Are the four horsemen of the economic apocalypse here?

ONE simple graph that shows the level of investment by Aussie businesses makes it look like they’re throwing in the towel.

I’M A positive person — I feel optimistic about the future of the Australian economy, normally. But there is one graph I saw a few days ago that makes me want to go down into a bunker with cans of baked beans and await the apocalypse.

What would you do if you knew the end was nigh? You’d probably stop saving money and not worry about the impact of all that jogging on your knees. Maybe, actually, not even bother jogging.

You’d live for the moment. That’s what business seems to be doing right now.

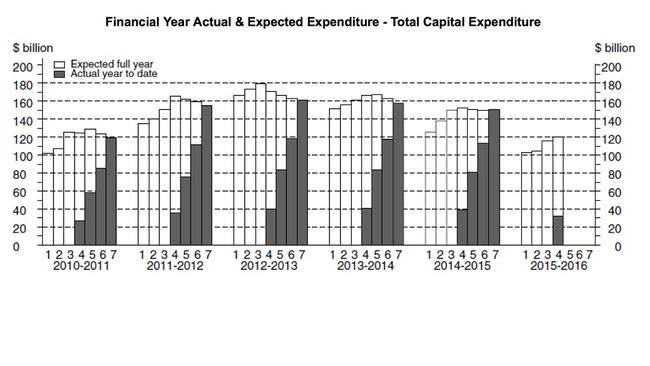

Here is the graph that put the frighteners on me — read on for an explanation.

It shows how much business expects to invest in things like trucks, machines, and buildings. Investment is what makes businesses grow, what makes the economy grow.

The white bars are planned investments and there are three white bars before each year, showing planned investment for that year. The black bars come along to show how much actual investment has been done. By the end of each year, the black and white bars are the same as plans match reality.

But the capital investment in the graph is weak. Aussie businesses are running like they’re not sure the sun will come up tomorrow. We’re up to the fourth estimate of investment for 2015-16, and it’s the lowest fourth estimate in the graph.

Three years ago we were looking at investing $170 billion in the year, but this year it seems we can only manage $120 billion.

If a business wants to grow, it has to invest. If business stop investing, our economy is likely to stall, causing yet more unemployment.

Now. There’s one good reason for some of the fall in investment — the end of the mining boom. Those big businesses were making massive capital expenditures on new mines, and now they’ve stopped. That explains a lot of the fall.

But mining is not the whole story. It seems like other industries have also given up.

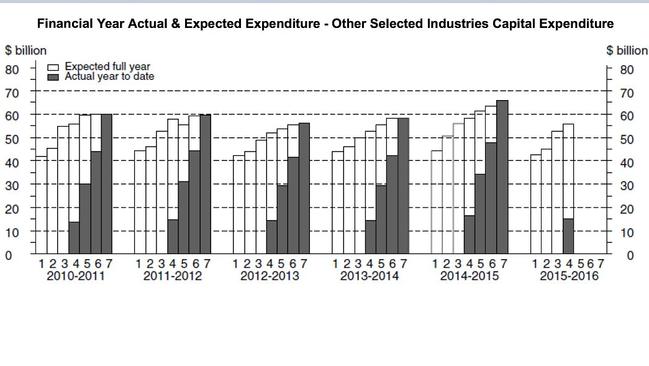

This next graph is for a bunch of industries that should be looking at a bright future with a growing population and a low Australian dollar — construction, wholesale trade, transport, and professional services.

The story is better than 2012-13, sure, but worse than last year, and no better than it was in 2010-11.

The boom in Australia’s mining industry is now just a faint ringing in our ears and we were supposed to get a triumphant crescendo in the rest of the economy. All those people leaving WA are crossing the Nullarbor in the hope of a job in some other industry, but business has basically given up on doing business.

We can see this in the annual reports of big companies. Woolworths capital expenditure in 2015 is actually slightly less than 2014. They talk a lot about “investing in low prices” but that’s actually just cutting prices and not the same as investing by actually building new stores, or similar.

The RBA has been cutting interest rates hard for exactly this problem. They have been trying to make borrowing money so cheap they can whip business into an investment frenzy. But it has been a disaster — like they held a party and nobody came. When this data came out the chance of an RBA rate cut went up. But expecting just one more interest rate cut will be just the trick to change things is a lot like wishful thinking.

One theory to explain this is the sharing economy — things like Uber and Airbnb — means we can now get more growth with less capital investment. This is a pretty hopeful idea — free growth! But the scale of those businesses is probably still too small to explain the problems we saw in the graphs above.

So the Aussie economy is facing a doomsday scenario, but there’s still a couple of reasons to think we might survive.

First, these statistics don’t cover everything. They exclude a couple of big industries, including health. Health has been the fastest growing bit of our economy in recent years, and it’s not even in the data. Maybe it’s growing?

The second big sector that’s not in the data is government. Malcolm Turnbull will already be planning for next year’s budget. If he decides the economy is more important than the Budget deficit, we might just be able to paper over the cracks until business gets its courage back.

But if the Government decides it’s also going to be stingy, then there’s only one place you can find me — I’ll be hiding in the bunker.