How much money should you have in your superannuation by age

There is a “massive” gap between the amount we need to have stashed away and what we have. Here’s how much you should need by age.

The majority of Australians are falling short in their superannuation savings, which could leave them in a dire situation when it comes time to retire.

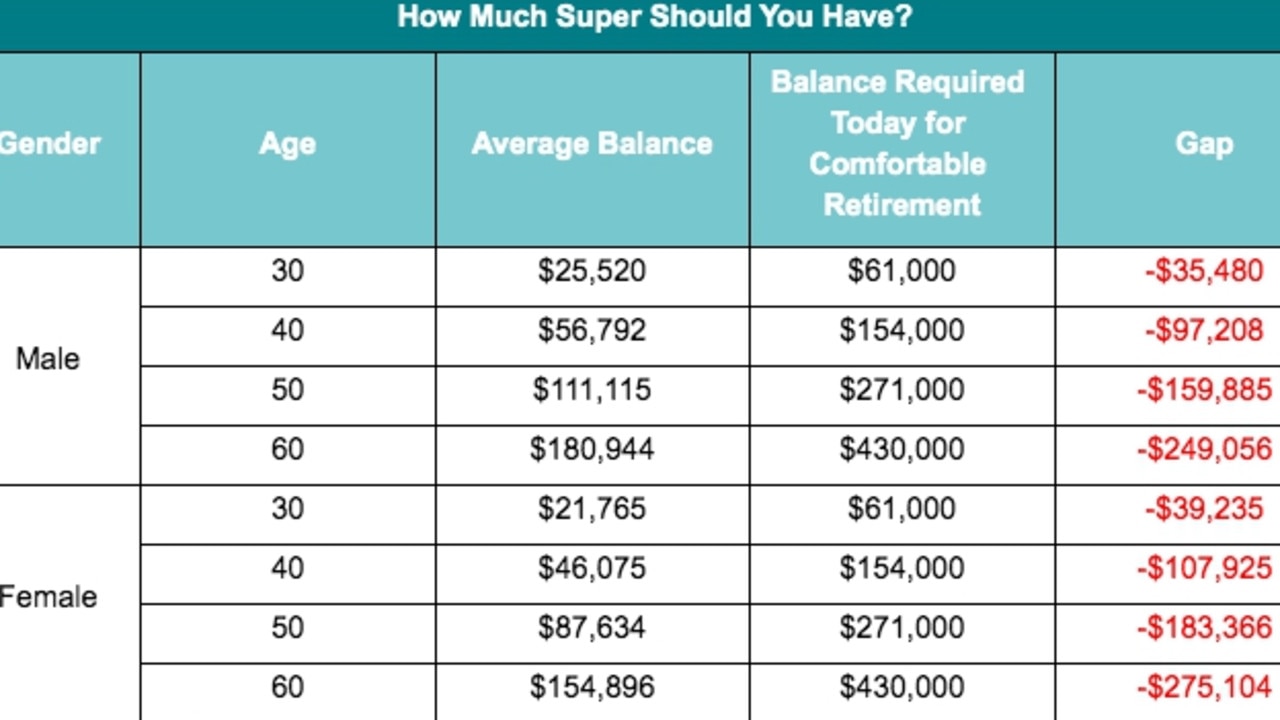

Recent Canstar research suggests 30-year-old men and women would need to have around $61,000 in their super account today to be on track for a comfortable retirement lifestyle, but on average, they are currently short between $35,000 and $39,000.

Women currently in their 60s face the biggest super gap of more than $275,000, based on this data.

Canstar’s finance expert Steve Mickenbecker said this was “sobering news for most Australians”.

“For every age group the gap between the required balance for a comfortable retirement living and the average balance is massive,” Mr Mickenbecker said. “For most groups they are only a third of the way there.”

The below table estimates how much super people of different ages “should” have in their super today to be able to afford a “comfortable” retirement.

‘SOBERING NEWS’

Mr Mickenbecker warned that we aren’t talking about “luxury living” on these figures – and it assumes you already own your own home.

“A comfortable retirement means holidays and dining out, not yachts and fine wine, and the number assumes you’re living in your own home without a mortgage,” he said.

“The news will be even worse for Australians who accounted for the $35.5 billion taken out of super this year under the COVID-19 early release scheme.”

