China’s worrying sign for Australia as economic fears rattle the price of our biggest export

One of Australia’s top weapons against widespread economic hardship is being tested by a concerning situation in China.

When the Global Financial Crisis hit back in 2008, one of the key strengths that pulled Australia through without the hardships seen elsewhere in the world was its abundance of natural resources.

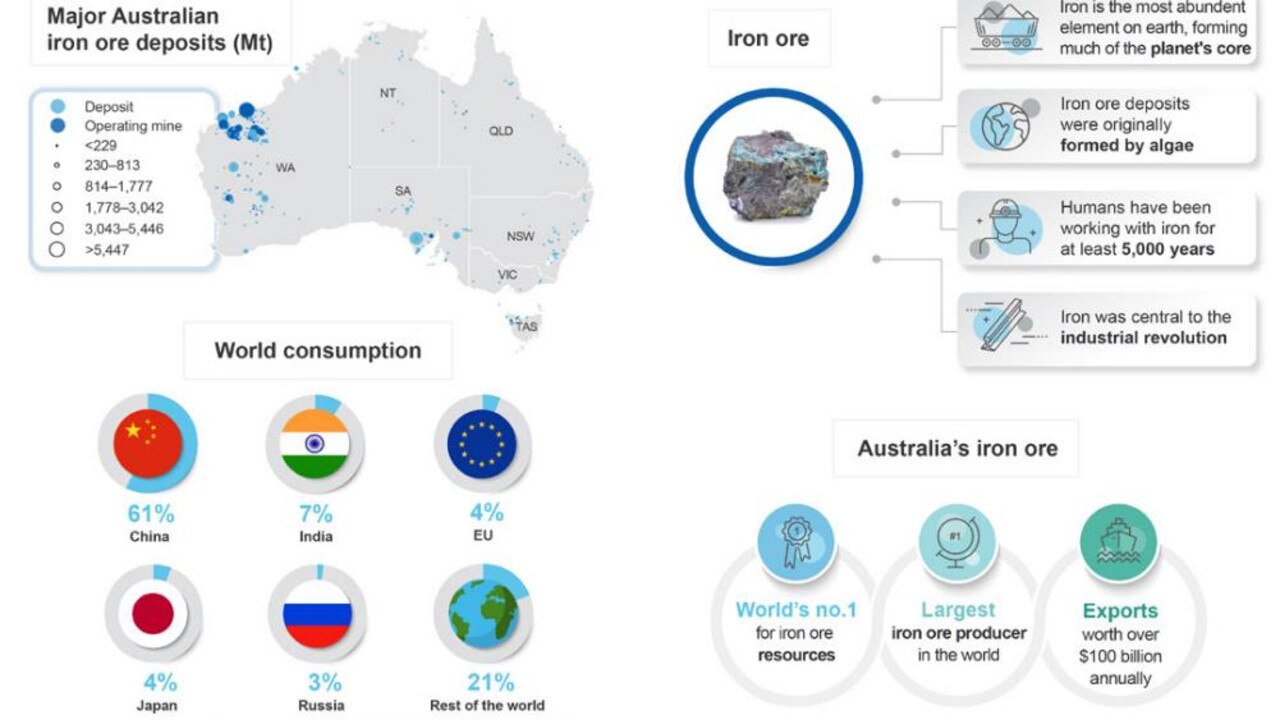

The most lucrative of all these resources — iron ore — is mined mainly in the red dirt of Western Australia’s Pilbara region and pumps an astronomical amount of money into Australia’s economy.

