Australia’s iron ore export boom to China is a double edged sword

One thing has helped Australia thrive through the pandemic, but if China’s plan goes ahead then Australia will be cut off.

For much of Australia’s history it was said the fortunes of our nation’s economy rode on the sheep’s back. With wool being Australia’s main export commodity between 1871 and the 1960s, where wool prices led, our economy at times followed.

Fast forward 60 years and Australia is just as reliant on exports for its economic prosperity as it was more than a century ago. Except this time, the nation’s economic future no longer rides on the back of a sheep, but atop a football-field sized iron ore bulk carrier bound for China.

When China entered the world’s first lockdown back in January last year, it seemed like Australia’s golden goose may have finally met conditions that would be its end.

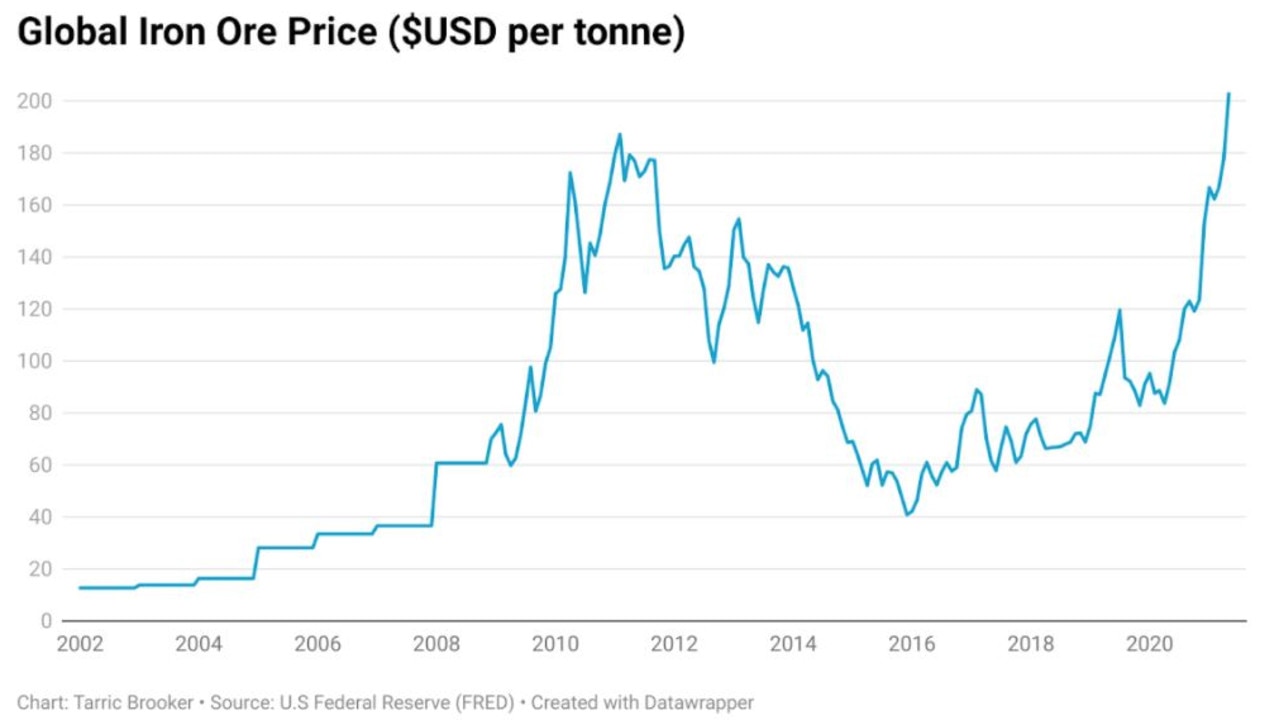

But in the months that followed, a construction-led Chinese government stimulus not only stabilised iron ore prices well above the $55 US dollars per ton assumed in the 2019-20 federal budget, but set prices on a course for new record highs.

By the time prices reached a peak of $226 US dollars per ton in May, iron ore had provided Australia’s headline economic growth figures and the federal budget with an enormous windfall.

