Don’t ‘buy the dip’ after ASX plunge, analysts say

When the share market experiences a massive plunge like it did overnight, the temptation is to dive in. But experts have a warning.

When the US sneezes, Australia catches a cold.

That’s the way investors have historically looked at the relationship between the US and Australian share markets.

And that is exactly what happened. As stocks nosedived on Wall Street because of rising inflation, a whopping $116 billion was wiped out of the ASX, costing Australia’s rich list dearly.

When the Australian stock market falls, investors often dive right in. The strategy, known as “buying the dip”, is based on the premise that buying when prices are low means reaping rewards when they inevitably surge again.

But experts say now is not the time.

Australian stock market expert Alan Hull told news.com.au that there is still “some distance to what we call the fundamental underlying base”.

“We haven’t reached that yet,” he said.

Stream more finance news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

ASX is in free fall... again

— David Taylor (@DaveTaylorNews) June 14, 2022

“I would think that people were buying the dip right now is very premature. I would say you’re very premature if you went in and spent a lot of money buying – thinking you’re buying the dip at this stage.”

Mr Hull said there is “no reason for the market to bounce back right now” because there’s “more bad news heading our way”.

Clifford Bennett, chief economist at ACY Securities, agrees.

“And the line from The Big Short movie, ‘It all came crashing down’, comes to mind,” he said. “We have been warning of precisely this since the start of the year, and even with the huge collapse already seen in US equities, I am not changing my view that investors should continue to play defence.”

He said the current situation “is not a buy-the-dip or look-across-the-valley scenario”.

“People need to step back and see the bigger historical picture.”

Bitcoin lost almost quarter of its value in around 36 hours. Really firming in my belief here that monetary policy explains asset prices. pic.twitter.com/sxJNNduypg

— ☔Jason Murphy (@jasemurphy) June 14, 2022

The comments follow warnings we are headed towards a crippling 1970s-style “stagflation”.

The ASX saw its most brutal day of trading since the start of the pandemic on Tuesday – as ordinary Australians saw their portfolios collapse and some of the nation’s biggest rich-listers lost $12 billion in a matter of hours.

Any hopes of a quick rebound have been dashed as the Aussie market opened even lower on Wednesday morning, dropping 0.7 per cent.

There is also real concern about what will happen on Thursday.

Australia’s four richest people saw billions slashed from their personal wealth as the local sharemarket nosedived in response to fears interest rate rises in the US could spark a worldwide recession.

Mining magnate Gina Rinehart ($34.02 billion), Fortescue’s Andrew Forrest ($30.72 billion) and the duo behind Atlassian – Mike Cannon-Brookes ($27.83 billion) and Scott Farquhar ($26.41 billion) were among the hardest hit.

According to the Australian Financial Review’s Rich List editor Julie-ann Sprague, Rhinehart lost an estimated $2.7 billion as her wealth is “pegged to listed iron ore miners”.

Fortescue Metals Group’s share price drop of 8.39 per cent would have also impacted philanthropist CEO Dr Forrest’s wealth, seeing it dip below $28 billion.

Similarly, Atlassian Corporation Plc suffered a 9.53 per cent hit to its share price today, a move which AFR states would have seen both founders lose $1.2 billion each.

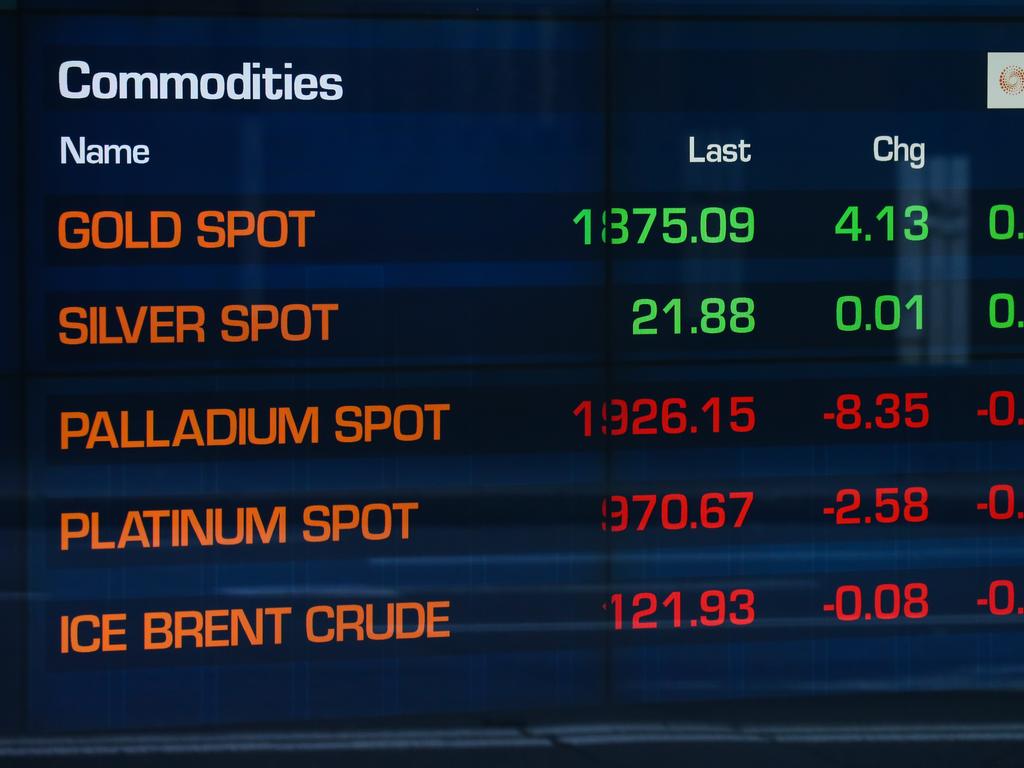

Investors were left surprised on Friday when data showed US inflation jumped to 8.6 per cent in May, the fastest pace in more than 40 years, as the Ukraine war further fuelled energy and food prices.

The reading has led to fervent speculation that the US central bank, the Federal Reserve, will now be contemplating a single interest rate lift of 75 basis points at its meeting this week.

With the central bank forced to be more aggressive, there is heightened concern that the US economy could be sent into recession next year.

“The market is now thinking much more about the Fed driving rates sharply higher to get on top of inflation and then having to cut back as growth drops,” said SPI Asset Management’s Stephen Innes.

The US dollar, however, gained versus major rivals, benefiting from its status as a haven investment and expectations of aggressive interest rate hiking from the Federal Reserve.

– With AFP