The gap is greatest for 60-year-olds who spent the first 10 years of their work life without superannuation contributions.

“A 60-year-old with an average super balance now has little chance to catch up and the future looks likely to be a part pension initially and eventually full pension, and a significantly lower standard of living,” Mr Mickenbecker explained.

The situation is worse for women, he added.

“For women the magnitude of the gap is worse, with average super balances 15 to 20 per cent lower than men,” he pointed out.

Mr Mickenbecker added that there’s still time for young Australians to “catch up”.

“The young can catch up but it’s time to go into repair mode as soon as incomes are restored post-COVID-19,” he said.

“This means making extra salary sacrifices into superannuation during the years when they are also saving for a first home. Most times home ownership comes first.”

‘PAY YOURSELF FIRST’

According to money educator and finance expert Vanessa Stoykov, if Aussies want to retire comfortably and not be destitute later in life, they need more in savings.

She suggested to start as young as possible, while older Australians need to act fast.

“The younger generation has the most time to recover. When you’re young is the time,” she said. “The older you are the more you need to think about it and faster.”

Ms Stoykov said we all need to make sure we’re putting around 10 per cent of our income in superannuation, whether we’re employed by someone or a self-employed contractor, in order to be able to live comfortably when we retire.

“If you’re a contractor you have to pay yourself super. It’s harder to hustle when you’re older,” she added.

“Pay yourself first. Put 10 per cent of everything you earn into your super straight up – 9.5 per cent is what most employers pay. When you do a $1500 job, put $150 into your super every job straight away.”

She added it’s not a bad idea to top up how much you’re contributing to your super, either.

“If you put four per cent more into your super your 20s then you’ll recover your balance, you’ll be OK and four per cent isn’t much for young people. You won’t feel it. You won’t have to give up much,” Ms Stoykov said.

Saving for the future comes down to “now versus later”.

“Do I want the money now or do I save for later?” she said.

Ms Stoykov suggested to check your super balance regularly with a super fund app.

“The more power people take into their super the better,” she said. “Take care of yourself and don’t expect the government can.”

HOW MUCH YOU NEED

Ms Stoykov pointed out that the reason superannuation was created was “so people could have a good life in retirement”.

“The average couple need around $40,000 and a single needs $28,000. But that’s modest. It’s very hard to live on $28,000 a year,” she explained.

“To be comfortable you need around $42,000 a year as a single or $62,000 for couples.”

But she said that’s assuming you own your own home and don’t have a mortgage lingering over your head.

“If you don’t own your own home, it’s going to be a lot harder to live a comfortable life,” Ms Stoykov said.

“If comfortable is $62,000 a year as a couple and you’re 65 and want to live until you’re 85, which is not out of the question, that’s 20 years of $62,000 you have to find. That's $1.2 million,” she explained.

WOMEN ARE WORSE OFF

About 80 per cent of Australians are falling short of what they should have in super.

“It’s $43,000 for a single and $62,000 as a couple and you’ve got to own your own home. You’ve got a massive gap,” she said.

Divorced women and women out of the workforce are the most severely affected.

“There are a lot of examples of women who’ve been divorced and have no super,” Ms Stoykov said.

“You can’t eat the letterbox. A lot of the time they have to sell the family home to cashflow their living.”

Ms Stoykov added that homelessness particularly among women is not uncommon due to a lack of retirement savings.

”The average balance for men is $270,000 in retirement and for women it’s $157,000 because of the broken work patterns and women raising children,” she said.

DON’T RELY ON THE GOVERNMENT

Given the year we’ve had, Ms Stoykov reminded Australians that we don’t know what the future holds and warned not to rely on government support.

“Who knows what’s ahead,” she proclaimed. “People assume they’re going to get the government pension, but who knows what’s coming.”

While she admitted that the government has helped “bail us out of the pandemic” and “compared to other countries in the world we’re lucky”, she warned against relying on the government’s support through the pension since it’s not a lot of money to live off and it’s based on the assumption that you own your own home.

While the government enabled people to withdraw money from their super this year to try to stay afloat during the pandemic, Ms Stoykov doesn’t agree with people accessing super to get a home deposit.

“It’s meant to be for a comfortable life, not to buy a dwelling,” she said.