New ABS figures show household savings at lowest level in 15 years

The National Accounts figures cover the first three months of 2023, breaking down the spending habits of Australians.

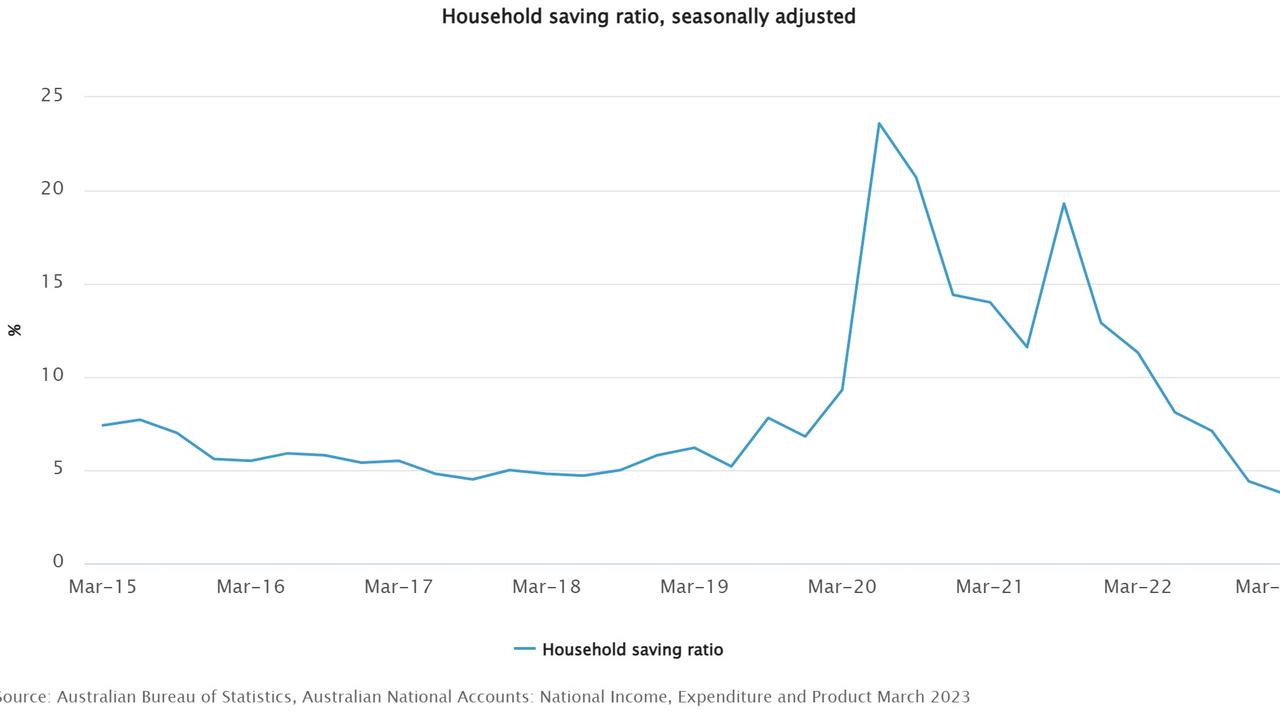

The latest round of economic figures released by the Australian Bureau of Statistics on Wednesday show household savings have fallen to a 15-year low.

The National Accounts data shows the household saving ratio plunged from 4.4 per cent in the December quarter, to 3.7 per cent in March — the lowest level since June 2008.

