Five signs Australia could enter recession as economists call for calm

Australia has just received a “confronting” figure on living costs and there are fears the country could soon plunge into recession.

Australia is facing a “perfect storm” of economic threats that could plunge the country into a brutal recession.

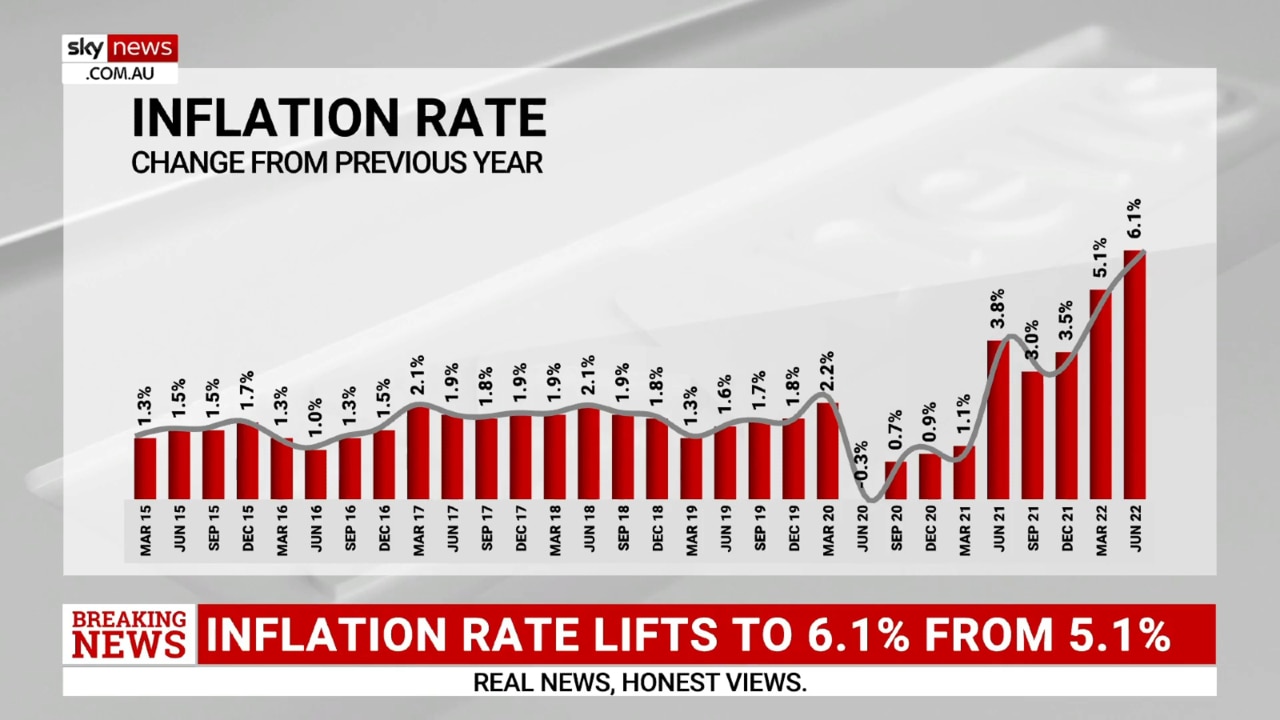

The annual inflation figure has risen to 6.1 per cent, which is the highest level in 21 years, a figure Treasurer Jim Chalmers described as “confronting”.

“Inflation is high and rising, it will get tougher, before it gets easier,” Dr Chalmers said.

The inflation figure won’t be news to the millions of Australians doing it tough every time they go to the supermarket or a bill arrives.

The number also doesn’t include the electricity price spike this month.

But worringly, it is set against the backdrop of the Covid-19 pandemic and Russia’s invasion of Ukraine, which are both putting huge pressure on the global economy.

Here are five factors that could trigger a recession in Australia.

Global outlook

The International Monetary Fund has this week issued a grim universal outlook, signposting the risk of recessions as global output contracted in the second quarter of the year.

The world economy will grow just 3.2 per cent this year, down from 6.1 per cent last year, the IMF predicts.

Next year could be even worse, with global growth forecast at just 2.9 per cent – only 0.4 percentage points higher than the 2.5 per cent growth level usually considered to trigger a recession.

The IMF has blamed downturns in the United States, China and Europe, combined with the ongoing war in Ukraine, surging global inflation and tighter monetary policy.

IMF’s director of research, Pierre-Olivier Gourinchas said the outlook had “darkened significantly”.

“The world may soon be teetering on the edge of a global recession, only two years after the last one,” he wrote.

In the United States, economists are waiting with bated breath for new data to be released on Thursday which would indicate whether the US had its second straight negative-growth quarter.

In the first quarter of 2022, the US economy contracted by 1.6 per cent, with signs the second quarter is on track for the same figure.

While the informal benchmark for a recession is typically a two-quarter decline, a more formal definition is based on a broader set of indicators including wages, spending, and employment figures.

