Coronavirus Australia: RBA says economy will be even worse than expected

Sorry Australia – the economic effect of the coronavirus is turning into less of a short sharp slap in Australia’s face and more of a chronic injury.

Sorry Australia, the economic outlook is worse than we thought. And it could get even worse. That was the message from the RBA yesterday as it issued a bunch of forecast downgrades and released a new COVID downside scenario that shows Australia a truly terrifying possible future.

The economic effect of the coronavirus is turning into less of a short sharp slap in Australia’s face and more of a chronic injury.

The official forecasts didn’t always predict this. Back in May, the RBA put out three scenarios.

The baseline, the upside and the downside. These showed things getting bad in a hurry then resolving fast too. Even the downside scenario from May showed rapid improvement.

For a little while the official forecasts showed we were going better than the baseline. Hip hip hooray, I said to myself. But the truth is recovering from the covid slump is much harder than we thought.

Australia has doubled the number of people on JobSeeker to 1.5 million people. That is enormous. JobKeeper is even bigger, supporting 3.5 million jobs.

The economy appears to be standing up, but only with assistance. That assistance is being gently removed. Getting back to a healthy economy that can actually support itself will be very difficult.

Yesterday Australia’s central bank put out a new set of forecasts and the new baseline is worse than the old baseline. GDP growth is now expected to chug back up slowly instead of springing up. It will be 5 per cent in the 2021 calendar year, which is not enough to offset the 6 per cent fall this calendar year.

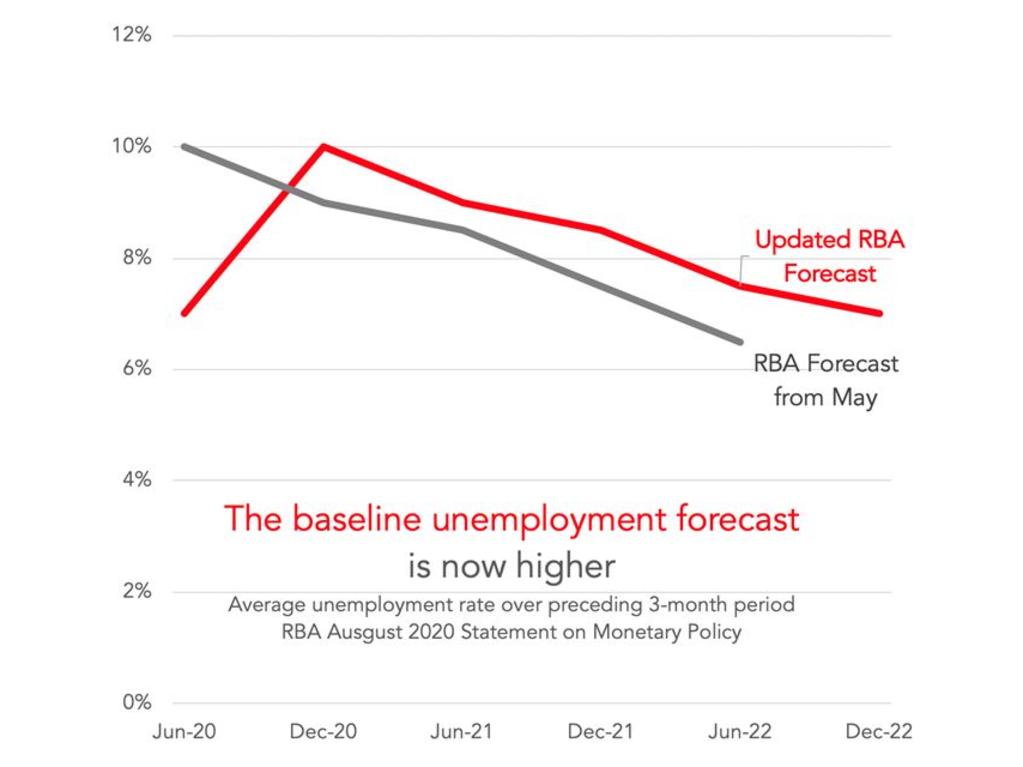

The next graph shows the RBA’s baseline unemployment forecast. It’s grim. Unemployment will peak later than expected and recover more slowly. Even out at the end of 2022, unemployment is expected to be up at 7 per cent.

RELATED: Economic crash will devastate us all

There are two reasons for this. First we know the government is about to reduce support for the economy. That will be a problem. Second, the Victorian situation was not predicted. The viral outbreak that has forced Melbourne into a shutdown is ruining even more businesses.

The RBA puts it like this.

“[R]estrictions in Victoria, alongside some job losses occurring as a result of the JobKeeper program beginning to be tapered nationally after September, will weigh on labour market outcomes in the September and December quarters.”

The RBA estimates the hit from the Victorian outbreak to national GDP at about 2 per cent. That’s assuming the tight restrictions have to be in place for only 6 weeks.

This leads us to the next possibility. It is possible the baseline forecasts just issued are too optimistic or too pessimistic. So the RBA has issued new upside and downside forecasts.

RELATED: Date economy could fall off a cliff

The upside scenario is slightly better than the baseline. But the downside scenario is utterly terrifying, with unemployment hovering over 10 per cent throughout 2021 and only recovering to around 9 per cent by the end of 2022. That is an awfully long time for jobs to be scarce. Years of frustration could be ahead.

The downside scenario is all about the virus bouncing back, says the RBA.

“A plausible downside scenario is where Australia faces further periods of outbreaks and heightened restrictions in certain areas, and the world experiences a widespread resurgence in infections in the near term.”

Given what Melbourne has already experienced, it is impossible to rule out fresh outbreak in other parts of Australia, and indeed rolling outbreaks around the world look quite likely. Japan, for example, is a country that did very well at controlling the outbreak initially but is now deep in a second wave. It recorded 1500 new cases on August 6.

Of course, this downside scenario isn’t the absolute worst-case either, as the RBA points out.

“A worse outcome than our downside could be conceivable if the virus cannot be contained and further waves of infection occur around the world for some years yet.”

This bothers me. I sometimes worry part of the reason places like New York and London are going well for now is because of warm weather. Obviously weather is not the only factor in viral spread, but it is notable that the virus cleared up in temperate places across Europe and North America as summer came. It is now peak summer in the northern hemisphere. Yes, people are being cautious because of the recent surge, but also windows are flung open and people are outside.

In four months they’ll all be inside with heaters on. Just like Melbourne in its recent outbreak. A second big wave in some of the biggest economies in the world would be very bad for the global economy, and it would be impossible for us to avoid the shockwave.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.