‘Cracks are appearing’: Graph reveals nightmare scenario facing Aussie businesses and families

As the RBA continues to smash Aussie families, experts are warning of a nightmare scenario that could be just around the corner.

With Aussies stretched to the limit amid soaring cost of living pressures and skyrocketing interest rates, experts are sounding the alarm over a fresh crisis to come.

Based on previous economic trends, it’s now clear that conditions are lining up for an avalanche of insolvencies in the months ahead.

According to Michael Chan, principal and personal insolvency specialist at national insolvency and turnaround solutions firm Jirsch Sutherland, “history could be about to repeat itself”.

He cautioned that as the cash rate continues to jump, alongside rising cost of living pressures and stagnating wages that fail to keep pace with inflation, we might be heading for a personal and corporate insolvency cliff.

“The perfect storm is brewing,” Mr Chan said.

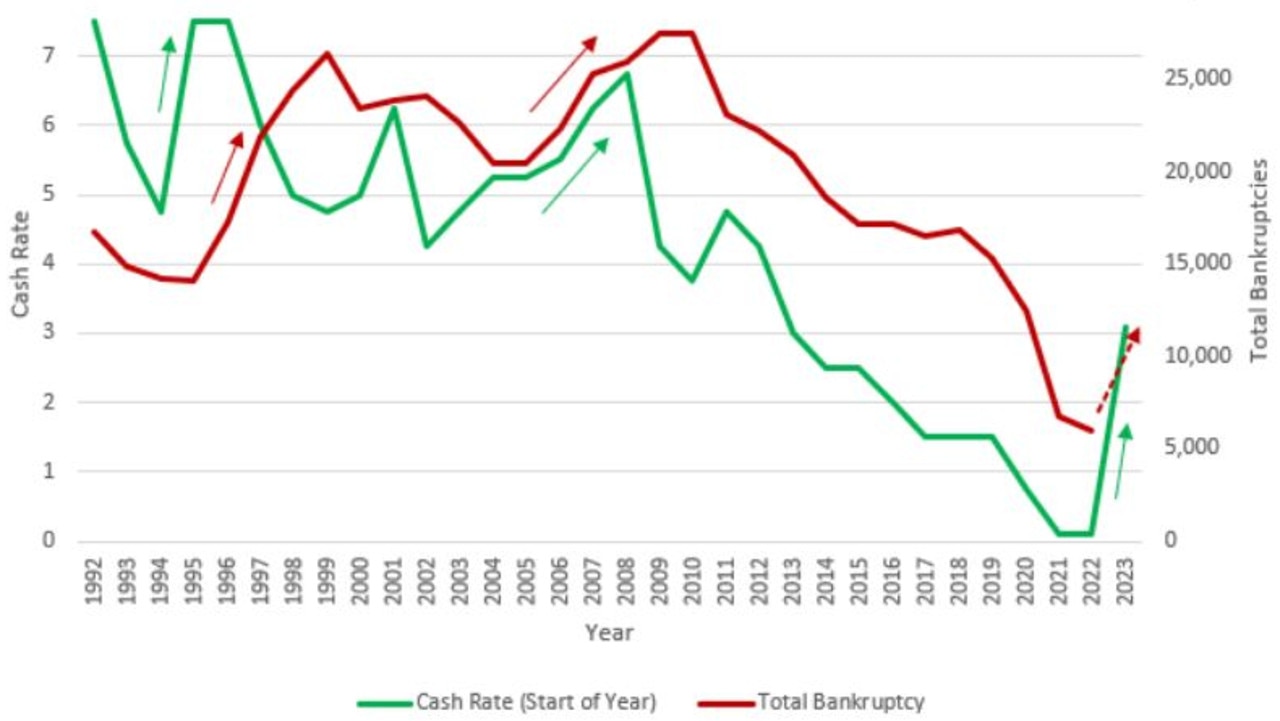

“When rising interest rates are coupled with inflationary pressures, past trends have shown a corresponding rise in bankruptcies.

“There are distinct correlations: there was a sharp economic slowdown in the mid-90s following the 1991 recession when the cash rate and bankruptcies rose simultaneously; bankruptcies and the cash rate were almost in lock-step during the 2007-2008 GFC; and it’s a similar situation now.”

He added that while bankruptcy numbers are currently still stable and homeowners still have some savings, “cracks are appearing”.

“For example, staff cuts and recession warnings are more prevalent, the tax man is lurking and regulators are getting ready,” he said.

“We are already seeing a definite increase in corporate insolvencies and believe personal insolvencies will follow.”

Mr Chan also insisted that “financial distress can sometimes take you by surprise”.

“The cost of living is increasing so quickly that even if you’re currently employed, you might not be able to service your debts,” he said.

“Having a job doesn’t mean you’re not at risk of bankruptcy. And there are other pressures to take into consideration: with the value of homes falling so rapidly, it might put homeowners into a negative equity position, not to mention people falling off the ‘fixed-rate cliff’ when they revert to sharply higher variable rates.

“That’s why it’s so important to speak with your accountant or an insolvency solutions specialist as soon as possible to discuss options – before the pressures increase even more.”

Some of the options for personal insolvency could include informal payment arrangements, debt agreements, personal insolvency agreements and bankruptcy.

“We do not recommend sticking your head in the sand and doing nothing,” Mr Chan said of those at risk.

Mr Chan's grim warning comes as the Reserve Bank jacked up Australia’s official cash rate by 25 basis points once again on Tuesday – its ninth consecutive rate hike – increasing the baseline rate to 3.35 per cent.

Anneke Thompson, chief economist at CreditorWatch, said there were signs consumers were starting to rein in their spending and that businesses were getting increasingly spooked.

However, she said the RBA “clearly wants to see some sustained evidence of a cooling economy before pausing any further cash rate increases”.

“What the RBA does next will depend heavily on January’s retail trade result. The December result showed a marked slowdown in consumer spending in all categories and states, with sales falling 3.9 per cent month on month,” she explained.

“A fall in total sales was to be expected given that Black Saturday sales now make November the peak sales month, therefore January sales will be closely watched.

“Inflation also appears to be moderating, and we should see further drops in the rate of price growth as data is now being measured off 2022 figures, when price rises had already kicked in.”

However, another key factor in the RBA’s future decisions will be “business confidence and conditions”.

“Here, NAB’s keenly-observed monthly survey shows that business optimism is now dropping, after six months of plummeting consumer confidence. Business conditions fell by eight points in December, the third successive month of falls,” Ms Thompson said.

“Business confidence did improve slightly, but there is still a wide gap between conditions and confidence. Capacity utilisation is also falling.

“This is a very good lead indicator of employment conditions, and gives us further evidence that the unemployment rate is probably going to rise throughout 2023, albeit moderately.”

Ms Thompson added that CreditorWatch’s own data indicates that business conditions going into the Christmas period were not following the same patterns as pre-Covid times.

“Usually, we would see a run up in average trade receivables per data supplier, before conditions moderated over the summer holiday period. This time, we have recorded falls in average trade receivables in October and only a very slight increase in November,” she said.

“This indicates that the peak of business activity may have already passed around the third quarter of 2022.

“Overall, it appears the RBA’s efforts to slow the economy and cool inflation are working. How quickly and deeply this ‘cooling’ is felt by businesses will be key to determining what happens next to the cash rate.”