Big four economic dramas Australia faces in 2019

These are the four scary factors that will decide whether Australians will be merry or miserable this time next year.

Next year is shaping up as a big one. The Australian economy faces four major dramas that will determine if this time next year is merry or miserable.

HOUSING

Everyone agrees a little bit of a house price fall is good for affordability, while too much could hurt the real economy. Discounts are getting substantial. There are buyers on the sidelines. How far will it go before they decide it is time to buy?

Australian house prices are down 3.5 per cent from their peak, and in some cities things are even worse. Perth is down 25 per cent since its peak in 2007, Sydney is down 8 per cent just this year and Melbourne is down 6.6 per cent this year, according to CoreLogic.

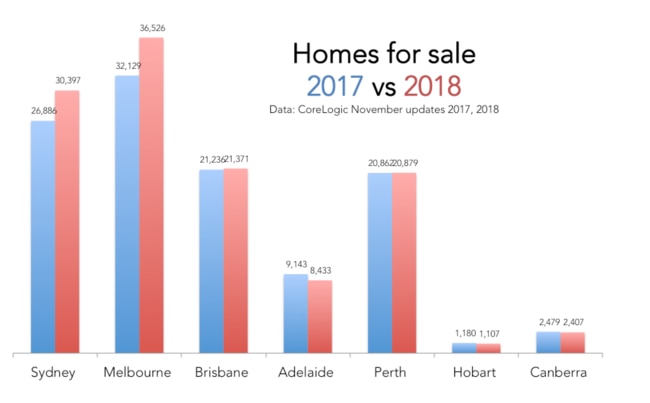

To see the future, watch two things: supply of homes and supply of loans. Supply of homes is high at the moment because sales have been weak. In Sydney and Melbourne, a lot of auctions have failed and homes remain on the market, as the next graph shows. That overhang of supply is tough on prices.

Supply will rise even further in 2019, with many large apartment projects set to finish. Even if all the apartments are pre-sold off the plan (they aren’t) and all the pre-sales settle smoothly (they usually don’t), when people move into these new apartments it will create a second round of vacant properties, some of which will be for sale. This means 2019 could give buyers a lot of choice.

Supply of loans could go either way. When the final report of the banking royal commission arrives in early next year, it is likely to point the finger at previous loose lending. That could make banks tighten up even more on loans and be even more diligent on checking living expenses.

But the government will not want to choke the housing market to death. So we may see more announcements like yesterday’s — the regulator is now going to allow more interest-only lending again. Changes like that should juice things up a little bit at least. The balance between tight lending and loose will make a big difference to the trajectory of house prices.

CHINA

China is our best and biggest customer and the reason we’ve become one of the world’s wealthiest countries. When China is strong, we are strong.

China’s newest economic data should send a shiver down our spines. They announced the lowest retail sales growth in 15 years and weak manufacturing activity. China’s government also recently banned the publication of one economic statistic the rest of the world relies on, which could be sign they’re hiding something.

Is the long run of high Chinese growth finally going to end? US President Donald Trump is taking credit for China’s slump, saying his trade war caused it. He thinks it will force them to surrender.

China just announced that their economy is growing much slower than anticipated because of our Trade War with them. They have just suspended U.S. Tariff Hikes. U.S. is doing very well. China wants to make a big and very comprehensive deal. It could happen, and rather soon!

— Donald J. Trump (@realDonaldTrump) December 14, 2018

If he’s right, the problems should go away when the trade war ends. That would be very helpful for us.

But he may be wrong. Perhaps China, which doesn’t have to worry about pesky elections, would rather wait for a new US president in about two years’ time rather than strike a humiliating deal now. A long-running tense stand-off would have a lot of collateral damage in Australia’s economy and could make our dreadful wages growth even worse.

US ECONOMY

Mr Trump may be boasting, but his own economy is looking pretty wobbly.