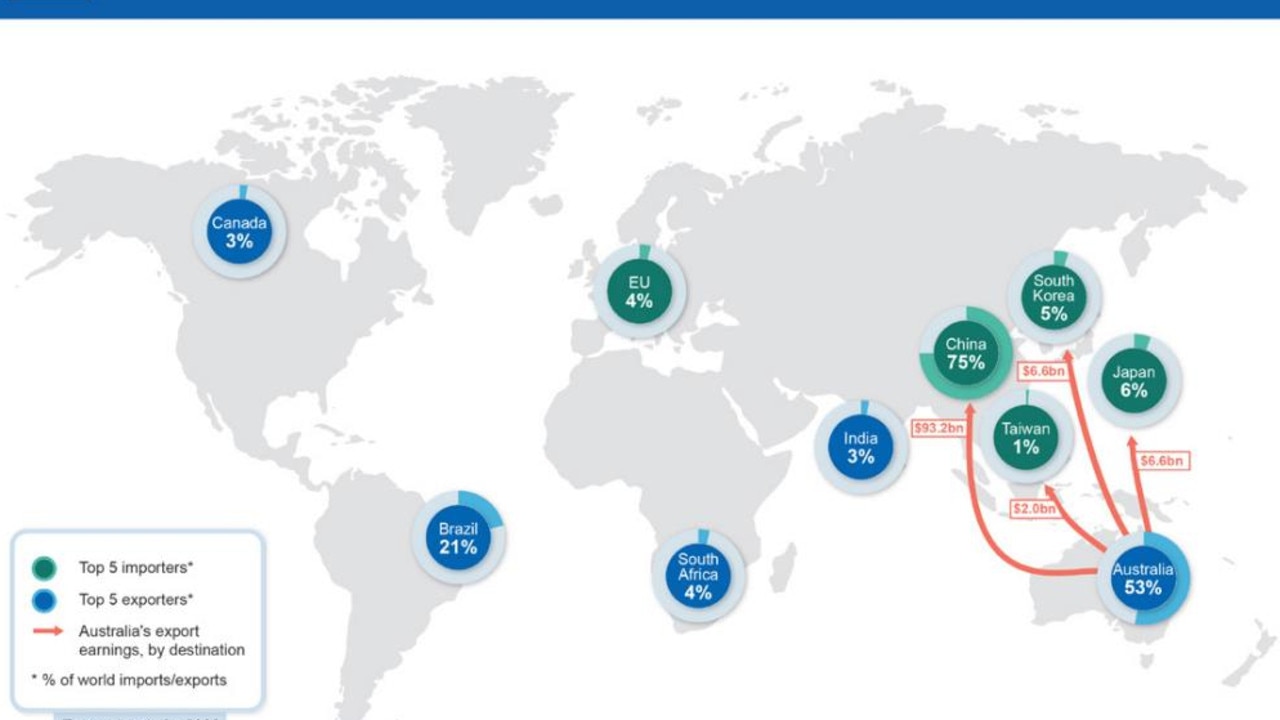

It is the cash cow that keeps on giving for Australia as its export values are estimated to have risen from $103 billion in 2019–20 to $149 billion in 2020–21 — reaffirming our spot as the world’s biggest exporter of one of the most important minerals to the global economy.

It is important because it is used to make pig iron, which is one of the main raw materials to make steel which is used in every aspect of our lives; from cars and construction products, to refrigerators and washing machines.

It is also by far Australia’s biggest export and the majority of it is shipped off to China which consumes a massive 61 per cent of the world’s iron ore.

However, there are concerning signs for Australia stemming from within China as the world hurtles into a new era of high inflation and interest rates, putting the global economy at risk of a recession.

The iron ore price tumbled on Wednesday to its lowest since the first week of December, as deep concerns about an oversupply of steel in China left the market rattled.

Benchmark September iron ore on China’s Dalian Commodity Exchange sank as much as 5 per cent to 716.50 yuan ($106.67) a tonne, extending its losses to a ninth consecutive session to hit the lowest since March 1.

China was looking to bounce back quickly from the pandemic last year, which along with supply issues from other iron ore producers like Brazil helped send the price of iron ore through the roof. In May last year it hit a record of more than $US230 ($A296) a tonne.

A lot has changed in the world since then, but China has not given up on its dream of eliminating Covid and investors are concerned about the superpower’s ability to stage an economic recovery while such draconian rules are enforced.

“Markets are particularly worried that demand growth expectations linked to China’s pledge to boost infrastructure investment may not materialise, especially with China’s zero-Covid policy still in play,” Commonwealth Bank of Australia analyst Vivek Dhar told Mining.com this week.

Extreme restrictions have dampened overall domestic demand in China, and there are fears of a continued chill in the economy as new coronavirus cases are detected each day.

Construction has also taken a hit in China because of heavy rains that have led to the piling up of steel inventory, further hitting the profits of mills and prompting them to idle blast furnaces to cut losses.

“Doubts over China’s future steel demand growth has meant that markets could no longer ignore current market conditions of oversupply in China’s steel sector,” Dhar said.

The result this week was that the price of iron ore took a big hit and Australia’s mining giants suffered too.

As the Australian share market in general took a hammering over the past two weeks, big mining companies like BHP, Rio Tinto and Fortescue were hit particularly hard.

The share price of the three companies sank 16 per cent, 7.94 per cent and 17.07 per cent respectively over the past month — with the heaviest losses in the past two weeks.

It was a rocky week for the price of iron ore too. On Tuesday, the value of the resource dropped a massive 8 per cent in one day to $US112.35 a tonne — but it pared back losses on Friday when it jumped 6.1 per cent to $US116.05 a tonne.

A rebound late in the week came after Chinese President Xi Jinping pledged to take stronger measures to achieve the country’s economic and social development goals.

President Xi, speaking at the opening ceremony of the BRICS Business Forum via video link on Wednesday, called for greater co-ordination on economic policy to stop China’s recovery from being disrupted.

He said China would ramp up moves to combat a difficult global economy and take more effective measures to achieve its annual economic goals while minimising the impact of the Covid-19 epidemic as much as possible.

He didn’t give specific details on how this would be achieved but it appears to have been enough to restore a little more confidence to the market.

But despite this, Australia’s three iron ore mining giants were trading in the red on Friday perhaps signalling that we’re not out of the woods just yet.

Drama at mega-mine threatening Australia’s dominance

It has also been an eventful week in the iron ore world because of a major development at a West African mega mine that is threatening Australia’s dominance.

Dubbed the Simandou mine, the massive site in Guinea is one of the largest, highest grade iron ore deposits in the world – having estimated reserves of 2.4 billion tonnes of the stuff beneath the red earth of its exterior.

However, this week Guinea’s military ruler Mamady Doumbouya, gave foreign miners just two weeks to establish a joint venture project acceptable to the government.

Guinea is seeking to exploit one of the world’s largest iron ore deposits in an open pit mine at Simandou in southeast Guinea. It is also attempting to build a railway link of about 670 kilometres between the site and a port on the Atlantic coast.

But the government has alleged that the mining giants which are its partners in the operation have failed to live up to expectations.

“We note a discrepancy between your view of the implementation of the terms of the framework agreement, and our expectations,” Doumbouya told leaders of the mining giants when they met on Friday in Conakry, according to a state media broadcast.

A 35-year agreement was signed three months ago between the Guinean state, Anglo-Australian firm Rio Tinto Simfer and the Winning Consortium Simandou, set up in part by Chinese and Singaporean interests.

“This situation is not only regrettable, but also unacceptable for the Guinean state,” Doumbouya warned.

“To move forward effectively, I expect the creation of the joint venture within fourteen days.” The completion date for the mine and the railway has already been set for December 2024, while the first commercial production should begin no later than March 31, 2025.

Iron ore exploitation has been held back for years by disputes over mining rights, suspected corruption and the scale of the investments needed in a landlocked part of a country severely lacking in infrastructure.

— with AFP