Coronavirus: Australia’s post-COVID economic recovery plan ‘doesn’t make sense’

A leaked report advises Australia to pin its hopes on one industry to drive growth after the COVID-19 outbreak but experts say “it doesn’t make sense”.

Cheap gas is being held up as the key to Australia’s post-COVID future but experts have slammed the idea as “silly” and say it “doesn’t make sense”.

A leaked document reportedly advises Prime Minister Scott Morrison on Australia’s economic recovery, pointing to the gas and manufacturing industries as the Coalition’s major focus.

But the idea of expanding Australia’s gas industry has drawn disbelief from other experts, who say it’s not in the national interest.

Gas and LNG financial analyst Bruce Robertson, of the Institute for Energy Economics and Financial Analysis (IEEFA), said there was a major global gas glut that was expected to last until 2030.

“Gas and LNG prices have bottomed globally, and companies everywhere are virtually giving gas away,” Mr Robertson said.

“This will continue for at least eight years due to the massive oversupply in gas globally.”

Mr Robertson said the gas industry itself had pulled back from further developing sites around Australia because of low prices and the global gas glut.

“Australia can’t develop an industry when that industry itself is telling us that it can’t develop without significant subsidies,” Mr Robertson said.

“I don’t think that it serves the national interest. It does serve the gas industry’s interests.”

RELATED: Follow the latest coronavirus updates

RELATED: PM’s plan to get Australia back on track

According to Sky News political editor Andrew Clennell, the leaked draft of the National COVID-19 Coordination Commission manufacturing report suggested up to 412,000 new jobs could be created by 2030 in the gas industry alone.

“We need to be decisive and begin immediately to create an Australian gas market that delivers globally competitive results,” the leaked report said.

The commission, which is advising the Morrison Government on how to recover from the coronavirus pandemic as quickly as possible, reportedly calls for the creation of a “competitive domestic gas market” to drive down prices in eastern Australia, making manufacturing cheaper and helping to create hundreds of thousands of jobs.

The chair of the commission, Nev Power, told the AFR this week that several options were under consideration to lower gas prices. They could include a $6 billion pipeline between Western Australia and South Australia, and changing regulations to increase production.

But experts say the gas industry is too volatile to sustain long-term jobs and Australia will find it difficult to compete globally on prices.

THE JOB MYTH

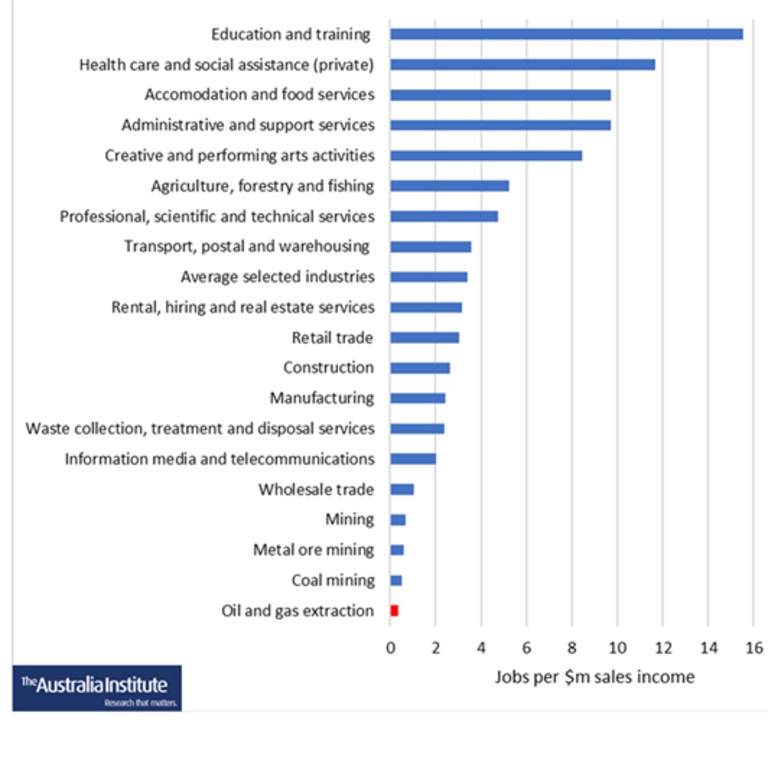

New analysis from the Australia Institute has found that despite Australia being the world’s largest LNG exporter, less than 0.2 per cent of the workforce was employed in the gas industry, and the companies pay little if any tax.

“Investing recovery funds in virtually any other industry would be likely to create more jobs,” Australia Institute climate and energy program director Richie Merzian said.