RELATED: Early sign China is headed for failure

RELATED: China’s battle plan spooks market

In 2011 during the previous peak of iron ore prices at the height of the mining boom, the annual value of iron ore exports hit $58.4 billion.

To put the current windfall iron ore prices are providing to the economy into context, Australia has exported $64.1 billion worth of iron ore in the past five months alone.

With the period of peak prices recorded in May yet to be covered by the Australian Bureau of Statistics’ (ABS) figures, it’s likely that the current monthly record value of iron ore exports of $14 billion will be broken once more.

Despite closed international borders costing Australia’s economy $47 billion a year in spending from foreign tourists, rocketing iron ore prices are earning that shortfall and more, in just a few short months.

But as headline GDP figures roar back to life and Treasurer Josh Frydenberg revels in the nation’s AAA credit rating being secured, behind the scenes the long term prospects of the iron ore boom that helped make both of those events possible is looking increasingly shaky.

China-Australia trade war

Prior to the pandemic China was relatively content to continue to buy iron ore from Australia. However, since the pandemic began relations have worsened significantly.

Beijing stepped up its targeting of Australian exports through punitive trade actions, partially as a result of Prime Minister Scott Morrison pressing for an investigation into the origins of the coronavirus pandemic.

As relations went from bad to worse, Beijing’s desire to find a more reliable and compliant source for the key commodity and driver economic growth continues to grow.

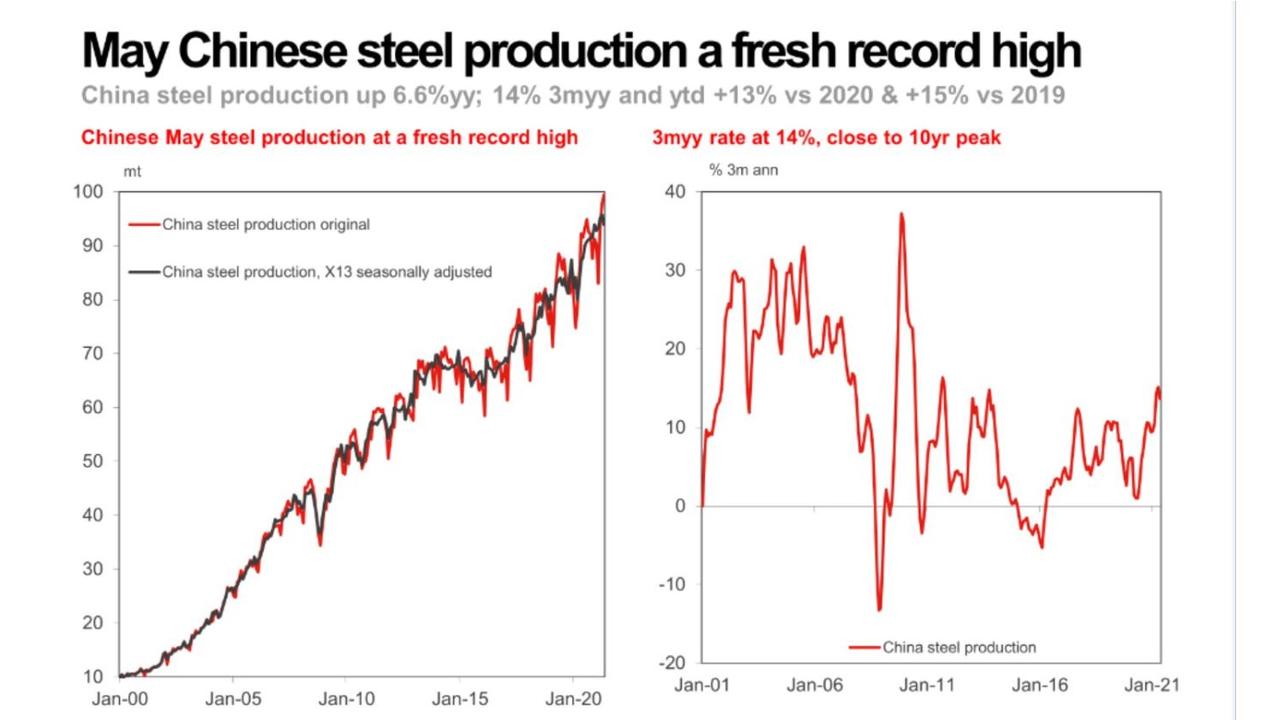

With steel production in China currently running at record highs and Beijing leaning heavily on construction as the foundation of its economic recovery, the last thing Beijing wants it to be paying absolute top dollar for iron ore.

