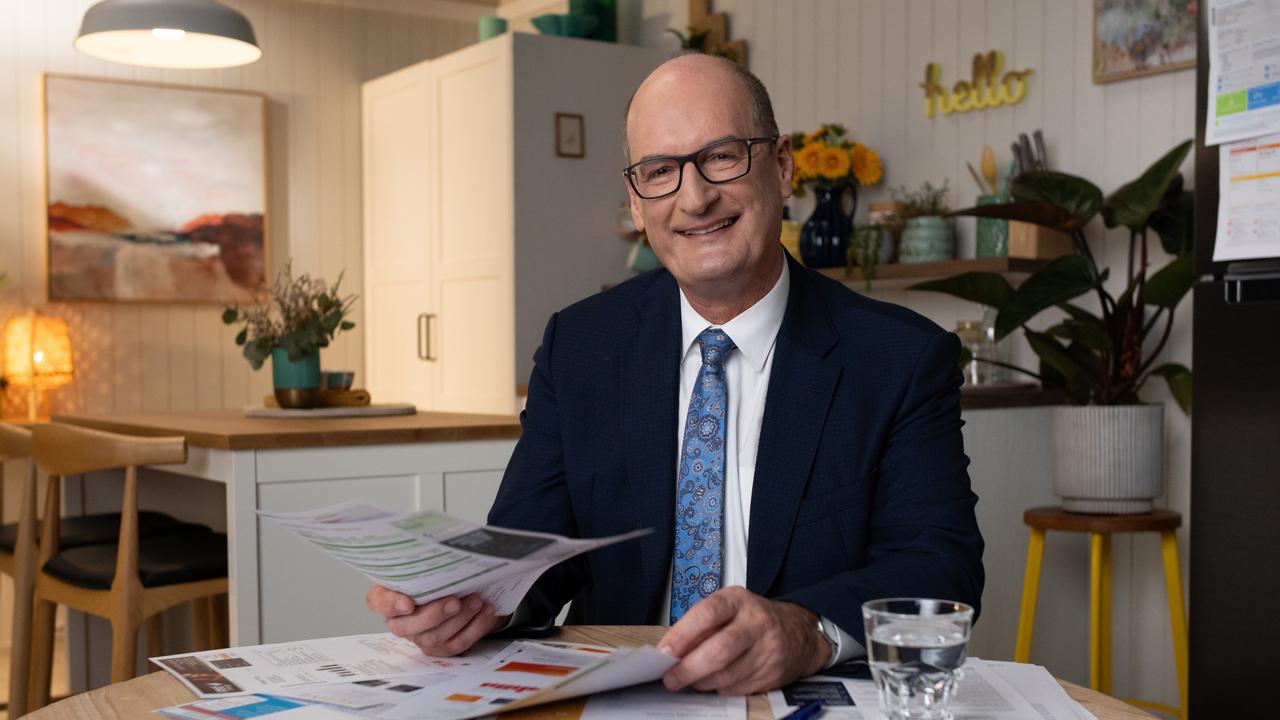

Beware the Bank of Mum and Dad: Kochie’s warning for every Aussie parent

Australian finance expert David Koch has sounded a warning over what he believes is an increasingly common parenting mistake.

Australian finance expert David Koch has sounded a warning over what he believes is an increasingly common parenting mistake — once the adult kids are of house-buying age.

In a financial landscape where the dream of homeownership for many young Australians seems eclipsed by soaring property prices, the “Bank of Mum and Dad” has emerged as a formidable force, bridging the gap between aspiration and reality.

However, Mr Koch said parents should think twice about going down this route.

He said they should approach financial assistance for their adult children’s property purchases with caution, structured agreements, and clear communication to mitigate risks and safeguard both parties involved.

On Thursday, the former Sunrise host and a prominent Australian finance journalist, offered insights into the complexities and risks inherent in parental assistance, urging for a structured approach to navigating the common intergenerational finance practice.

In his latest column in The Nightly, Koch began by highlighting the staggering statistic: “The Bank of Mum and Dad provided $2.7 billion to their adult children to buy property over the past year.”

This figure, he noted, positions parental assistance as a significant player in the housing market, rivalling traditional lenders.

Drawing upon the estimation by the Productivity Commission, he emphasised, “If it was an actual bank, it would be somewhere between the fifth and ninth biggest mortgage lender.”

Koch did not shy away from acknowledging the potential pitfalls of such financial aid.

He warned against the casual approach often taken, stating: “We all want to help our kids … But the question is what that help looks like.”

“Treat the loan as a business transaction and draw up a formal agreement between each party outlining the terms of the deal, including a set repayment schedule,” he emphasised, urging for formal agreements akin to business transactions

The seasoned finance expert drew attention to the University of Newcastle’s findings on the increased risk of financial elder abuse associated with parental assistance.

Quoting the study, he said, “Borrowing from the Bank of Mum and Dad encourages ageist attitudes, which leads to kids financially abusing their parents.”

Such insights underscore the imperative for caution and foresight in navigating familial financial transactions.

Delving into the nuances of different forms of financial assistance, Koch differentiated between gifts, loans, and guarantees.

“If your child is married or in a de facto relationship and it ends, gifts will usually be considered part of the family assets and divided up in court,” he warns, advocating for sensible formal loans and limited guarantees to mitigate legal risks.

The narrative extended beyond property purchases, as Koch offered guidance on parental investments in entrepreneurial ventures.

“Think of your role as that of a regular investor,” he advised, adding there should be clear expectations and prudent decision-making.

The reliance of young Australians on parental assistance for home ownership has surged, with the “Bank of Mum and Dad” emerging as a pivotal player in the housing market.

As Koch mentioned, it is so significant that the Productivity Commission suggests it would rank among the top mortgage lenders if formalised as a bank.

While not all assistance takes the form of gifts, the number of children receiving such aid has doubled in the past two decades.

While facilitating entry into the housing market for some young Australians, the trend raises concerns about its implications.

The surge in parental assistance potentially exacerbates housing price inflation, casting doubt on its long-term efficacy.

Additionally, the impact on parents providing financial support remains uncertain, with questions looming over the sustainability and repercussions of such assistance, with financial elder abuse already the third most common form of elder abuse in Australia.