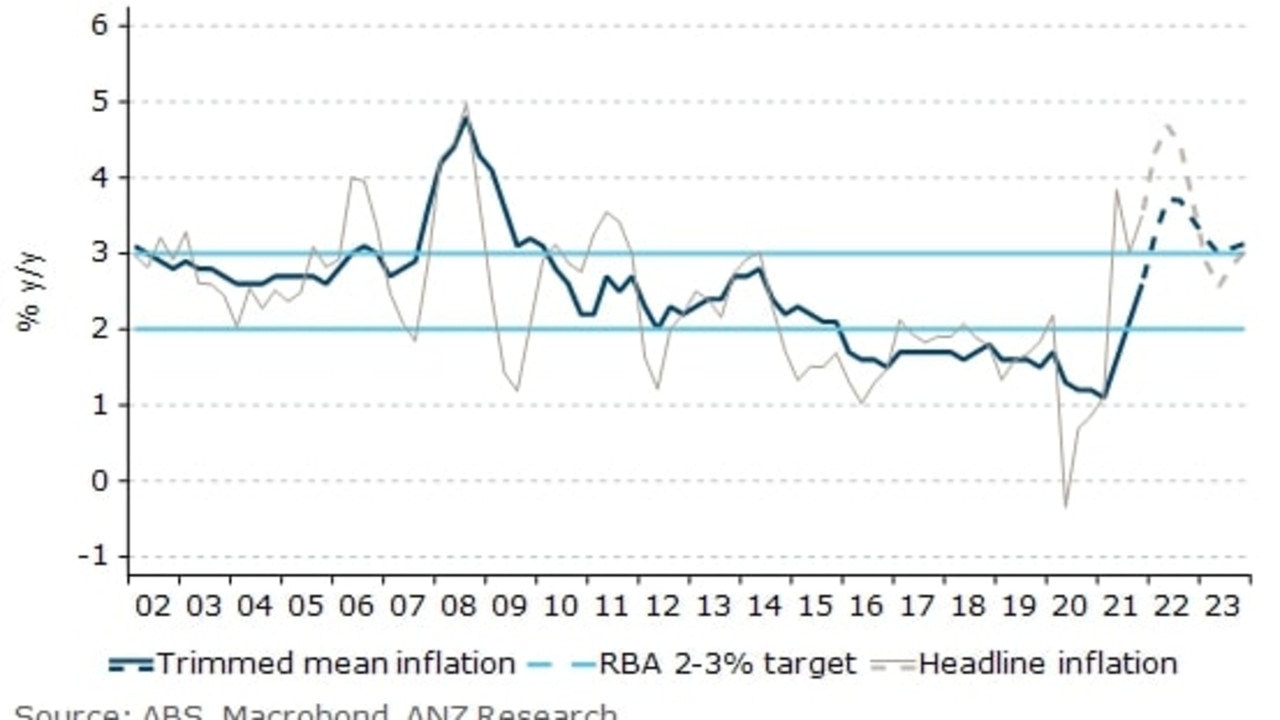

ANZ bank predicts inflation could soar as high as 5 per cent in the coming year

Australia’s inflation rate could soon soar to levels not seen since the global financial crisis, according to one of the country’s big banks.

Inflation could soar as high as 5 per cent over the coming year according to one of the nation’s biggest banks, in a grim cost of living prediction.

Australian families face a triple threat of rising inflation, low wage growth and interest rate hikes, according to ANZ.

The big bank has made the ominous prediction in a new research paper that is forecasting much higher inflation than previous Reserve Bank predictions.

Rising petrol prices, Covid-19 supply chain disruptions, the floods and the war in Ukraine are all factors feeding into the pressure.

“We see headline inflation approaching 5 per cent by mid-2022 as the impact of higher petrol and food prices flows through,’’ the report states.

“While this spike is not unexpected, as the RBA noted in recent commentary, it increases the peak and duration of higher inflation.”

Inflation last hit 5 per cent in Australia in September, 2008 during the global financial crisis.

Want a streaming service dedicated to news? Flash lets you stream 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

In recent years it has plunged to historic lows. But experts warn this time around the impact on household budgets will be tougher, because the peak of inflation during the GFC was accompanied by increasing wages.

“Well, inflation at 5 per cent this time will be very different to last time,’’ APAC economist Callum Pickering told news.com.au.

“And the main reason for that is because before the GFC was being driven, to a large extent, by rising wages, whereas this time wage growth is still very low.

“And it’s certainly not going to keep pace with inflation. So that’s going to be tougher than the GFC. What it basically means is that what households can purchase with wages and salaries is going to go backwards.”

Mr Pickering said it was “tough one” for the Reserve Bank because the inflation pressures are coming in from overseas.

“And rising interest rates, depending on how much the Reserve Bank does, could potentially have a big impact on sort of domestic production and job creation as well,’’ he said.

The good news is it increases the likelihood of tax cuts and one-off payments in the March federal budget.

“Federal governments always like to talk a big game around cost of living and doing things to address that. I certainly wouldn’t be surprised if there are some temporary measures that might be introduced, perhaps to alleviate some of that pressure,’’ Mr Pickering said.

“It could be payments and it could be tax offsets. There’s a range of different sort of tools that they could potentially use.”

The ANZ report notes that the RBA has previously spoken about the “psychology” of inflation – that continual supply shocks put further upward pressure on inflation.

If this shift happens then “higher inflation would be more persistent and broadbased”.

Reserve Bank governor Philip Lowe suggested on Friday that he is not feeling pressured to raise interest rates despite bank warnings.

“I don’t feel mounting pressure,” Dr Lowe said.

“We do what we think is the right thing at each of our meetings, so the pressure, it’s great for media stories, but I don’t feel that myself.”