property investors seeking their sixth or seventh property,” he said.

SQM’s modelling says a widely predicted rate cut to the official cash rate by the Reserve Bank would provide a “cushion” to the effects of Labor’s property policy.

“Even so, the market would still record dwelling price falls,” Mr Christopher said.

“Housing construction; already in a slump, would likely fall further due to the lack of investor demand.

“This would set up a shortage of housing come later 2020 based on current strong population growth rates.”

This isn’t the first time the forecast group and the shadow treasurer have clashed over property policy.

In November, Mr Bowen slammed “economically irresponsible doom-and-gloom predictions” and implied Mr Christopher was conflicted.

“Only a few years ago, Louis Christopher was supporting Labor’s reforms to negative gearing, so what has changed? We can only speculate,” the statement said.

“Economists without a vested interest agree that our plan is a responsible way to ease pressure in the housing market, to make sure that everyone is competing on a level playing field.”

Mr Christopher hit back, saying: “Chris needs to do some research or stop misleading the public about me and SQM. Yes we are independent, because, professionally we don’t care if the market rises or falls.

“We research all asset classes, not just real estate. Under the negative gearing repeal scenario, the declines are more than just 3 per cent over and above forecasted declines. The range is total peak to trough declines of 20-30 per cent.”

Continue the conversation on Twitter @James_P_Hall or james.hall1@news.com.au