Housing market: Federal Government, RBA apply stimulus on property market

A change to lending standards could mean Aussies who were recently deemed too risky by the bank could now be viewed as desirable borrowers.

The financial regulatory body has made it easier for Australians to borrow more in the latest of a string of stimulatory measures to help kickstart the struggling property sector.

The housing market has experienced some of its heaviest falls this side of the Global Financial Crisis, particularly in Sydney and Melbourne, but the Reserve Bank governor Philip Lowe slashing rates to the lowest levels in history combined with the fresh income tax cuts should free up some spending room for Australians.

Financial experts also believe interest rates across the globe trending lower should also provide some relief for the economy because it puts less pressure on wholesale rates and, ultimately, mortgages.

RELATED: What the Reserve Bank decision means for housing market

RELATED: What the Coalition’s proposed tax cuts mean for you

RELATED: RBA cuts cash rate to new record low of 1 per cent

The Australian Prudential Regulation Authority eased the serviceability buffer by no longer expecting banks to ensure customers could still repay their loan if its interest rate increased to at least 7 per cent from last Friday.

Lenders can now set their own minimum interest rate and set the cushion for 2.5 per cent, allowing more people to sign up for larger loans.

“The changes being finalised today are not intended to signal any lessening in the importance APRA places on the maintenance of sound lending standards,” APRA chairman Wayne Byres said last week.

“This updated guidance provides ADIs (authorised deposit-taking institutions) with greater flexibility to set their own serviceability floors, while maintaining a measure of prudence.”

Comparison site Canstar’s finance expert, Steve Mickenbecker, told news.com.au the wide range of loans now available below 3.5 per cent means serviceability can be assessed on repayments calculated for 6 per cent, rather than 7 per cent.

“Times have changed and APRA is moving with the times,” he said.

“When the guideline was introduced in 2014 the RBA cash rate was 2.5 per cent, a full 4.5 per cent below the 7 per cent buffer, and the world economic outlook was rosy.

“Now at 1 per cent, the cash rate is 6 per cent below the buffer, growth looks challenged and higher rates look quite a way off.”

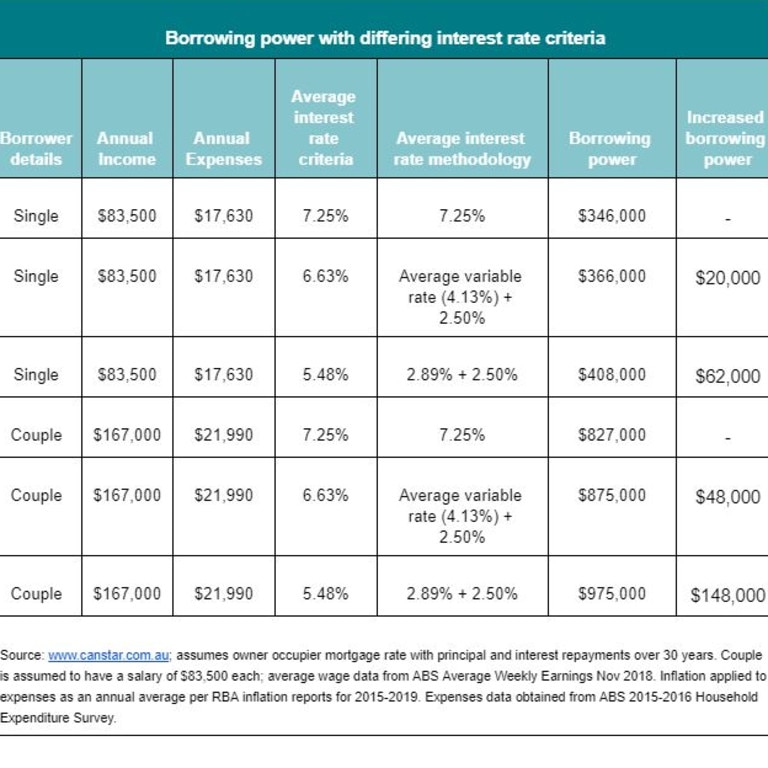

Mr Mickenbecker said someone earning the average weekly income was limited to borrowing $346,000 but the serviceability change from APRA means they will soon be able to borrow an additional $62,000.

He says Australians who have been declined a loan before the new interest rate buffer because of affordability issues could find themselves in demand today as desirable borrowers.

“Alone this move is significant, making loans more affordable to Australian borrowers,” Mr Mickenbecker said.

However, the string of stimulus means financial regulators will have their hands tied if the economy and housing market doesn’t react positively.

“If all of this doesn’t work, we will be in for a long and rocky wait,” he said.

Realestate.com.au chief economist Nerida Conisbee says the recent suite of changes proves how difficult it is to get economic policy right.

“Property market conditions can change quickly and putting in too many brakes at once can lead to conditions turning too hard and too quickly,” she said.

“All this stimulus is being applied because the Australian economy isn’t doing all that great which will be a key factor in moderating this upturn.”

LJ Hooker head of research Mathew Tiller told news.com.au the consecutive rate cuts by the RBA will provide more of a stimulus to lift property prices than APRA’s easing on serviceability purely because more people were aware of the cuts.

But he said the lower number of houses and apartments currently on the market will provide a greater spike to prices than any policy manipulation.

“The biggest driver of price growth at the moment is going to come from the fact that listings are remaining quite low, and at the same time confidence has returned to buyers across all segments,” Mr Tiller said.

“And that demand is starting to see buyers compete for the limited amount of stock that’s on the market at the moment.

“That’s where we’re going to see price growth come from in the short term and then that will be maintained by the changes in interest rates and APRA serviceability for loan requirements over the medium to longer term.”

Continue the conversation on Twitter @James_P_Hall or james.hall1@news.com.au