Jason Murphy: Does anyone really stop working because of high tax rates?

There is plenty of misinformation out there about tax and lets face it, not many of us are experts. But these graphs tell a surprising story.

The Australian government keeps telling us we need lower taxes to prevent deterring people from work.

But is that true? Do people really ever stop work because the tax rate is too high?

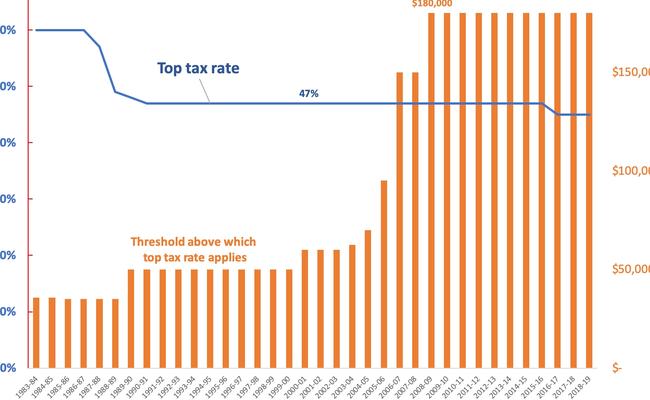

Australia’s top tax rate certainly keeps falling. It was 60 per cent in the early 1980s and it has fallen since, to 45 per cent now, on income over $180,000. That means if you make a dollar over $180,000, 45 cents of that dollar goes to the government and you keep 55 cents.

The next chart shows that not only has the tax rate fallen but the threshold above which you pay the top rate keeps getting higher.

For most of us, the idea we would stop working or stop investing because of higher taxes is crazy. If you make more money, paying higher taxes is a side effect. And who doesn’t want a bit more money?

But Australia’s tax rates do have an effect on some people. When Australian tennis legend Pat Rafter took up residence in Bermuda, it wasn’t just for the sunny weather.

A 45 per cent tax rate is actually much more generous to the top income earners than it used to be. Top income tax rates used to be much higher.

TAXMAN

It makes sense that below a certain threshold, high taxes make you work more, because you need more money to live. But for the ultra-rich, it is possible high taxes entice them to work less. If you absolutely don’t need to work to live a life of total luxury, and the taxman will take most of what you make, why bother?

The rich are always complaining about tax. The Beatles wrote a song about it, called Taxman.

Back then the top tax rate in the UK was 95 per cent, which explains the lyric: “There’s one for you 19 for me.”

The Beatles broke up in 1969 and the top UK tax rate came down in the 1970s. But who knows - perhaps if the UK had kept the tax rate lower they might have had more incentive to stick together. Perhaps they would have been like the Rolling Stones and kept touring eternally.

WHAT DO THE ECONOMISTS SAY?

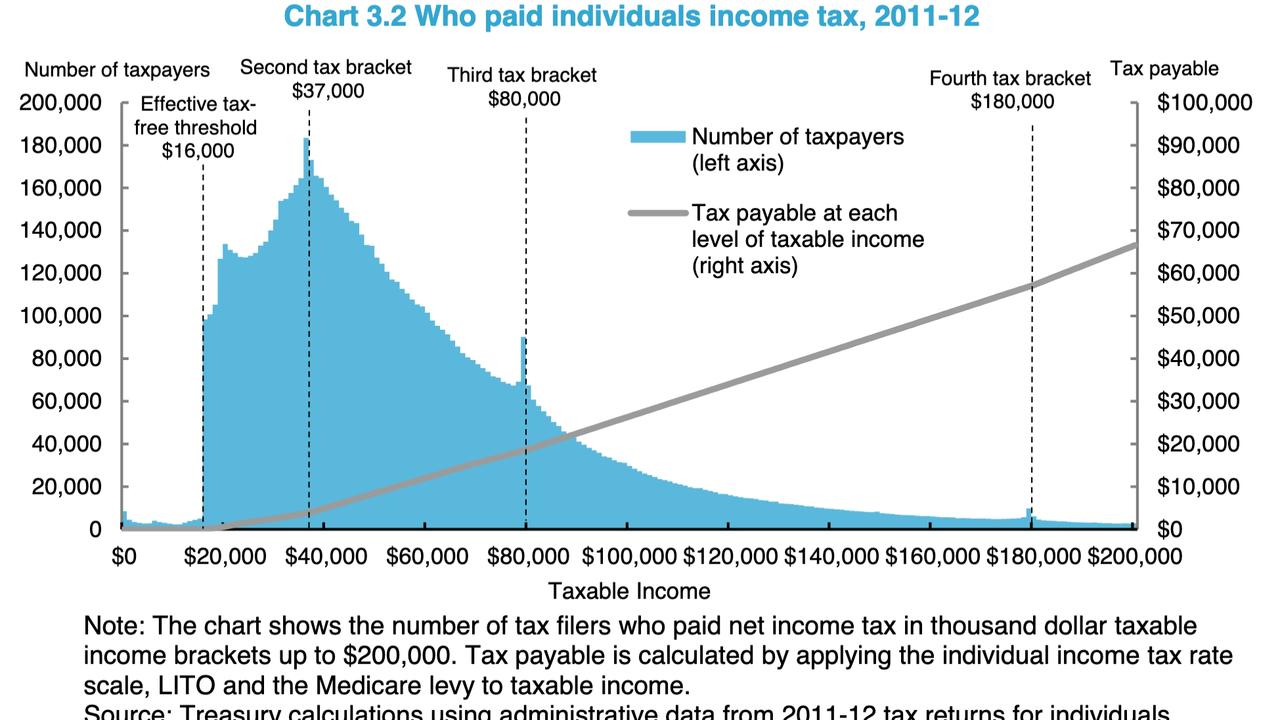

Economists do notice that reported taxable income tends to cluster just below the relevant income tax thresholds. You can see in the next chart that the blue lines stack up high just below the tax thresholds.

People are definitely doing something to make sure they don’t pay too much tax. But notice we are talking about “reported taxable” income. It is not certain that the only way they get their tax down is by working less. While some people will work less, there are also other methods to reduce taxable income, including giving to charity and putting money in super.

But when you talk about high tax rates deterring work, it is not the rich we need to worry most about. Quite the opposite. The biggest effect is for people at the other end of the spectrum.

LET’S GET EFFECTIVE

When you start to make a bit of money you not only start paying tax, you lose government payments as well. Some people may have to pay other things like the Medicare surcharge, HECS/HELP debts, and child support.

The overall effect of earning more money on all such payments and taxes is known as the effective marginal tax rate. It tells you how much you lose as you make more money.

Effective marginal tax rates matter most where people receive government payments like the age pension, disability pension or the Family tax benefit. You can only collect these payments if you make under a certain threshold of income. As you make more money they are taken away, and at the same time you pay more tax. The effect is some people can work twice as hard and not have much to show for it.

In some cases, effective marginal tax rates can even be over 100 per cent, so if you make a little bit more money from work, you actually end up with less. High effective marginal tax rates are not only unfair, they discourage people from working and might trap some people on government payments.

Jason Murphy is an economist. He writes the blog Thomas the Think Engine | @jasonmurphy