RELATED: Extreme plan to punish China

As a result of high commodity prices, Beijing has already implemented a number of different policies to stamp out speculative trading in an attempt to bring prices down.

On Tuesday, China’s National Development and Reform Commission (NDRC) announced the state planner and market regulator jointly launched in an investigation into the iron ore spot market. The investigation is set to target hoarding and speculation within iron ore markets.

While these moves could potentially bring prices down significantly in the short term, it’s the long-term message they send that should be of far more concern for Australia and the federal budget.

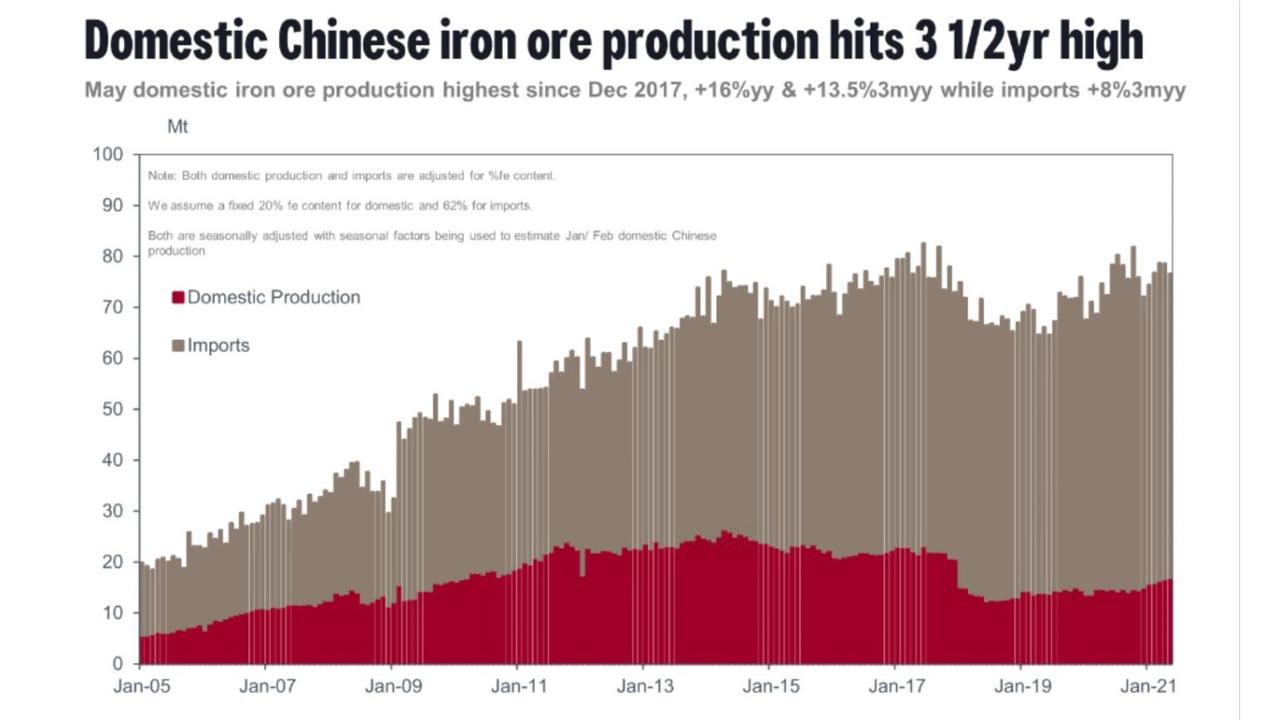

Beijing is looking to permanently diversify its sources of iron ore, both to limit its exposure to high market prices and to ensure that it has a continuous supply of raw materials, even if tensions with the United States and its allies escalate into crisis.

For years China has attempted to develop alternative sources of iron ore, from the mines of Brazil to numerous attempts at projects throughout much of Africa.

