Coronavirus has people buying home improvement items over alcohol, data shows

We’re tiring of hoarding rice and pasta, even alcohol sales are less than this time last year. But while no one wants new clothes, there’s one area we’re spending big on.

Australians have moved on from hoarding supermarket food and bottle shop booze and have found a new obsession to spend up big on in the face of coronavirus.

It’s arrivederci rice and hello home furnishings as, content we now have fully stocked pandemic pantries, we move into nesting. That’s good news for the likes of Bunnings, Harvey Norman and JB Hi-Fi which have seen an uptick in sales.

Analysis of credit and debit card transactions from Commonwealth Bank has shown Australians are purchasing less clothes and going for fewer haircuts. We’re even spending 42 per cent less on healthcare, despite being in a health crisis.

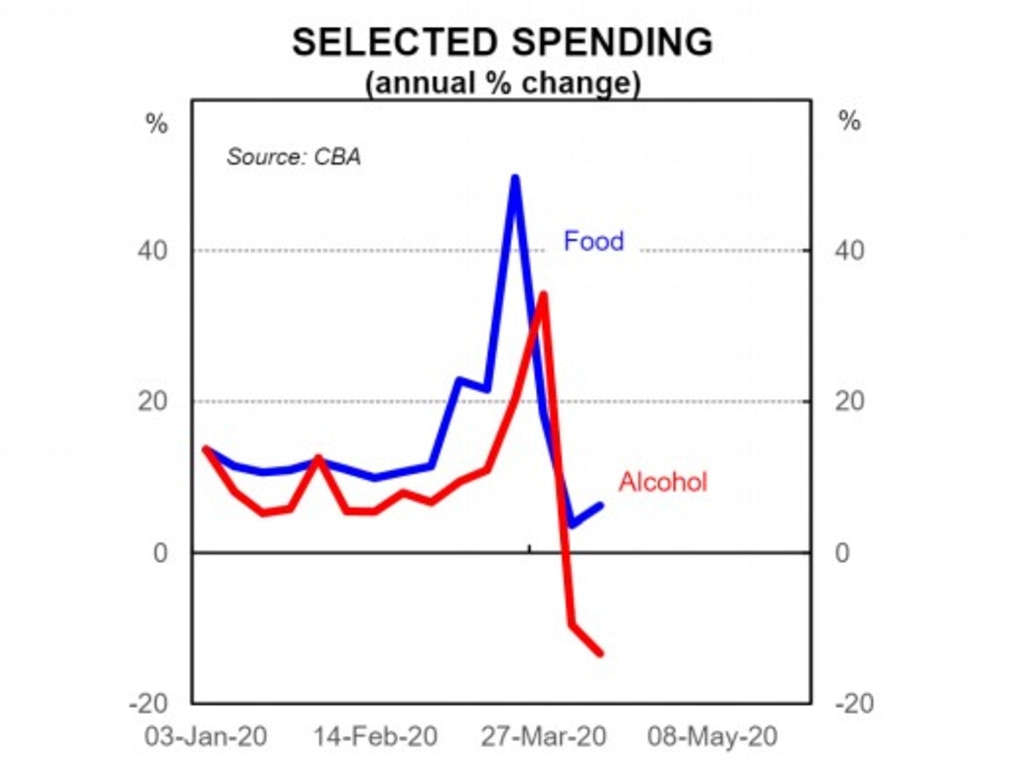

And while liquor store sales are soaring, leading to suggestions we’re all going to leave lockdown as newly minted alcoholics, the data reveals we’re actually spending less on booze overall given transactions in pubs have almost dried up.

CBA has crunched the numbers on the last three weeks of spending, mirroring the length of the current restrictions, and compared that to the same period last year.

It shows overall spending has plummeted, said the bank’s head of Australian economics Gareth Aird. The company has described it as a “massive fall”.

“It is simply not possible for households to spend on a range of goods and services when the businesses that provide them are shut,” he said.

“The appetite to spend on some goods and services has abated as households seek to avoid face-to-face interaction where possible, with medical and health services spend a case in point.”

RELATED: Some retailers are closing their doors; others are selling more than ever

RELATED: Will the latest restrictions kill off retail?

All states are showing a consumer slowdown, with New South Wales and Victoria experiencing the biggest annual declines in debit and credit card spending.

Shoppers do continue to buy up big at the supermarkets, albeit at a lesser rate than previous weeks.

Three weeks ago, in late March, grocery sales were 40 per cent higher than the same period last year. That’s now down to 28 per cent above the usual for last week. Which would be amazing for the supermarkets under normal circumstances but now looks almost measly.

Overall, however, the food segment is up only 6 per cent due to a 38 per cent downturn in sales from cafes and restaurants. Although at least they are still getting some sales as people switch to takeaway meals.

Food sales actually rose slightly last week, which could be due to sales of hot cross buns, eggs and other Easter must-haves.

Bottle shop sales were up a massive 86 per cent year on year three weeks ago, as Australians panic bought in anticipation of liquor stores being closed. As they haven’t been forced to shut, spending is now a mere 23 per cent more than usual.

But alcohol sales in pubs and bars have, unsurprisingly, fallen through the floor dipping to 72 per cent less than last year.

When you add the rise in bottle shop sales to the massive loss in pub sales, it actually means we’re spending 13 per cent less on alcohol then we were this week in 2019.

WINNERS

The other category to go up is household furnishings and equipment. This broad segment includes furniture but also just about anything for the home, from TVs to paint and plants.

Last week sales were up 10 per cent with Australians continuing to spend more on items to spruce up the home and tools and materials for DIY projects. CBA has said Easter usually drags down sales in this segment so it’s likely sales would have been even higher were it not for the Good Friday shutdown.

Bunnings is reported to have seen a big growth in the garden category over the last three weeks. There were queues outside some stores on the Easter weekend, partly due to social distancing measures.

A rush on home technology has also helped JB Hi-Fi as people either deck out their work-from-home spaces or buying gaming machines.

“Over the last few weeks, we have continued to see double-digit growth in the household furnishings and equipment category compared to last year, as people use the additional time at home to get those extra jobs around the house and garden done,” Mr Aird said.

Economist and analyst Dr Prashan Karunaratne has described a hike in buying items for the home as an example of “the substitution effect”.

He told industry website Inside Retail last month that if consumers couldn’t spend their money on the usual things, like travel or recreation, they might choose to perhaps redo the garden instead.

“It affects the way consumers achieve their satisfaction in terms of their needs and wants. Consumers now foresee a short-term lifestyle change and have a need to find substitutes to achieve their desired level of satisfaction,” he said.

LOSERS

However, the increase spending by Australians on food and home furnishings is nowhere near enough to make up for the downturn in other areas.

Three weeks ago, transport spending – which includes topping up smartcards – was 24 per cent down; it’s now 44 per cent lower than last year as people hunker down at home.

Spending on recreation, which also includes air travel and hotels, is down 37 per cent. Each week we are spending less in this category.

Two of the biggest drops have been in clothing and personal care. It seems we are no longer bothered how we dress or how we look with spending down 58 per cent and 61 per cent respectively.

Even if we wanted to buy clothes and make-up, it’s now more difficult with stores like Myer, H&M, Zara, Country Road and Sephora all closing their physical doors and pushing customers towards online.

The likes of David Jones, Target, Kmart and Big W however continue to trade to tempt customers who still need socks, jocks and lippy.

Commonwealth Bank’s Mr Aird said he didn’t see things improving for some time.

“Despite the incredible fiscal and monetary policy packages, we do not expect to see a rebound in our spending data for the foreseeable future.”