Josh Frydenberg reveals $20 billion tax cuts will be fast-tracked amid pandemic

Middle income earners could get an extra $2565 a year after the government confirmed it was looking to bring forward planned tax cuts.

Personal income tax cuts for middle income earners worth up to $2565-a-year are likely to be brought forward to help boost spending, the Treasurer Josh Frydenberg has revealed.

The tax cuts, worth $20 billion, were scheduled to come into force in 2022. A third stage of the tax cuts, with a tax rate of 32.5 per cent to apply to the vast majority of workers, is currently scheduled from 2024.

However, Mr Frydenberg has confirmed this morning that the fast-tracking of the tax cuts was now a live option in the wake of the COVID-19 pandemic.

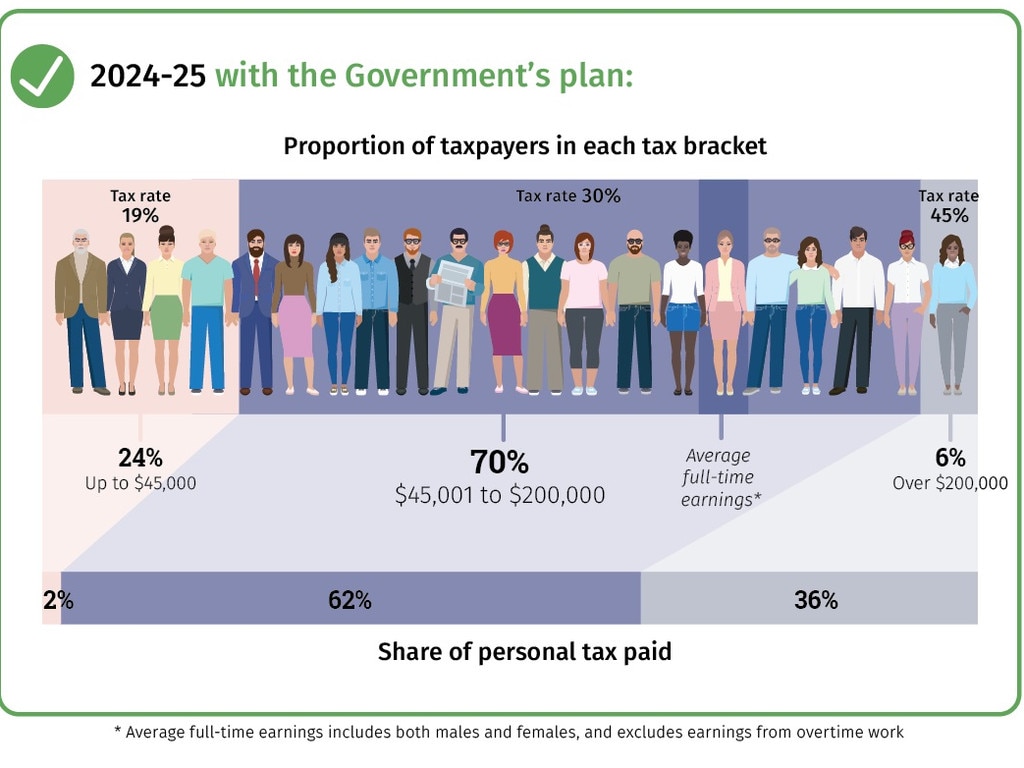

“There are three stages to those legislated income tax cuts and, you know, the benefit was very clear. We’re creating one big tax bracket between $45,000 and $200,000 where people pay a marginal rate of no more than 30 cents in the dollar,’’ Mr Frydenberg said.

“So we are looking at that issue and the timing of those tax cuts because we want to boost aggregate demand, boost consumption, put more money into people’s pockets and that is one way to do it.”

The second stage of the tax cuts lift the income threshold when the 19 per cent tax rate kicks in from $41,000 to $45,000 and the rate at which the 32.5 per cent tax rate applies from $90,000 to $120,000.

The 2022 tax cuts are aimed at middle income earners and will deliver annual tax cuts of $580 to a worker earning $40,000.

However, the value of the tax cuts rises to $1080 a year for workers earning $50,000-a-year in income.

You can use an online tax calculator to see how much you will save.

For workers earning $120,000 a year the tax cut is worth $2565, the maximum amount under that stage of the seven-year tax cut program.

The third stage of the tax cuts is currently scheduled to come into force in 2024.

It will apply a 32.5 per cent tax rate on all income between $41,000 and $200,000.

TREASURER TIGHT-LIPPED ON JOBKEEPER FUTURE

The Treasurer was tight-lipped this morning over the future of the $1500 a fortnight JobKeeper subsidy, which is due to expire in September.

But he did flag that more income support beyond September for struggling businesses was now likely.

It follows calls from the Victorian Premier Dan Andrews to extend JobKeeper or other forms of income support in light of the second shutdown in Victoria.

“The first thing to say is that the JobSeeker and JobKeeper programs are already legislated to the end of September. So even with the six-week lockdown announced by Premier Andrews, that takes it out to the end of August,’’ Mr Frydenberg said.

“But after that, there’s going to be that really awkward and tough reopening measures again, which might last a couple of months past that.

“Yes, and there’s going to be another phase of income support. The details of which will be announced on July 23. We recognise that some sectors are going to recover more slowly than others.

“For example, the tourism sector as a result of the international borders being closed. We’ve announced a number of sectorwide specific packages for housing, for the arts, for tourism. But we also recognise that the recent events in Victoria are being to be an impediment to the speed and the trajectory of the economic recovery across the nation.”

Mr Frydenberg also praised the big banks for extending mortgage relief to struggling businesses.

“I mean, the initial 6-month loan deferral period has been very helpful. Some $266 billion in loan payments have been deferred,’’ he said.

“About 800,000 customers, and 60 per cent have been residential mortgages. So the decision by the regulator and by the banks to have this extended for another four months is very welcome.”