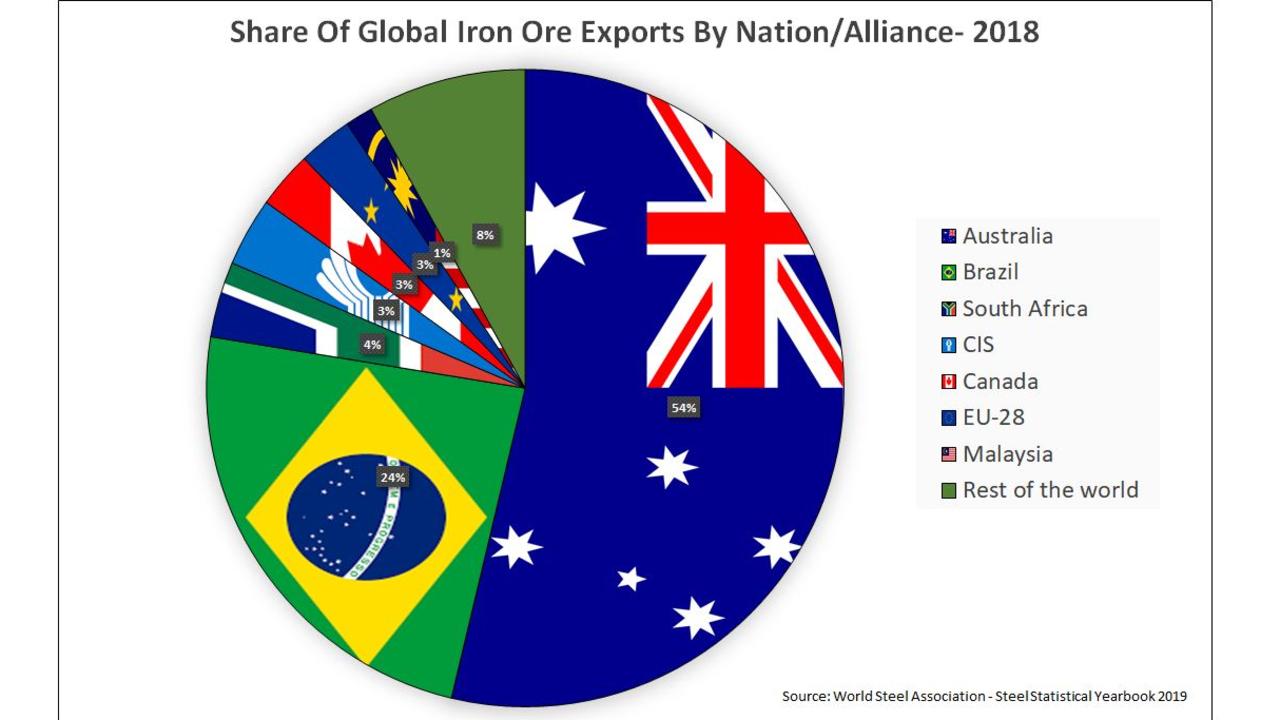

As Beijing’s seemingly insatiable thirst for construction driven economic growth continues, none of these other projects have materialised as a source of iron ore that could even begin to rival Australia’s relative monopoly over seaborne supplies to China.

But as the geopolitical battle lines are drawn and tensions continue to flare over Taiwan, Beijing now has a renewed sense of urgency to find an alternative to Aussie iron ore much sooner than they may have otherwise thought.

China has already reopened some of its own mothballed iron ore capacity and is ramping up production.

The push to develop the enormous Simandou iron ore deposit in the West African nation of Guinea is likely to be high on the list of projects, as Beijing attempts to secure future supplies and put downward pressure on prices.

How successful Beijing will be in securing alternatives to Australian iron ore is an open question. Historically they have struggled to construct an alternative supply chain, but things have changed a great deal since then.

With tensions rising and prices near all-time record highs, an alternative to Australian iron ore has gone from a, would be nice for Beijing, to something that is arguably approaching a necessity.

For now Australia will make hay while the sun shines, enjoying the bounty of the billions of dollars iron ore provides to the nation’s economy and the federal budget.

But in the long run, if Beijing does find another major source of iron ore, Australia may have a serious problem.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator