Australia’s economic rebound: GDP rises 3.3 per cent

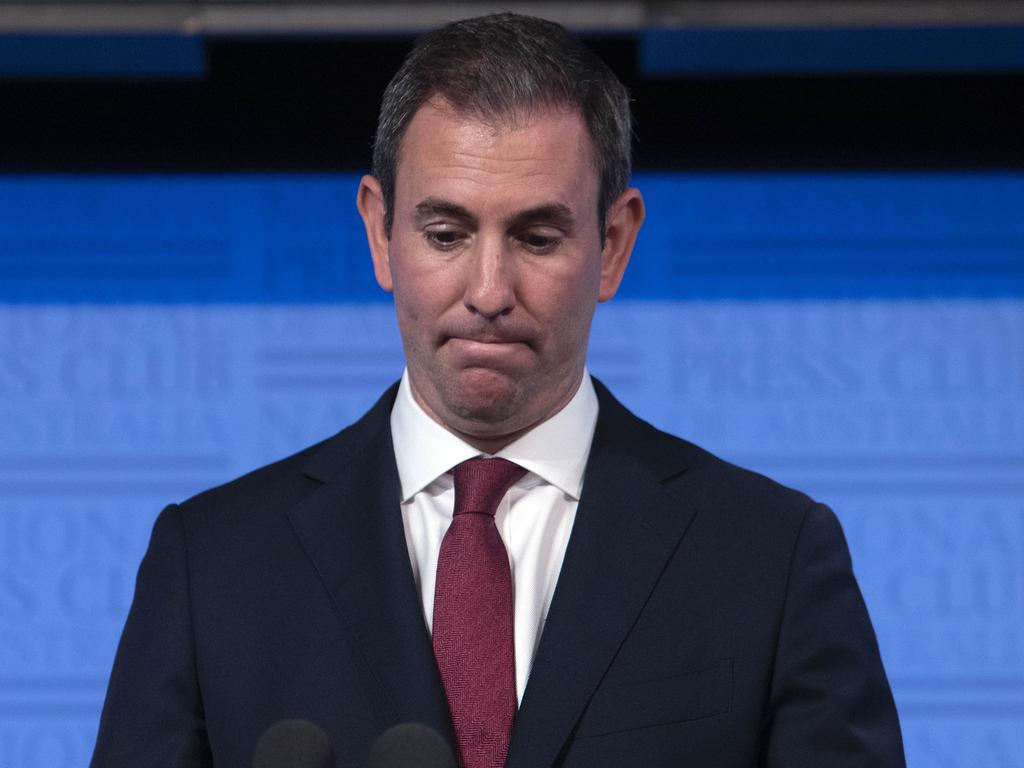

The Treasurer has hailed Australia’s economic rebound as ‘better than nearly any other country in the world’, with the recession now officially over.

The recession is officially over, with the Australian economy growing 3.3 per cent in the September quarter, according to new figures.

The economy went into recession in the June quarter after the worst contraction in gross domestic product since World War II.

But the Australian Bureau of Statistics on Wednesday confirmed an uptick in GDP, after shrinking 7 per cent in the previous quarter.

“Australia has performed better on the health and on the economic fronts than nearly any other country in the world,” Treasurer Josh Frydenberg said.

“Real GDP increased by 3.3 per cent beating market expectations. This is the largest quarterly increase since 1976.

“Technically, Australia’s recession may be over. But Australia’s economic recovery is not.

“There is a lot of ground to make up and many Australian households and many Australian businesses are doing it tough.”

The new figures show a household consumption spike of 7.9 per cent in the September quarter, the largest rise in the 60-year history of the national accounts.

The rise claws back a majority of the unprecedented 12.5 per cent drop in the June quarter, as services spending jumped 9.8 per cent.

“Household spending in the quarter was driven by partial recovery in spending on hotels, cafes and restaurants, recreation and culture, and transport,” the ABS said regarding the rise in 14 of the 17 categories.

The resumption of elective surgeries and increased visits to health providers saw spending on health categories jump 26 per cent.

Experts are heralding the figures as a win, given Melbourne was in lockdown for a large portion of the quarter.

Victoria was the only state to record a fall, 1 per cent, which was driven by declines in household spending and investment.

Spending on food rose 6.6 per cent as families prepared for the second coronavirus lockdown.

This partly offset a decline in spending on clothing, recreation and furnishing across the state.

Mr Frydenberg said national growth in the September quarter would have been 5 per cent, if Victoria had grown in line with the rest of the nation.

Nationally, household saving also decreased from 22.1 per cent to 18.9 per cent.

Dwelling investment was up by 0.6 per cent after eight consecutive quarterly falls, prompting Mr Frydenberg to say the outlook for the housing market was “positive”.

Imports rose 6.5 per cent in line with household consumption but exports decreased by 3.2 per cent in the quarter, and were 14.9 per cent lower through the year.

“Services exports including tourism and education continue to be particularly affected as international borders remain closed,” Mr Frydenberg said.

Business investment fell by 4.1 per cent with mining investment down by 5.2 per cent and non-mining investment down by 3.7 per cent.

GDP per capita fell by 4.7 per cent in the September quarter with spending decreasing 6.5 per cent over the year.

The technical definition of a recession is two consecutive quarters of negative growth, which occurred in the June quarter.

However, the easing of coronavirus restrictions in most states and territories contributed to the economic rebound in the September quarter.

New South Wales and Queensland saw the largest recoveries in demand, registering a 6.8 per cent uptick.

That was just ahead of South Australia (6.7 per cent) and the Northern Territory (6 per cent).

Tasmania (5.5 per cent) and the ACT (2 per cent) registered increases while Western Australia, which had less ground to make up, saw demand rise 4.9 per cent.

“Eighty per cent of the 1.3 million Australians who either lost their jobs or saw their working hours reduced to zero at the start of the pandemic are now back at work and Australia’s AAA credit rating has been reaffirmed,” Mr Frydenberg said.

“The rebound in employment together with social assistance benefits, which are 48.3 per cent higher through the year, have contributed to an increase in household disposal income of 3.4 per cent in the September quarter.”

The Morrison government has been criticised for cutting off support too early for some sectors of the economy.

Mr Frydenberg said it would look at targeted support where it was appropriate.

“But as for our macro supports, like JobKeeper, they are tapering down,” he said.

“The recovery today in terms of September quarter is even better than we expected at budget, better than what the market has expected.”

Opposition treasury spokesman Jim Chalmers said heralding the end of the recession would be cold comfort for many Australians still living with the effects of the largest downturn in almost 100 years.

“What really matters is not one quarterly GDP number on a page but how Australians are actually faring and whether they can provide for their loved ones,” he said.

“Hundreds of thousands of jobs have been lost since the virus outbreak began and more Australians are expected to join the unemployment queues by Christmas.

“The latest OECD Economic Outlook has warned the Morrison Government that premature cuts to vital support in the economy will hamper Australia’s recovery from the worst downturn in almost a century.”

Deloitte senior economist Harry Murphy-Cruise said even with the record rebound, Australia’s economy was still 4.2 per cent smaller than it was in the December quarter of 2019.

“Australia’s COVID numbers extremely low, state borders opening up and vaccines on the horizon, that leaves us really well-placed,” he said.

“The bad news is that the damage still remains deep, and that Australia still has a substantial repair task on its hands.”

BIS Oxford Economics chief economist Sarah Hunter said the December quarter was also likely to see robust growth as Victoria caught up with the rest of the country.

“The fiscal and monetary support for households and residential construction should drive further gains in consumer spending and dwelling investment, and this will provide a lift going into 2021,” Dr Hunter said.

“We expect GDP to return to pre-COVID levels towards the end of 2021.”

The Reserve Bank of Australia this week held the cash rate at 0.1 per cent.

Governor Philip Lowe told a House of Representatives economics committee on Wednesday he predicted unemployment would remain above 6 per cent over the next two years.

“These positive figures cannot hide the reality that the recovery will be uneven, bumpy and drawn-out,” Dr Lowe said.

“Some parts of the economy are doing quite well, but others are in considerable difficulty, even as the overall economy is growing relatively solidly.”