Donald Trump is already damaging the Australian economy

THE billionaire’s nomination for the most powerful job in the world has already messed with the Australian economy, in a big way.

LIFE just got more difficult for our farmers, tourism operators and manufacturers.

The apparent cause of the trouble? That wispy-haired megalomaniac from New York, Donald J. Trump.

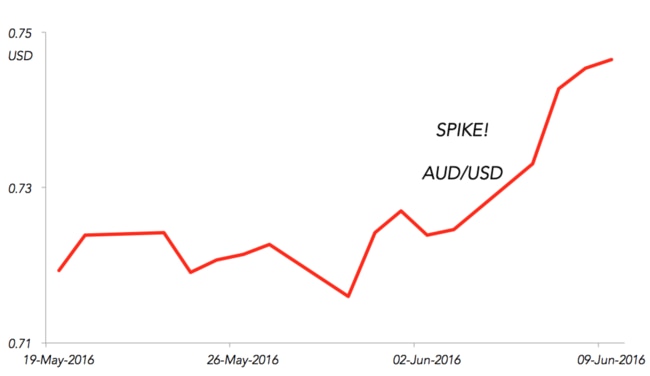

The Aussie dollar spiked in the last week, as confidence leaks out of the US economy and their dollar slumps.

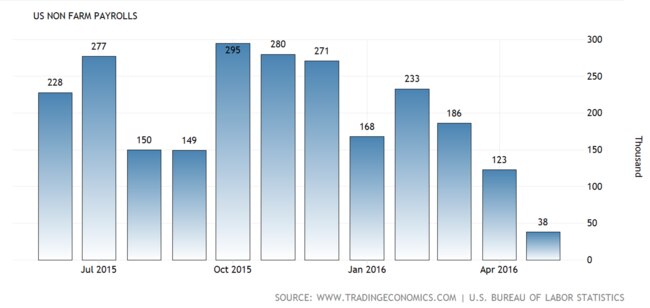

US companies have stopped hiring new people as the future turns uncertain. Are they going to spend the next four years being ruled by the iron whims of Donald Trump? If so, they don’t want to be hiring.

The next graph shows that during last year, when the US political scene looked normal, US firms were adding around 300,000 new employees every month. But Since January, as Trump momentum began to build, US jobs growth has got worse and worse.

Trump is going to be bad news. For Muslims (who won’t be able to enter the US) and for Mexicans (who won’t be able to send money home unless the Mexican government promises to pay for a wall). But he is already bad for business.

Trump policies — including the above plus abolishing Obamacare and starting a trade war with China — are apparently giving them the shivers. US small business confidence hit a 2-year low in March.

It’s a shame. The US was the one part of the world recovering nicely from the GFC. It could have dragged the rest of us along too. But now it is in jeopardy.

America is a giant part of the global economy and when it sneezes, Australia catches a cold. The fastest way that transmission happens is via interest rates and the exchange rate.

THE SIMPLE VERSION

The US Government really wants to raise official interest rates to get back to normal. Their rates were basically zero for 6 years.

When US interest rates go up, global investors want to move their money into America, to get those higher returns. So they sell assets they have in Australia and trade their money back into US dollars. Selling a flood of Aussie dollars at once causes the price to fall and we get a lower Australian dollar. (This is the link between interest rates and exchange rates everyone talks about and nobody ever explains).

For example, when the US raised rates in December our dollar fell to its lowest level in many years, making our exports cheaper in global markets. Another such event now looks quite unlikely.

The cascade of events that causes a lower Aussie dollar won’t happen if the US economy is sputtering. Instead, we get a higher dollar that will choke our fledgling exporters even as they get their first glimpse of a new dawn.

The news gets even worse. Our higher-than-comfortable dollar means the RBA could be forced to cut interest rates to at least try to give our businesses a boost. Markets expect it to cut rates from the already record low level of 1.75 per cent to 1.5 per cent by the end of the year.

That may or may not stimulate the real economy. What it will do is pump more hot air into our housing market. Commonwealth Bank already announced it will cut rates for property investors. The higher the amount of debt, the bigger the risk of a housing market downturn. And the weaker the global economy, the higher chance of such a downturn. The future is getting even more difficult to navigate.

All this and Trump isn’t even president yet. Who knows what could happen if he actually wins.

Jason Murphy is an economist. He publishes the blog Thomas The Thinkengine. Follow Jason on Twitter @Jasemurphy