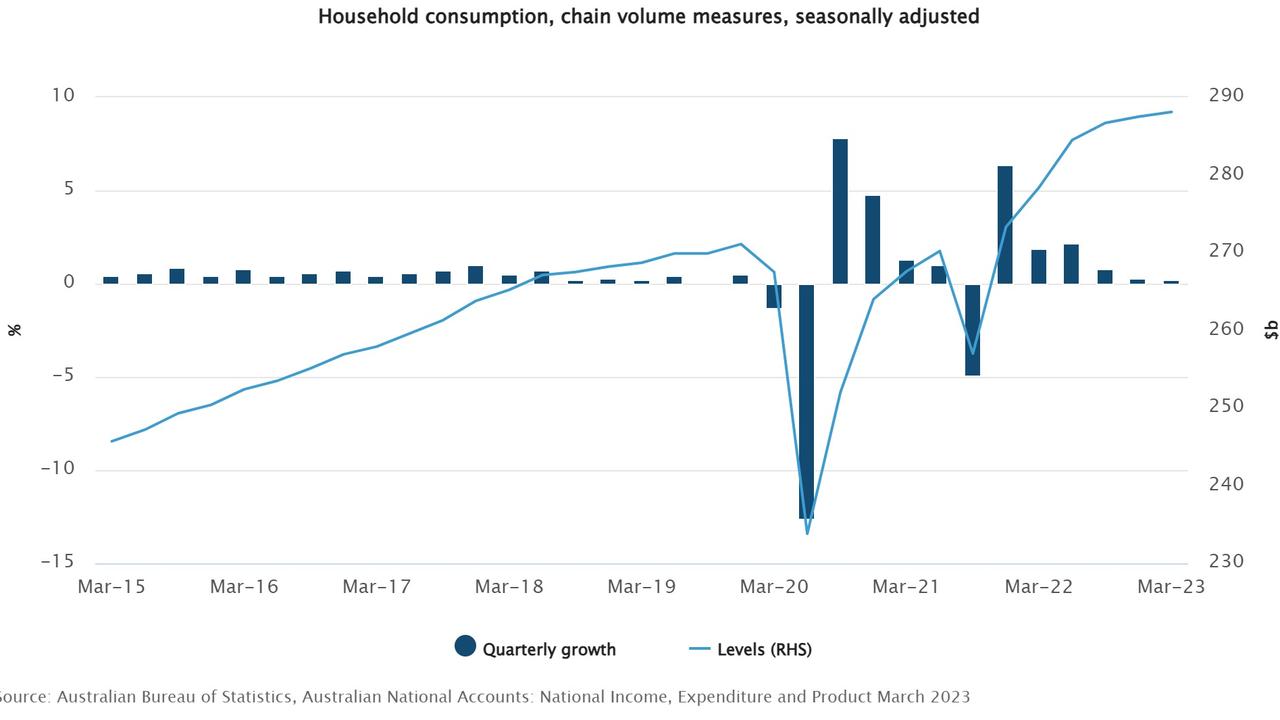

The fall has been attributed to a rise in household consumption, outweighed a softer rise in gross disposable income.

Wednesday’s figures also show, since December, household spending has grown just 0.2 per cent — essential spending was up 1.1 per cent, while discretionary spending was down 1.0 per cent.

Queensland’s Cost of Living Rebate ended, resulting in a 5.2 per cent boost to spending on electricity, gas, and other fuels, also spurred on by the move into the colder winter months.

Growth in rent and other living services, as well as insurance and other financial services, were stable at 0.5 per cent.

Food consumption was also up 0.4 per cent as food supply chains restabilise following pandemic disruptions.

Wages were up 2.4 per cent, contributing to a 10.8 per cent growth in wages and employment over the previous year.

The data confirms Australians are doing it tough in the wake of a slew of interest rate rises, and comes just a day after the RBA board decided on another 0.25 per cent hike, bringing the official cash rate to 4.1 per cent.

