Data reveals how Baby Boomers have seized Aussie economy’s spoils as young people suffer

Young Aussies are being “hit hard” as they struggle to make ends meet – but damning stats reveal Boomers are laughing all the way to the bank.

ANALYSIS

Baby Boomers have won the intergenerational lottery.

For decades, successive Australian governments have stacked policy against the young in favour of the old.

We’ve handed generous tax breaks to the aged. Older individuals can earn high incomes that are largely tax-free, whereas young people on the same income must pay up.

Baby Boomers have the highest home ownership rate in Australia and were lucky to have gotten into the market while houses were still reasonably priced. They then enjoyed the rapid appreciation of home values, while younger Australians have been priced out.

Many Baby Boomers have also been able to purchase an investment property or two.

Most decent jobs 40 to 50 years ago didn’t require higher education – yet the Boomers that did go to university enjoyed free education, while fees for younger Australians have become a major financial roadblock early in life.

Pandemic a financial dream for Boomers

Australia’s national accounts show that Australian households accumulated an extraordinary war chest of savings during the pandemic, courtesy of the various stimulus packages from the government alongside reduced spending during lockdowns.

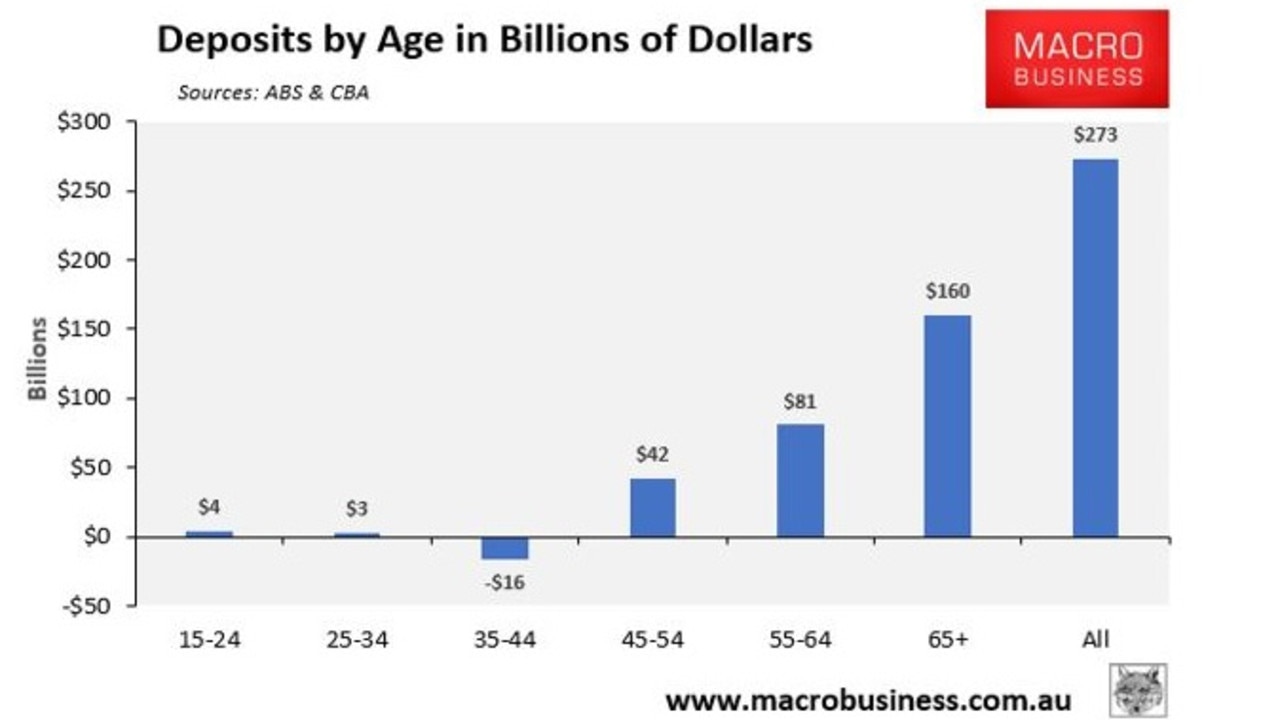

However, as illustrated in the next chart, the bulk of these savings ($160 billion) have accrued to those Australians aged 65-plus, followed by Australians aged 55 to 64 ($81 billion).

By contrast, younger Australians aged under 45 have seen their savings decline, with those households in the key home buying and child raising demographic of 35 to 44 most badly impacted.

Since Baby Boomers have the highest rate of home ownership in the nation (most without a mortgage), they have also enjoyed the biggest rise in wealth since the start of the pandemic.

Roy Morgan’s Wealth Report 2023, released this month, showed that Australia’s wealth increased by 7.0 per cent between March 2020 (pre-Covid) and March 2023.

