Experts reveal next industries that could be slapped with Chinese tariffs as trade war escalates

As China’s savage trade war with Australia escalates, there are fears that a string of new industries could be next in the firing line.

A string of industries are on “high alert” amid fears China could be planning to ramp up its trade attack against Australia.

The escalating feud between the two nations has already proved devastating for many sectors and individual businesses, with Beijing recently imposing staggering import taxes of up to 212 per cent on all Australian wine.

The barley, beef, timber and lobster industries are also among the growing list of those slapped with tariffs and restrictions in recent weeks – and attention has now turned to what could be next on China’s hit list.

RELATED: China fallout: 1 in 10 Aussie jobs to go

IBISWorld senior industry analyst Liam Harrison told news.com.au agriculture was particularly at risk, but that the disintegrating relationship between the nations was a major concern for all of us given Australia’s massive reliance on China.

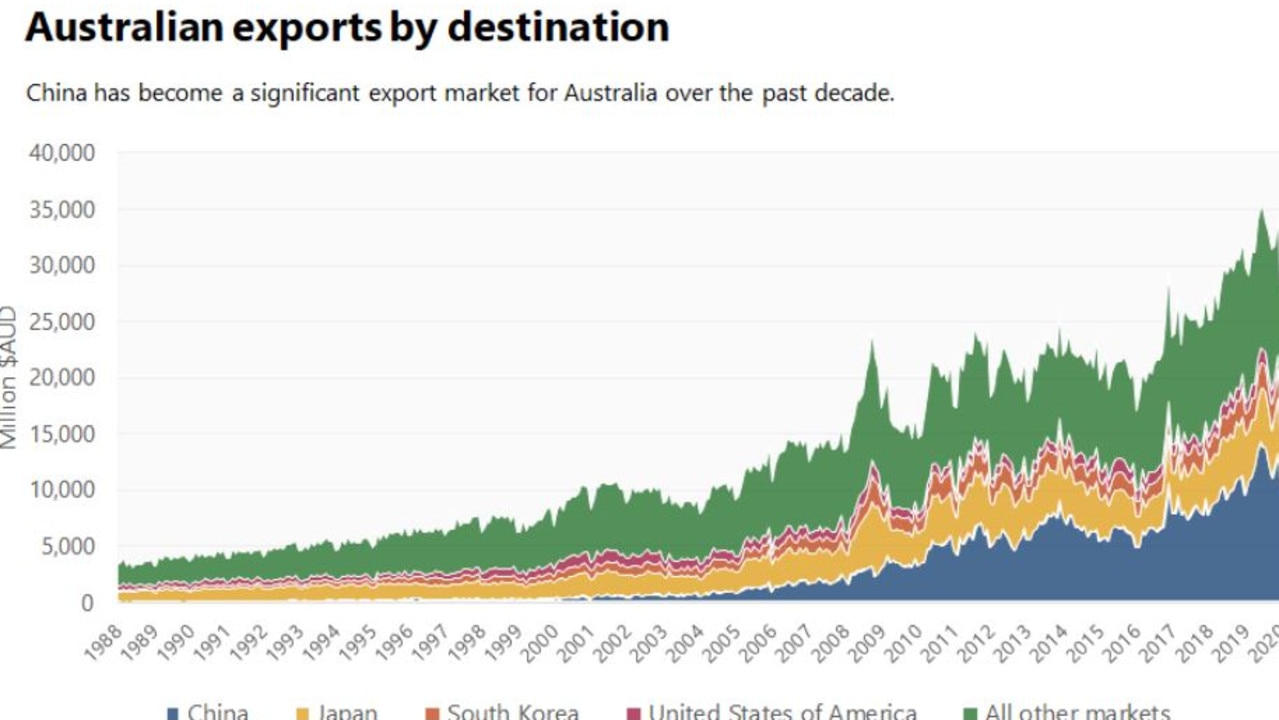

In fact, it accounts for 28.8 per cent of Australia’s two-way trade in goods and services and was our largest export destination in 2019-20, accounting for 35.3 per cent of the nation’s merchandise and service exports.

