‘Hurt Australia’: Why Russian president Vladimir Putin’s demise would backfire

Australia has a long history of benefiting from ugly dictators – and it turns out Russian president Vladimir Putin is no different.

ANALYSIS

Australia has a long history of benefiting from ugly dictators via the commodities trade.

We were one of the countries most adept at circumventing sanctions aimed at Saddam Hussein to provide Iraq with wheat and our farmers with cash.

For decades we have tied national wealth to Chinese tyranny. We’ve not been concerned until recently about Aussie iron ore being recycled as warships and missiles being aimed back at us.

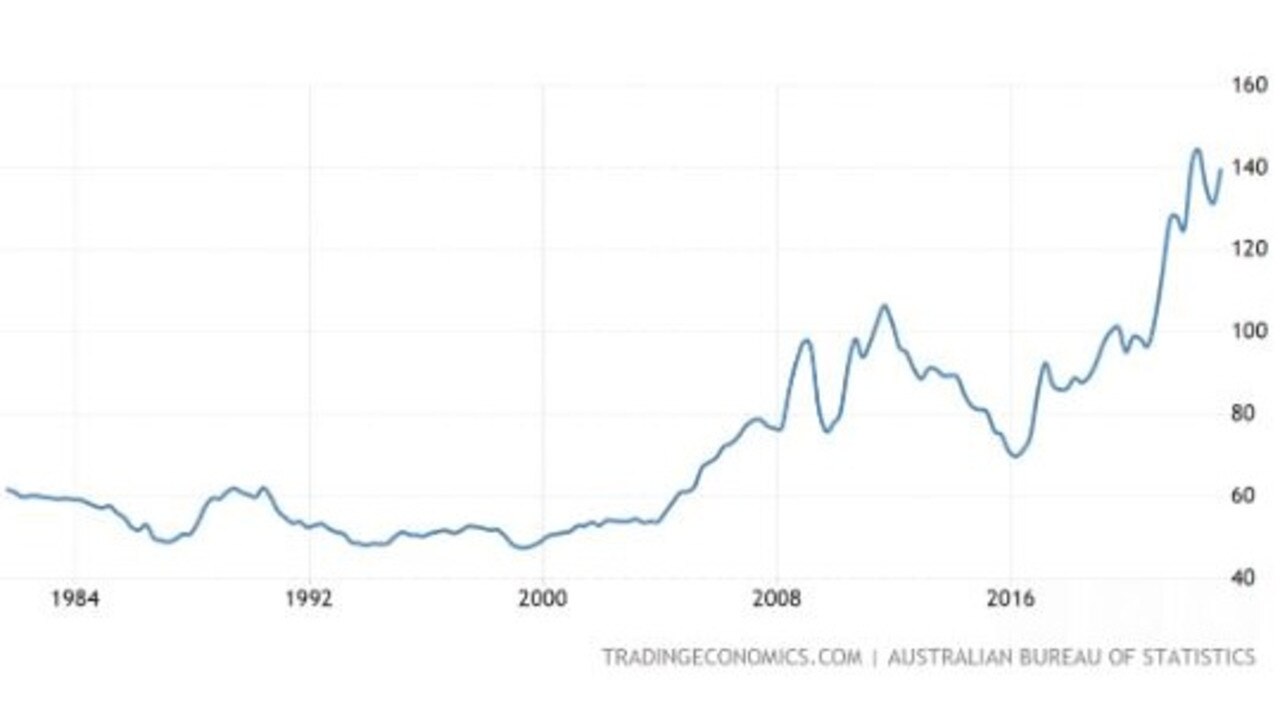

Likewise, we laughed all the way to the bank during the recent Russian invasion of Ukraine, which skyrocketed the price of our essential commodities to unimaginable levels. This was an enormous pay rise for the nation as the terms of trade spiked to historic proportions.

This meant that for every tonne of coal, iron ore and LNG we sold overseas, we received 300-400 per cent more money without lifting a finger.

The magic of commodity booms

Terms of trade booms have several marvellous effects.

The largest is a dramatic lift in budget corporate tax receipts. Often, this enables tax cuts, as it did repeatedly during the China booms of the Howard government years.

This time it did not, but it did help repair the budget after the Covid splurges and probably made retention of the Stage Three tax cuts possible, for good or bad.

Terms of trade booms also lift the stock market and household wealth. And as firms look to expand capacity into the runaway prices, they eventually lift wages too.

Conversely, since Australia’s vast Ukraine war pay rise peaked in mid-2022, it has fallen a long way. This change will appear in the above chart in the months ahead as long-term commodity contracts reprice lower.

All of those lucky benefits will recede with it.

On the wrong side?

Of course, nobody in their right mind would wish for the war to continue. But how it ends also matters a great deal to Australian fortunes.

If a coup were to displace Vladimir Putin and a peace settlement ended the war, we would be worse off economically.

Not only would the risk premium continue to come out of iron ore and coal, but Ukraine itself is a commodity powerhouse.

Reconstruction would immediately focus on repairs to commodity output. Global prices would fall across hard and soft commodities as Ukraine sought to recapture market share.

Unfortunately, that may not be the most likely outcome. Wars have a nasty habit of ending in the collapse of one side or another.

If Ukraine were defeated and occupied, then that would probably mean reconstruction was permanently delayed as an interminable guerrilla war unfolded. That will boost commodity prices.

On the other hand, if Russia were to collapse, be gripped by civil war, or the Putin regime topple, Ukraine might recover, but the Russian supply of commodities would diminish, particularly oil.

This scenario would probably hurt Australia the most economically, as export revenues fell sharply just as another global energy shock landed.

Conclusion

Ukraine has already demonstrated its capacity to upset global commodity markets.

It took a year for prices to settle after the invasion.

How and if the war ends have within them the seeds of a similar scale of disruption.

David Llewellyn-Smith is Chief Strategist at the MB Fund and MB Super. David is the founding publisher and editor of MacroBusiness and was the founding publisher and global economy editor of The Diplomat, the Asia Pacific’s leading geopolitics and economics portal. He is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second Garnaut Climate Change Review.