Annual consumer price index inflation highest since 1990

Annual consumer price index inflation has reached its highest in more than three decades, according to the Australia Bureau of Statistics.

Annual consumer price index inflation has reached its highest in more than three decades, driven by goods, according to the latest data from the Australia Bureau of Statistics.

Goods accounted for more than three quarters of the 7.3 per cent rise in the CPI over the past year, reflecting high freight costs, supply constraints and prolonged elevated demand.

CPI rose 1.8 per cent in the September quarter, driven by new housing and gas prices.

“This quarter’s increase matches that of last quarter and is lower than the 2.1 per cent result in March quarter this year,” ABS program manager of prices Michelle Marquardt said.

“All three results exceed any other quarterly results since the introduction of the goods and services tax, and underlie the highest annual increase in the CPI since 1990.”

Major contributors to the rise in the September quarter were new dwellings (+3.7 per cent), gas (+10.9 per cent) and furniture (+6.6 per cent).

“Labour shortages in the house construction industry, leading to rises in labour costs, contributed to the rise in new dwellings this quarter,” Ms Marquardt said.

“The continuation of material shortages added further price pressure.”

But she noted the rate of price growth in new dwellings eased relative to recent quarters (+5.6 per cent and +5.7 per cent in June and March quarters).

She said that reflected a “softening” in new demand and easing supply constraints.

Meanwhile, annual gas price reviews led to higher wholesale prices passed on to consumers.

Electricity rose 3.2 per cent, offset by the WA government’s $400 electricity credit and smaller credits from the Queensland and ACT governments.

“Excluding the effect of these schemes, electricity would have risen 15.6 per cent in the quarter,” Ms Marquardt said.

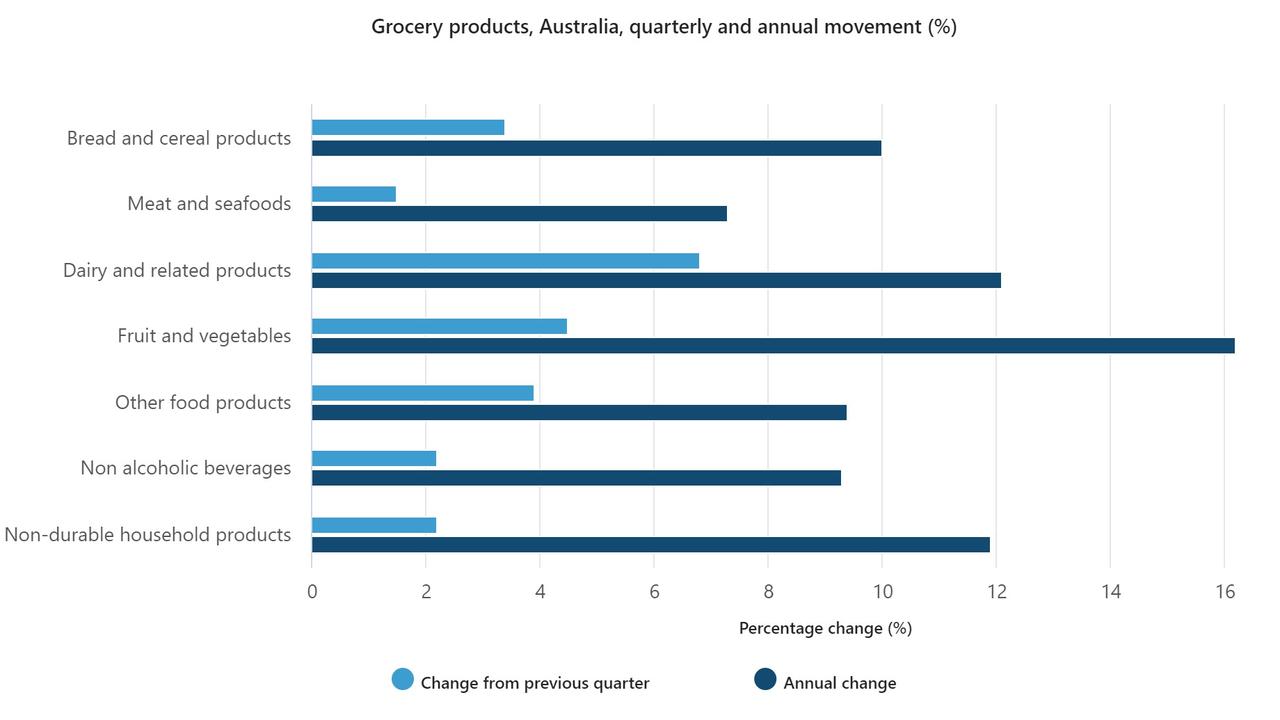

Food (+3.2 per cent) prices continued to climb via meals out and takeaway food (+2.9 per cent) due to higher ingredient, wage and transport costs.

Fruit (+6.6 per cent) and vegetables (+2.9 per cent) were also up, linked to high input costs and weather damage.

Mind your eyes: latest inflation print in Australia is red hot.#inflation#CPIpic.twitter.com/0lCqY16uIi

— Jack Howe, CFA (@JackHoweCFA) October 26, 2022

Automotive fuel (-4.3 per cent) fell in all three months of the quarter, reflecting falling crude oil prices.

For the second consecutive quarter, annual price inflation for new dwellings was the strongest recorded since 1999 due to high material and labour costs, as well as high demand.

“Fewer grant payments from the federal government’s HomeBuilder and similar state-based housing construction programs compared to the same time last year also contributed to the annual increase,” Ms Marquardt said.

“Excluding the impact of the reduction in grant payments made, new dwellings would have recorded an annual rise of 17.7 per cent.”

BIS Oxford Economics head of macroeconomic forecasting Sean Langcake said the data was broadly in line with the Reserve Bank of Australia’s expectations, meaning it would have a relatively limited impact on their outlook.

“Inflation remains uncomfortably high for the RBA, but they have already tightened conditions materially, which will temper demand-driven inflation in 2023,” he said.

“We continue to expect a further 50 basis points of tightening before the RBA pauses to gauge how the economy is tracking.

“Last night’s budget was quite restrained on the expenditure side, and should not add to the inflationary pressures the economy is facing.

“Indeed, increased child care and pharmaceutical subsidies will provide some downside for measured inflation in 2023.

Commonwealth Bank of Australia head of Australian economics Gareth Aird said he expected the RBA to increase interest rates again at its next meeting.

“There are no two ways about it – inflation is red hot in Australia right now, as it is in many parts of the world, and we expect the RBA will respond by raising the cash rate again at the November board meeting next week,” he said.

“Indeed, our call has been that the RBA will deliver one or two more 25bp rate hikes and then pause for an extended period.

“We see the peak in the cash rate being 3.10 per cent. Our expectation now is that the RBA raises the cash rate by 25bp at both the November and December board meetings.”

Mr Aird noted the RBA’s hikes between the May and October board meetings did not impact the June or September quarter inflation outcomes.

“Indeed, the rapid recent rate hikes and our expectation of some further modest tightening is unlikely to shift the inflation needle over the December quarter — inflation is a lagging indicator,” he said.

“The impact of policy tightening will impact consumer inflation in 2023.”