Coronavirus Australia: Grim warning predicts oncoming financial crisis

The coronavirus crisis is wreaking havoc across the globe – and it has created the “perfect storm” for a looming financial pandemic.

Australia is still reeling from the devastating COVID-19 outbreak – but a finance expert has warned the “next pandemic” will be a financial one just as disastrous.

Tammy Barton, the founder of Australian financial services company MyBudget, is convinced there is a looming financial pandemic of job losses, wage reduction, business shut downs, challenging new working environments, home schooling, childcare crises, isolation and social distancing which will cause a “perfect storm of financial stress”.

The Telstra Business Woman of the Year award winner said Australians were already struggling to cope financially before coronavirus hit, and that it had only exacerbated the problem.

RELATED: Fury as Aussies ‘forced to pay for COVID-19’

RELATED: Astonishing result of toilet paper hoarding

“A study from last year showed that one in five people had less than $250 in the bank and a third of those had no savings at all. Those people weren’t ready for an unexpected vet bill or a blown tyre, let alone a pandemic that’s derailed the economy and led to massive job loss,” she told news.com.au.

“The coronavirus crisis has really exposed the extent of this financial stress across the country. Financial stress doesn’t stop at your hip pocket. It can impact mental and physical wellbeing, family relationships, work performance, productivity — it can infect every part of someone’s life.”

Ms Barton said it would widen the divide between those who had savings to fall back on and those who were already living week-to-week.

“Low income earners are overrepresented, but middle to high income earners aren’t immune either. This wave of financial stress is now reaching into homes and businesses and lives where it’s never been before,” she said.

“We’re expecting to see a spike in debt, with more people leaning on their credit cards, or having to make payment arrangements with their creditors.

“It’s probably a couple of months away, but we’re also likely to see more people having to sell assets, like cars, boats and other belongings, and those who’ll be forced to cash-out of their investments to get through the crisis.”

However, she stressed that while the jobless rate would rise, most Australians were still in work, and the country’s welfare net had never been stronger with more financial assistance available now than ever before.

Ms Barton said while the first instinct for many would be to “bury their head in the sand”, it was essential to ask for help and discuss your situation with others.

But she is concerned some of us will fall into “quick-fix traps” like draining their savings quickly, accessing their super, ignoring their bills, putting purchases on credit or turning to buy now pay later schemes.

“All that does is delay the pain and compounds the problem for the future. It can also lead to a slippery slope where escalating interest charges result in maxed out credit cards and creeping interest on loans and bills that aren’t being paid,” she explained.

“People can think they have the situation under control and then it suddenly snowballs.”

GET FINANCIALLY FIT

However, Ms Barton said it was possible to start future-proofing yourself today no matter your situation.

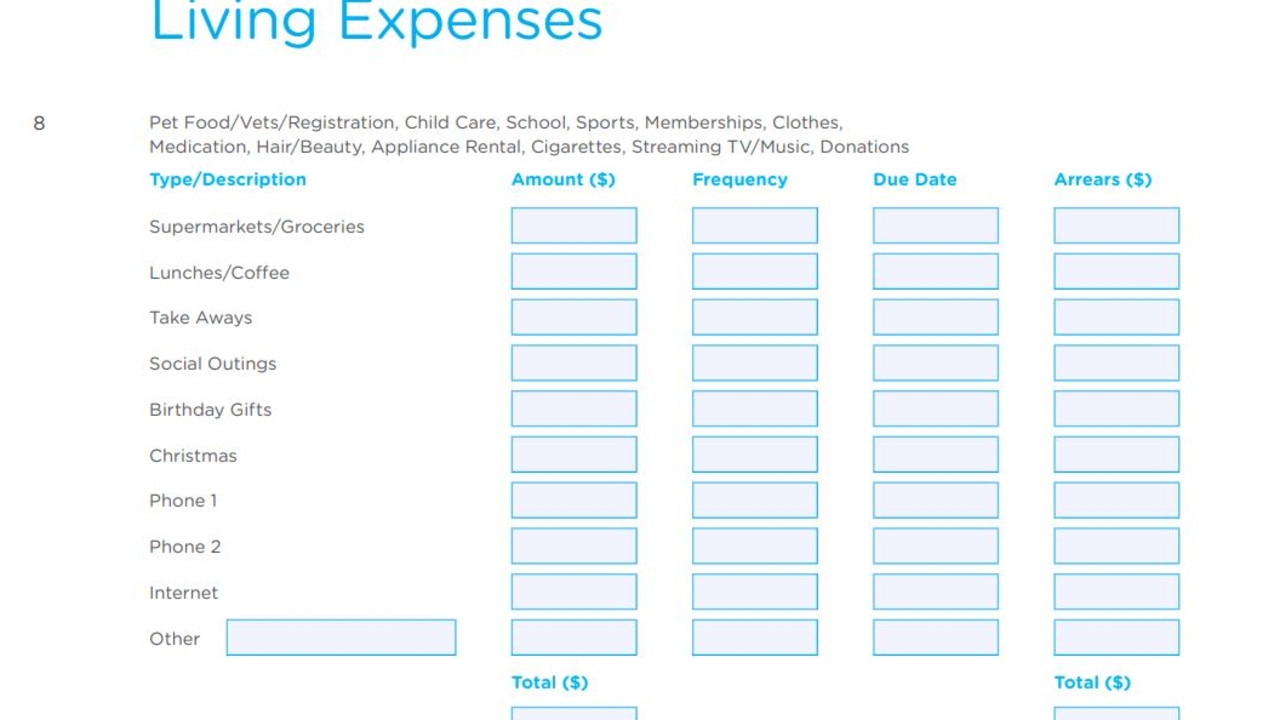

“For most people, the first step is to actually work out where their money is going,” she said.

“It’s impossible to make the most of your income when you don’t have a budget that shows how you’re using your income. I find most people are surprised by how far their money can go when they have a plan that guides their spending habits.”

While many Australians had a fear of budgeting, Ms Barton said it was impossible to get financially fit just by looking at your bank account or credit card statement at the end of the month.

“You’re the sum of your daily money habits, which add up into more and more financial gains over time,” she said.

“The saying goes, ‘The best time to plant a tree was 20 years ago. The second best time is now.’ And that’s exactly how it is with your finances.

“Don’t ignore your money problems. Create a plan for your finances that helps you prepare for life’s ‘what ifs’ and start embracing the positive habits that build up savings and financial fitness one day at a time.”