Mr Harrison said Australian companies had focused on the Chinese market since the 2015 China-Australia Free Trade Agreement was signed, and that the recent spat had “pulled out the rug from beneath many Australian businesses”.

“For example, for the wine industry it has been quite devastating because China was a very lucrative market,” he said.

“It has also been a big issue for barley and the beef restrictions were a bit of a shock as we didn’t expect that, and it is now escalating.”

He said while some individual impacted businesses will be able to manage the cashflow issues caused by the China crisis and others may manage to turn to alternative markets to get by, for many, the repercussions will be crushing.

“The potential for business shutdowns is definitely on the cards – the ones that are very heavily reliant on China will have lost their market and will have all that stock with very few places to sell to, and they will now try to compete in other markets,” he said.

“Some businesses will be feeling very real fear.”

Here’s a breakdown of the Australian sectors which could be next on the chopping block.

HONEY

Aussie honey – especially high-end manuka honey – is a huge hit in China, which snaps up a quarter of our honey exports.

But as the product can be easily sourced from other nations, Mr Harrison says it leaves local honey producers exposed.

Australian honey exports have grown at an annualised 4.1 per cent over the past five years due to the China-Australia Free Trade Agreement, which lowered trade barriers for honey exporters.

RELATED: Latest Aussie company on China’s hit list

DAIRY

The dairy industry is also vulnerable, especially the milk and cream processing and milk powder manufacturing industries.

Chinese demand for Australian milk powder, especially baby formula, has skyrocketed over the past decade due to the perceived health and safety of our products, with exports to China reaching 19,726 tonnes over the nine months through September 2020.

But Mr Harrison said if China were to crackdown on Aussie dairy there would be a massive backlash from consumers, which means it would “represent a fairly significant escalation in trade hostilities”.

FRUIT

Mr Harrison said agriculture was most at risk of fresh action by China, and that the fruit industry was particularly threatened as it was already feeling the squeeze from a range of other factors including the bushfires, a lack of international workers to pick crops due to COVID-19 and potential changes to the fruit juice health rating.

At the moment the citrus fruit, nut and other fruit growing industry sends more than 45 per cent of its total exports to China, while apple, pear and stone fruit growers also send more than 30 per cent of exports to Chinese markets.

As a result, losing that market would be “devastating to an already weakened industry”.

PHARMACEUTICALS

Australian prescription and non-prescription medicine and supplement products such as vitamin and mineral supplements are another group of products Chinese consumers can’t get enough of, with exports of vitamins and supplements to China soaring to more than $680 million in 2018-19.

But as these products are readily available from other nations as well, it would be easy for China to cast us aside.

RELATED: Why China turned on Australia

MINING

Australia’s lucrative mining industry is hugely reliant on China, especially bauxite and iron ore mining.

But as there are few other viable options on the table, many experts including Mr Harrison believe China would be reluctant to cut off Australian supplies.

In other words, if China were to introduce restrictions on Aussie mining, it would be crippling for us – but also very painful for China at the same time.

WHAT IT MEANS FOR YOU

So what does it all mean for those of us who aren’t directly affected by the trade war?

Firstly, Mr Harrison said the situation might actually lead to lower prices at the supermarket checkout, with China’s refusal to accept Aussie produce potentially leading to a glut in the local market.

But he said the biggest impact was the hit to our wider economy which was already struggling to recover from the coronavirus pandemic.

“In our day-to-day lives we may not notice the impact immediately, but it’s more of that spill over effect – a reduction in a business’s income could lead to a drop in the number of people who are employed which causes a reduction in consumption,” he explained.

Mr Harrison warned that the coronavirus pandemic’s decimation of the global economy also meant it would be unlikely that any new markets would emerge to replace China any time soon, leaving Australian industries “highly exposed to any potential tariffs”.