This wealth increase was driven primarily by the rising value of owner-occupied homes, which increased by 43.2 per cent from $4.16 trillion to $5.95 trillion.

Half of the population – primarily homeowners – currently account for 95.4 per cent of Australia’s net wealth.

The lowest half of the population – primarily renters – also saw their wealth share rise, but only from 3.6 per cent to 4.6 per cent.

Boomers’ dream run continues

There are three Australias right now.

The Reserve Bank of Australia’s (RBA) rapid interest rate hikes directly impact around one-third of mortgage-holding households, especially generation Xers and Millennials with young kids.

They have seen their mortgage repayments rise by around 50 per cent at the same time as their disposable incomes have been eroded at the fastest rate on record due to inflation and higher cost of living.

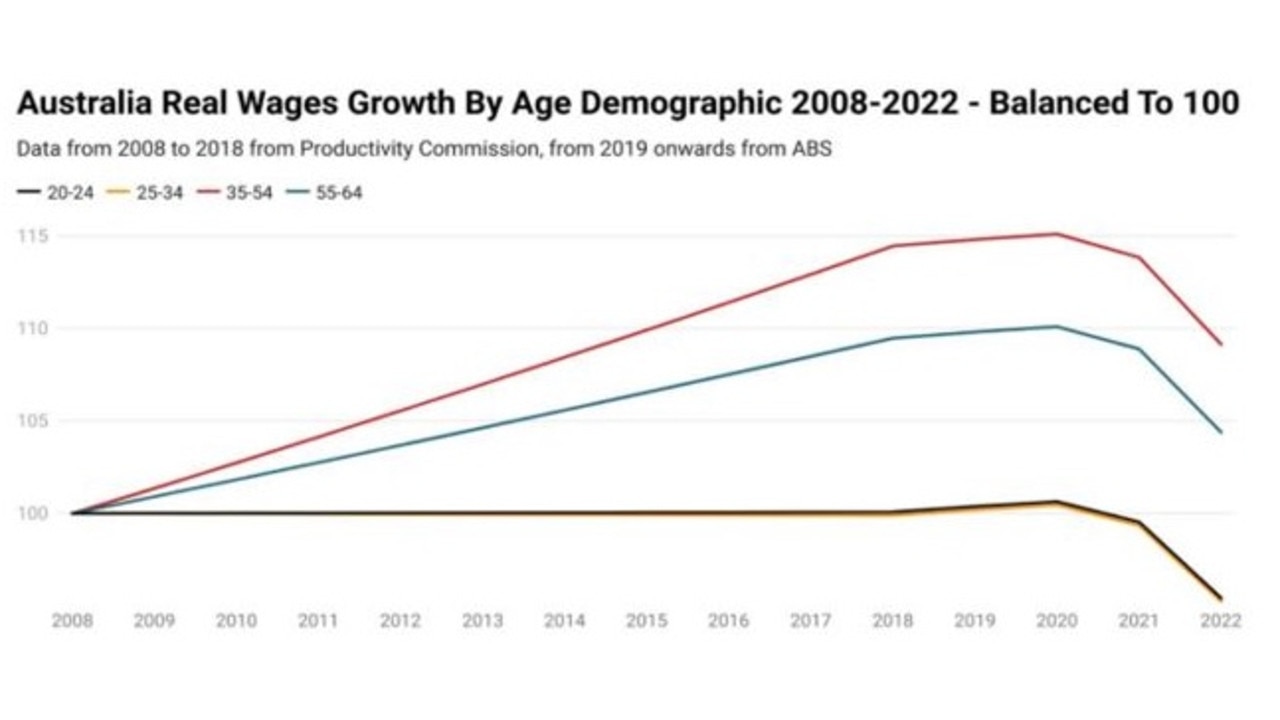

Australians aged under 35 are also earning less in real terms than they did in 2008.

Another one-third of (mainly young) renting households are being hit hard by the fastest rent rises on record, as well as declining real wages, which is reducing their discretionary income.

According to PropTrack, rents soared by 11.8 per cent nationally and by 17.0 per cent across the combined capital cities in the year to June, amid record net overseas migration and a severe shortage of stock.

The other third of Australians are dominated by the older generations (led by Boomers) and are on the other end of the economic spectrum.

They mostly own their homes outright and are largely unaffected by rising mortgage rates or rent increases.

Some Boomers are even benefiting from soaring rents, as they own a large chunk of the nation’s investment properties (many mortgage-free).

Meanwhile, Australians on the aged pension have their payments linked to inflation (unlike workers’ wages), meaning their purchasing power is being maintained as prices rise.

