‘Explosions of crisis’: Australian dollar ‘sinking’ with ‘Chinese Titanic’ as Xi’s economy tanks

China’s once “unsinkable” economy is now spectacularly tanking. And it is taking the Australian dollar with it into the vortex.

The Titanic was an unsinkable ship that became the greatest metaphor for human folly in the 20th century.

The Chinese economy is threatening to become the 21st century version – an unsinkable economy, projected by the great and the good to sail into glorious global domination.

The more this type of story gets around, the more sceptical an investor needs to become.

Economics is not made of platitudes. It is the basics of human behaviour mixed with arithmetic. A highly volatile combination that is ultimately predictable with time and practice.

In the case of the Chinese Titanic, it has been sinking for years.

But only those who understood the limits of its endeavour could see the water levels rising.

The Chinese miracle

The early 21st century Chinese miracle was never as magical as it seemed. The awe sprang from its size, not difference. China was following a well-trodden path of emerging economic development pioneered by many countries.

It included allowing global capital to mobilise cheap labour for exports. To shift people from the country to the city to increase productivity in these new industries. To build out the cities to accommodate them. And to ride favourable demographic tailwinds.

However, these development forces only run for a while. And, because China is so large, for even less long.

There are only so many export markets to dominate. China was never very young. Central planning enabled its cities to build at unimaginable rates in a market economy constrained by risk considerations.

All three factors have become an iceberg upon which the Chinese development model has run aground, making economic slowdown permanent.

Moreover, it looks like the central planners got it wrong and massively overbuilt everything.

The Australian miracle and the AUD

No country benefited more at the macroeconomic level than Australia from this boom. The economy grew relentlessly. A chronic current account deficit was cured. Average incomes soared. Even the federal budget was so flush it made our dodgy pollies appear competent.

This largesse delivered Australia a soaring currency. From the late 20th century, a floundering Pacific peso at 47 cents rose to a post-GFC reserve currency status at $1.11.

This did untold structural damage to the economy by hollowing out all industries such that we now produce the lowest proportion of stuff-to-GDP in the OECD, below the tax haven of Luxembourg.

But while the China Titanic sailed on, it did not matter. We were told to follow mining wherever it went, and it went to China.

Sinking fast

Now, the unsinkable ship has been holed by the largest property Ponzi scheme the world has ever seen. Layer upon layer of enormous and dubious leverage must be rationalised over time.

It will probably happen both fast and slow. Intermittent explosions of crisis will erupt from a calming raft of public support via stimulus and bailouts.

But the trend direction will remain the same. Growth will keep falling, and deflation keep strengthening, driving Chinese interest rates to their version of zero.

This will crash the Chinese currency, the yuan (CNY), over time.

As the Chinese Titanic takes on water at an alarming rate, the two major tailwinds behind the AUD are likewise becoming heavier.

Aussie interest rate spreads are negative to the US and other developed economies. And the terms of trade, the ratio of export prices to import, are tumbling with much further to go.

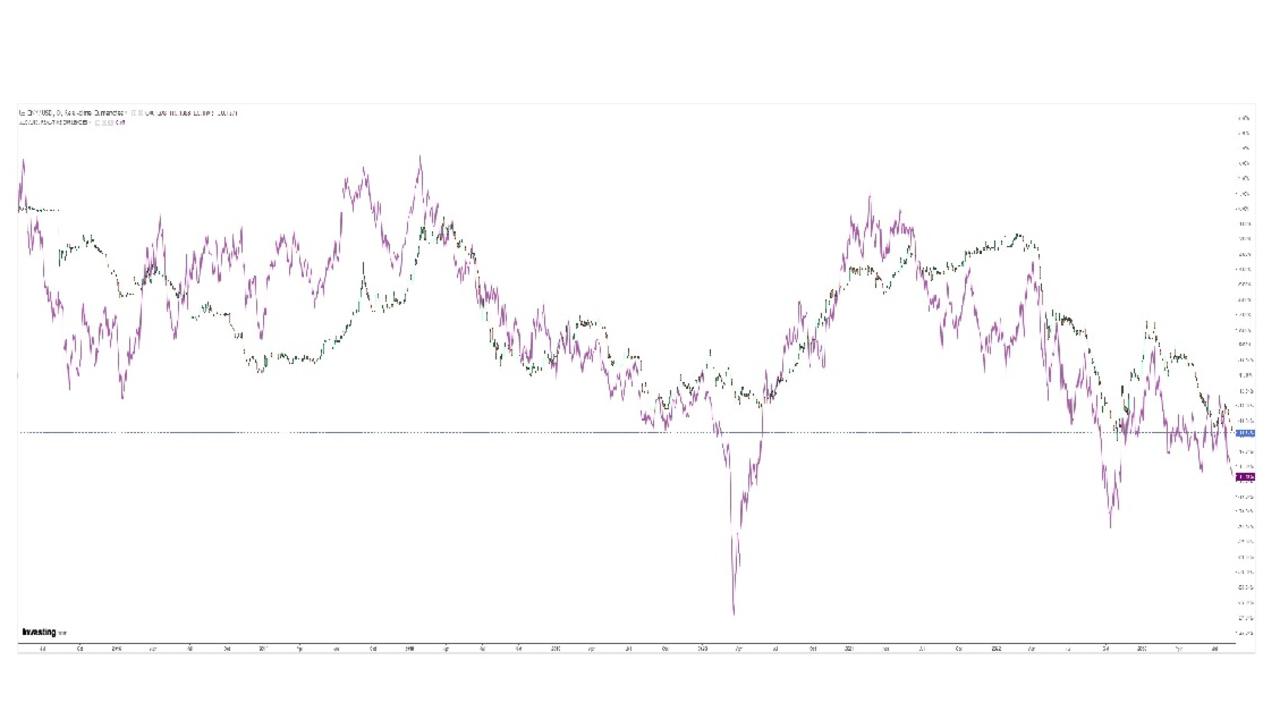

Like the yuan, the Aussie dollar will sink. The two have been joined at the hip since the post-GFC period.

This is not a bad thing. The AUD is our lifeboat as the Chinese Titanic dies.

A much lower AUD will repair our shattered competitiveness, drop our imports and lift our non-mining exports.

A low enough dollar will make Australia irresistible to global capital seeking a foothold on the doorstep of growing Asian markets.

But it will take time, because we’ve held on to the Chinese Titanic too long, so the AUD will be caught in its descending vortex for a while as it plunges into the deep.

David Llewellyn-Smith is Chief Strategist at the MB Fund and MB Super. David is the founding publisher and editor of MacroBusiness and was the founding publisher and global economy editor of The Diplomat, the Asia Pacific’s leading geopolitics and economics portal. He is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second Garnaut Climate Change Review.