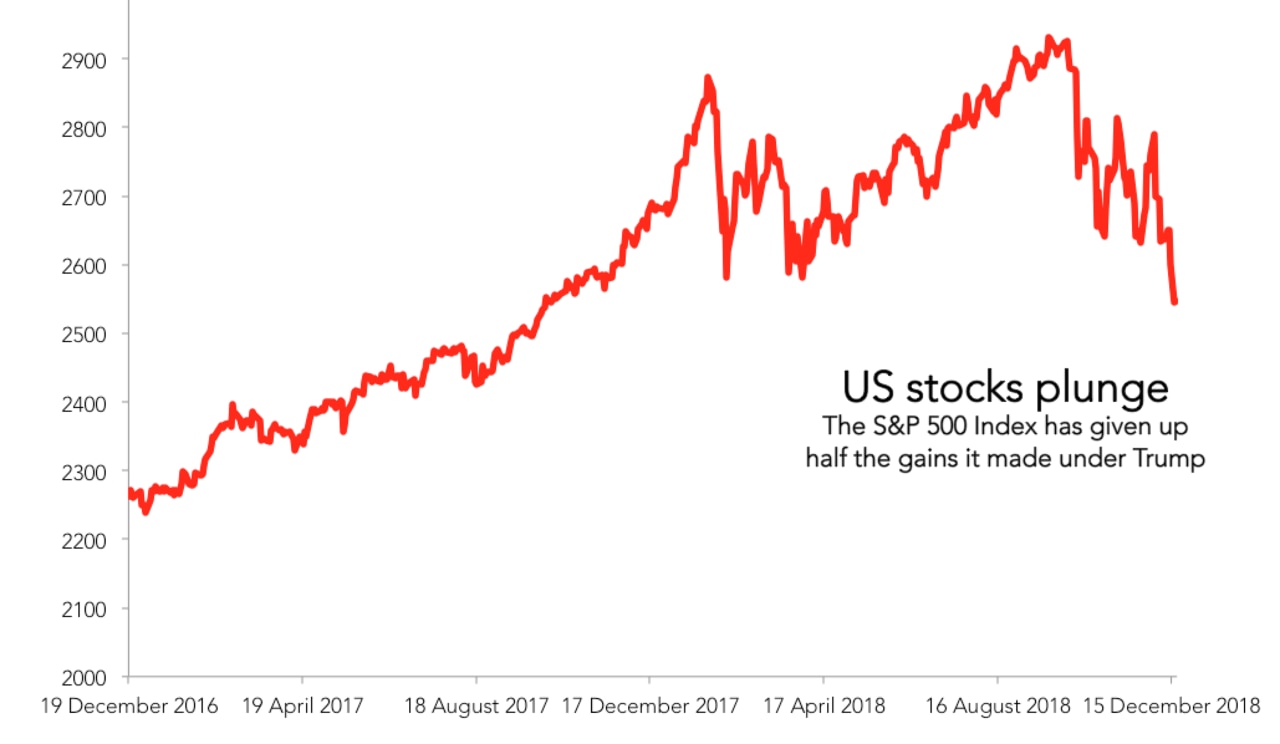

Markets are crashing, some signs point to a recession and the US central bank is still raising interest rates.

The fall in the markets in America has now wiped out 2018’s gains and more. It is ugly. Where do we go from here? Is the market just blowing off steam or is America’s economy about to trip over?

Sometimes the stock market contains clues to what the real economy will do next, and that is especially the case when the bond market is showing the same clues. The US bond market recently showed a bright red flashing sign: a “yield curve inversion”. It’s a technical indicator that has in the past been a good signal of a coming recession.

Australia doesn’t depend directly on America for trade. But it is the world’s biggest economy. An American recession would cause plenty of collateral damage, and be hard for us to escape entirely.

THE DARK HORSE: ROBERT MUELLER

The fourth great drama in the world economy is not an economic issue at all, but a political one. Mr Trump is under investigation by Robert Mueller. Mr Mueller has already sent lots of Mr Trump’s associates to jail. What will he find on Mr Trump himself?

Nobody knows. And nobody knows when the investigation will finish. It might be 2019. It might be later.

We can only imagine what global markets and the global economy will do if Mr Mueller drops a report that makes implies the President should be impeached. I’d expect panic and talk of a constitutional crisis. But if the report finds Mr Trump is in the clear, the skies could brighten.

The Trump investigation could end well for the economy and that is true of all these dramas. Each has a flip side. House price falls could steady at a safe level. China might have a new growth spurt. America might forge onwards. Risk must be kept in perspective. When downsides come they are very painful. But in most years, the good outweighs the bad. Next year certainly comes with lots of reasons to worry, but it might yet turn into another good year.

Jason Murphy is an economist. He writes the blog Thomas the Think Engine