Boomers spend big, fuel inflation

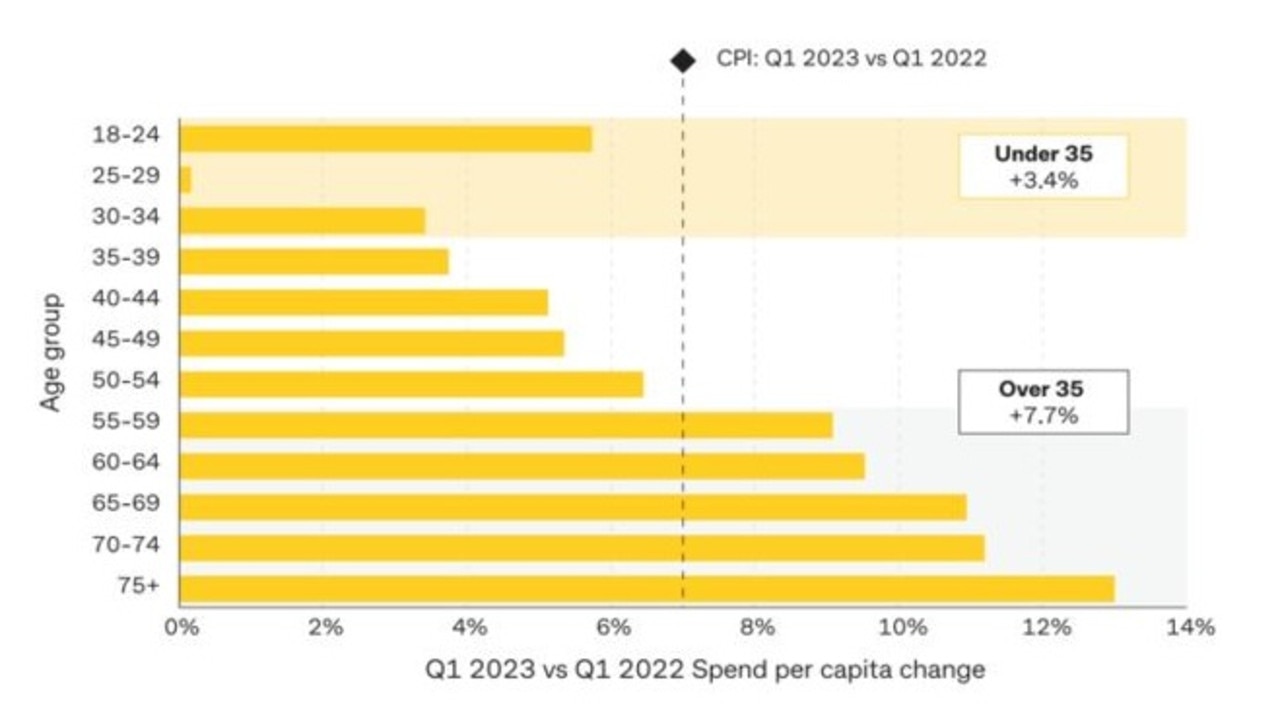

According to an analysis of seven million CBA customers’ purchasing habits, spending per capita for all age groups under 55 fell relative to the rate of inflation in the year to March 2023.

Australians aged under 35 increased their spending by only 3.4 per cent in the year to March, which was less than half the rate of inflation.

This means that the average young person is buying fewer goods and services.

The age group under the most pressure is 25 to 29-year-olds, whose spending remained nearly flat in value over the previous year despite a seven per cent increase in prices.

By contrast, spending among the over 55s climbed at a faster rate than inflation over the year to March, with CBA customers over the age of 75 increasing their spending by approximately 13 per cent.

CBA’s data also showed that the substantial increase in spending at cafes and restaurants reported in official Australian Bureau of Statistics data has been driven by older cohorts, who spent 18 per cent more on dining out than the previous year, compared to a 7.1 per cent increase among under-35s.

Data provided by Property Exchange Australia (PEXA) last month also showed that more than one quarter of all property sales in the eastern states – both residences and land – were made without a mortgage.

In 2022, over $122.5 billion in cash-funded homes were sold, accounting for 25.6 per cent of all residential sales in NSW, Queensland and Victoria.

PEXA’s head of research, Mike Gill, explained that most cash buyers were older homeowners who had previously paid off their mortgages.

Therefore, the older generations are driving Australia’s household consumption and are helping to push up house prices, which has forced the RBA to respond with higher interest rates – which is negatively impacting younger Australians with mortgages.

Older Australians also look to have tightened their stranglehold on the nation’s homes.

To the Baby Boomers go the economy’s spoils.

Now watch on as they eat smashed avocado toast.

Leith van Onselen is Chief Economist at the MB Fund and MB Super. Leith has previously worked at the Australian Treasury, Victorian Treasury and Goldman Sachs.