Given unemployment is low and American households have savings, there is hope a recession could be avoided.

In Australia, high employment levels and savings buffers could keep the economy safe, with economists warning not too focus too much on other countries.

Treasurer Jim Chalmers said the IMF’s description of a global slowdown was “concerning”.

“The global economy is trending on a precarious and perilous path,” he said.

Richard Denniss, chief economist at the Australia Institute, said the federal government needed to turn its focus domestically.

“If we believe the world economy is slowing down … That’ll be bad for our economy,” he told NCA NewsWire.

Inflation

Australia’s inflation rate has risen to 6.1 per cent – a percentage point higher than the first quarter of the year, but below what many economists predicted.

It is the fastest annual increase in 30 years, and the biggest cost increases were new homes, petrol, and furniture.

The worsening inflation figures have been caused by global oil prices – caused by Russia’s war on Ukraine; triggering high transport costs.

But, Mr Denniss says, if we worry too much about inflation, “we could cause a recession”.

“There’s nothing we can do to make the world price of oil go down. There’s nothing we can do to lower transport costs, but there’s lots we can do to avoid a recession,” Mr Denniss said.

Dr Chalmers said the latest inflation figures were “confronting” and reflected the pressures Australians across the country were feeling.

“It will get tougher before it gets easier,” he said.

“We are focused as a government in dealing with some of the supply chain issues which are pushing up inflation here … We are very focused on these domestic factors.”

Dr Chalmers said inflation was expected to peak towards the end of this year before moderating next year.

Interest Rates

The Reserve Bank of Australia is tipped to raise interest rates again in light of the latest inflation figures.

Mr Denniss said this was one of the biggest factors that could trigger a recession, and cautioned the RBA against raising the rates too quickly, too fast.

The RBA slashed rates to a record low 0.1 per cent during the Covid-19 pandemic, before recuperating that with three consecutive rises from May through to July.

The cash rate currently stands at 1.35 per cent, and RBA governor Philip Lowe has predicted that will continue to climb to a peak of around 2.5 per cent.

Dr Chalmers said rising interest rates, when combined with inflation, were hurting people.

“For every extra dollar that people find to service their mortgages, it means a dollar that can’t go to funding the skyrocketing costs of other essentials,” he said.

Mr Denniss said the Reserve Bank had a role to play in controlling inflation, but would cause a recession if it continued increasing interest rates too fast.

“If we keep increasing interest rates because inflation is higher than we’d like, we might cause a recession,” he said.

“Increasing interest rates won’t help us prepare for a slowing global economy… but they might actually further dampen the Australian economy.”

Government spending

If the government cuts its spending too drastically, there will be a detrimental impact on the Australian economy and could trigger a recession, Mr Denniss warned.

Ahead of the October budget, the Labor has hinted it would need to find cuts to dial down the $1 trillion deficit left behind by the former government.

But, Labor will also budget for cheaper childcare and cheaper medicines in a bid to help with rising cost of living.

Mr Denniss said good government policy was a sure-fire way to keep the risk of a recession at bay.

“Don’t cut government spending too fast … If we worry too much about government debt, we can cause a recession,” he told NCA NewsWire.

“If we’re worried about a recession, we should absolutely keep spending.

“If we decided that we should halve the debt in the next five years, and we slashed government spending at a time the world economy was slowing, we could cause a recession. If we’re worried about a recession, we should absolutely keep spending.”

He said there was a case for the government helping people with cost of living pressures.

“During Covid, we made childcare free – that lowered inflation. It can massively lower the cost of living and help the economy,” he said.

“The government should be looking at ways it spends money to help people- both to help boost the incomes of low-income owners, but more importantly lower the price of things the government controls”

Dr Chalmers said introducing cost-of-living relief required the government to tread a “pretty careful” budgetary path.

“Focusing on childcare relief and also relief in the cost of medicines … are good ideas, and other things we might contemplate but we are intent on being responsible economic managers and we are operating under some pretty severe constraints,” he said.

Consumer confidence

The latest ANZ-Roy Morgan Consumer Confidence Index has consumers the least confident since the beginning of the Covid-19 pandemic.

The monthly rating for July is 82.4 points, down from 85 in June and 90.3 in May. It’s a considerable fall from the 107.5 points in December 2021.

It’s also the lowest since April 2020, when it was 79.8 as the Covid-19 pandemic shut down the Australian economy.

Before the pandemic, consumer confidence was last that low during the early 1990s recession.

ANZ head of Australian economics David Plank said the latest inflation figures would likely drive sentiment down further.

“Headlines about another surge in actual inflation when the Q2 CPI is published will likely place some downward pressure on sentiment this week,” he said.

Mr Denniss said consumers “weren't imagining” that things were tough at the moment, and that there was no silver bullet.

But, he concluded, there is “no reason to panic” about inflation, and recession.

“Things are getting harder … And there’s no one thing any government can do to fix this,” he said.

“But hopefully governments start solving the underlying problems that are causing this.

“But we shouldn’t cause a recession in order to avoid some inflation.”