“The main purpose of recovery funding is to create jobs to tackle expected double digit unemployment in the wake of the Covid 19 crisis,” Mr Merzian said.

“Spending recovery funds on an capital intensive, jobs poor industry completely defeats the purpose.”

The Institute also noted that subsidising gas would shift the focus away from lower cost renewables and lock Australia into higher energy prices and higher emissions for decades.

“Covid 19 recovery spending is a once in a generation opportunity to rebuild Australian manufacturing through cheap renewable energy and new equipment to electrify industrial processes,” he said.

‘WE SIMPLY CAN’T COMPETE’

The last few years has seen a number of companies in Australia close, blaming high gas prices.

This includes Dow Chemical, which announced it would close its Melbourne manufacturing plant last year; as well as RemaPak, a Sydney-based producer of polystyrene coffee cups, and Claypave, a Queensland-based brick and paving manufacturer, which both entered administration.

Lowering gas prices in Australia could be a vital lifeline to many businesses who have suffered over the years with high gas prices, partly because so much of the gas Australia produces is being exported overseas.

But Mr Robertson believes there were ways to lower gas prices without opening up new sources of gas supply.

“A gas-led (coronavirus) recovery is not one of those ways,” he said. “It is unbelievable how silly this proposal is from the COVID Commission.”

There are reports the government wants to keep the gas price at around $6 to $7 a gigajoule in Australia, which producers are already suggesting is too low and could make extraction uneconomical, according to the AFR.

But Mr Robertson said this was double the average gas price in the US in the last 12 months.

“We simply can’t compete with expensive gas,” he said.

A Climate Council report Primed for Action: A Resilient Recovery for Australia released this week noted the recent oil price war between Saudi Arabia and Russia had also driven down gas prices.

This has seen three of Australia’s largest oil and gas companies — Woodside, Santos and Oil Search — drop planned expansions in the past two months. Origin Energy has also been forced to stall exploration in the Northern Territory’s Betaloo Basin.

“It is a shaky foundation on which to reboot a fragile economy,” the report notes.

“Gas projects cannot provide sustainable long-term employment opportunities because of this volatility.”

The oil and gas extraction sector saw the biggest job losses between March 14 and April 18, with falls of 40.5 per cent, according to Australian Bureau of Statistics data released this week.

The Climate Council report noted that manufacturing industries built on gas and gas-fired electricity would also have higher ongoing operating costs than those built on renewables.

“There is no argument for a gas-led recovery in Australia that makes sense in the 21st century,” it said.

Mr Robertson said Australia’s economic recovery needed to focus on industries which are already doing well and had a competitive advantage such as medical technology, agriculture, IT, tourism and zero emission renewable energy.

‘IT’S OLD THINKING’

The Federal Government’s technology road map, also released this week, suggests gas will have a part to play in firming renewables until 2030, after which renewables will become more reliable.

“According to the International Energy Agency, switching from coal to gas can provide ‘quick wins’ for global emissions reductions and has the potential to reduce electricity sector emissions by 10 per cent,’’ the road map reported.

But Climate Council senior researcher Tim Baxter disagrees.

“It’s often said that there is no credible transition (to a clean energy system) that involves no new gas and that is actually untrue,” he told news.com.au.

He pointed to the Australian Energy Market Operator’s draft 2020 Integrated System Plan, which looked at a number of scenarios to transition to a 100 per cent renewable system — none of which involved developing new gas sources.

Mr Baxter said the COVID-19 commission’s suggestion that Australia needed a gas-led recovery was “old thinking”.

“It doesn’t even make sense anymore,” he said.

“It’s imagining a world as it was 30 years ago, we just don’t live in that world anymore.”

He said renewables backed with storage was now a cheaper way to generate electricity.

“If you need new energy you wouldn’t invest in something more expensive,” he said.

The other big problem with gas, is that world needs to get its emissions down to zero and gas cannot deliver this.

“To hold global temperatures stable, there can be no new greenhouse gases in the atmosphere each year, and you don’t get there by developing new fossil fuels,” Mr Baxter said.

He said the world’s biggest fund manager BlackRock and other organisations were no longer investing in fossil fuels.

“What we’re seeing is world is moving away from fossil fuels whether we like it or not.”

Several countries already have net zero plans, and so does every state and territory in Australia.

“Every state and territory in Australia has a goal for zero emissions,” Mr Baxter said. “Australia has this goal whether the (Morrison) government realises it or not.”

“This is a thing that is happening and by denying that reality, it’s actually doing a disservice to those workers because the fossil fuel industry is on the way out — that’s just the reality of it.

“There will economic impacts coming out of the COVID pandemic but gas is wrong way to deal with it.”

Continue the conversation @charischang2 | charis.chang@news.com.au