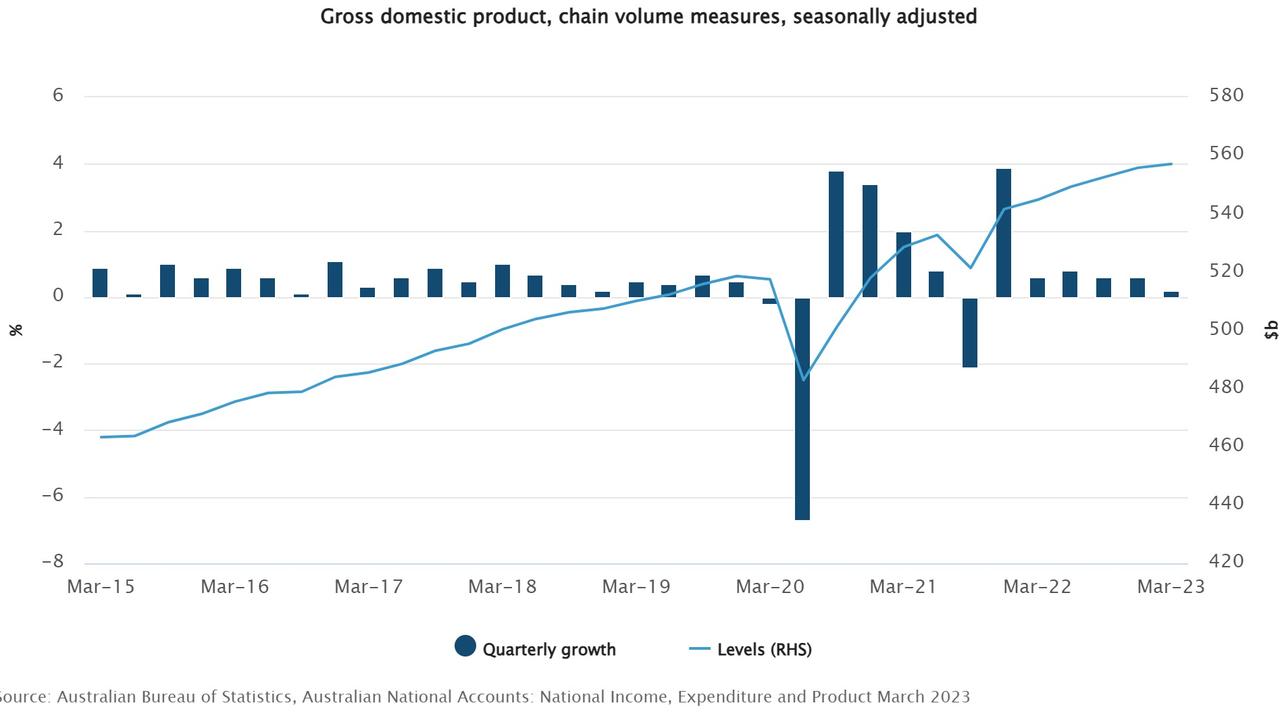

In terms of the broader economy, the figures show Australia’s economic performance is dwindling, with the economy growing by 0.2 per cent, down from 0.6 per cent in the last quarter.

That means the nation’s economy is growing at 2.3 per cent annually.

Gross domestic product (GDP) also grew just 2.1 per cent, again falling short of a predicted 2.4 per cent, further indicating the economy has slowed in the first three months of the year.

But Treasurer Jim Chalmers says the flat economic result is “unsurprising.”

“These are the sorts of numbers we anticipated in our budget forecasts,” Dr Chalmers said in a media conference shortly after the release of the statistics.

“Inflation is moderating from its peak. Not as fast as we'd like … but there is more data in these figures today that inflation is moderating from its peak at Christmas.

“We knew that this was going to be a difficult year, given the challenges coming at us from abroad.”

Asked about the RBA’s rate hike, Dr Chalmers said he wouldn’t second-guess their decision.

More Coverage

“I cherish and respect the independence of the Reserve Bank – not just in my words but in my deeds,” Dr Chalmers said.

“The reforms to the Reserve Bank that I want to put through the parliament are actually about making the Reserve Bank more independent, not less – because I think it’s an important feature of our system.”

The previous report, covering the December quarter, showed the nation’s economy grew 0.5 per cent — also well below economist’s predictions.