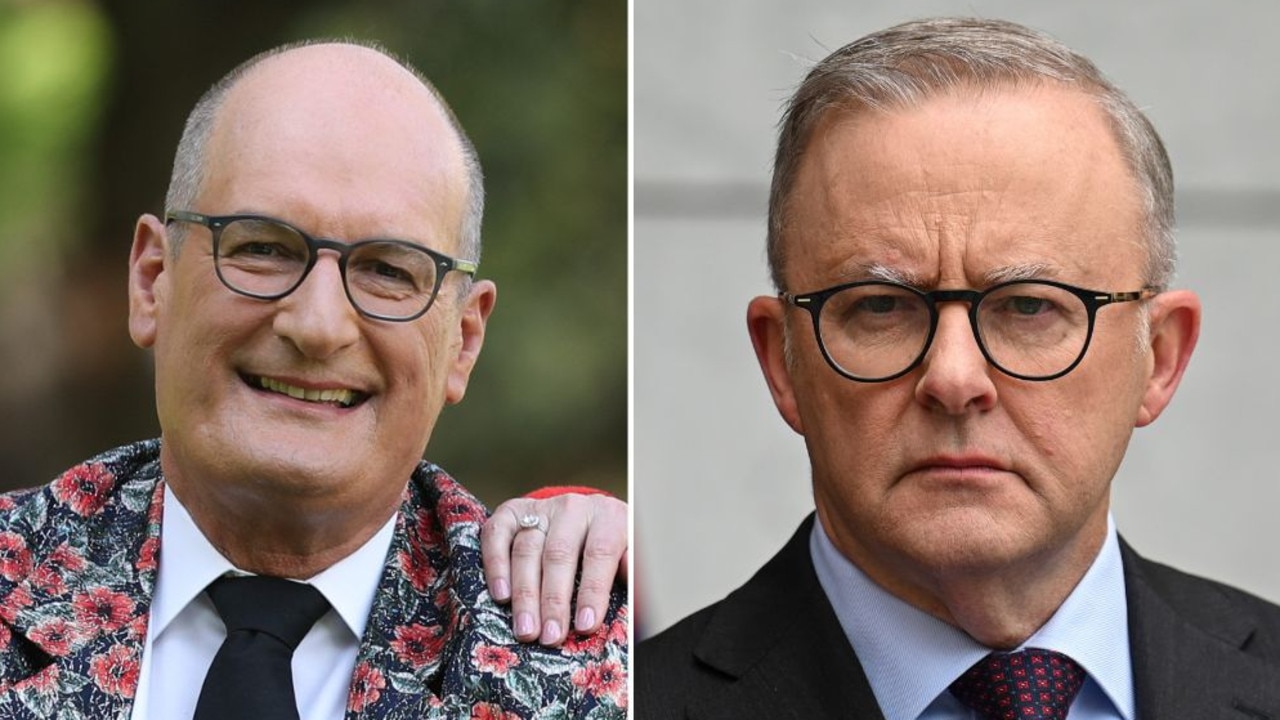

Kochie looks at what reporting season means for investors

IT can be a roller coaster ride and need a significant investment, but cracking the China market can be massive for Australian investors. Kochie explains why.

WITH the latest profit reporting season just concluded for Australia’s listed companies it’s a good time to examine the health of corporate Australia, identify any trends and learn some new lessons on equity investing.

It’s also a good time to assess the status of stocks in your current investment portfolio to determine whether you want to stay in them or get out. Remembering the end of the financial year is fast approaching and that window of whether to rebalance for a better tax outcome opens.

The strong message from this profit reporting season is that corporate Australia is in good, but not spectacular, health.

Importantly, based on the profits reported, the Australian sharemarket is not overvalued on a price-to-earnings basis. In fact the PE ratio of the overall market is right on its historic long term average.

From the results a lot of new, and existing, investment themes can help us make future investment decisions.

CHOICES: Should you invest in property or shares?

. Investors will cane any company which disappoints.

With the rule of continuous disclosure of information to the market, investors have never been better informed about the state of their share investments between official profit reporting seasons. Companies must immediately inform the market if there is any significant change to their business fortunes.

As a result, share analysts can be pretty comfortable in making their assessments about stocks they follow.

So if a stock doesn’t deliver on expectations their share price is absolutely smashed by disappointed investors ... and they will likely get a “please explain” from the Australian Stock Exchange and maybe ASIC as well.

Dominos was just one of a number of companies which felt the backlash of a disappointing result. It’s a harsh lesson that investors expect transparency.

. Understand investment cycles and the ripple effect of economic trends

It was only a couple of years ago that share prices of our major resource companies were being pounded by the end of the mining investment boom. In this latest reporting season they were the market darlings.

Led by Rio and BHP, bigger than expected profits and dividend payouts led to a significant share price boost.

Why? Well the end of the investment boom naturally led into a production boom which coincided with an improvement in the global economy and rise in commodity prices. They became money-making machines.

They are a good example of using current economic figures as a lead indicator of future sharemarket performance.

We’ve known the US and European economies have been improving for a while now, and China has been solid, so it’s only to be expected commodity prices would rise and resource stocks would benefit.

Same thing with the housing and construction sectors. Record home building and massive infrastructure projects have fed into the companies involved in those sectors which are, in turn, delivering healthy profits. Bluescope Steel and Coates Hire (part of Seven Group) have been classic examples of that.

. Well run “disrupters” are impacting traditional business models and winning.

This reporting season has also been reflecting how tough it is for companies with outdated business models and which aren’t prepared to innovate.

Nowhere is this starker than the retail sector. The department store model by itself is broken while specialty and online retail is thriving. Just look at the difference in fortunes of department store chain Myer and online retailer Kogan.

Myer is suffering from expensive store leases and dwindling profit margins from constantly being “on-sale” while Kogan is thriving from better prices, lower costs and great customer service.

Making sure your stocks continue to innovate and pivot seems to now be a key ingredient of success.

. Cracking China

It can be a roller coaster ride and need a significant investment, but cracking the China market can be massive. And now the breadth of companies with China exposure has increased enormously beyond just resource stocks.

The new frontier for Australian companies is catering for the growing demands of the burgeoning wealthy Chinese middle class consumer.

RELATED: Kochie on when bad investment advice can backfire

A2 Milk and Bellamy’s are two, of many, cases in point. Both reaping the benefits of a major export boost to China with significant profit rises. But it hasn’t been all smooth sailing.

A year or so ago the Chinese government proposed changes to the licensing of many consumer imports and both stock prices dropped sharply. Eventually those changes weren’t as harsh as first mooted and the share price, and profits, have rebounded nicely.

BUFFETT’S GOLDEN SHARE RULES

Last week the world’s most famous investor, Warren Buffett, held his annual investor meeting. It’s always worth remembering his 5 simple questions to answer before investing in a particular stock.

. Do I understand the business?

Warren Buffet only invests in companies where it’s clear exactly what they do.

. Is it run by people I admire and trust?

Often it’s the quality of that board and that executive team which underpins success or failure.

. Does it have a sustainable competitive advantage?

In today’s business and investment environment, it’s that edge over competitors which translates in to success.

. Is it the right price?

He’ll identify a good stock and then patiently wait until its price realigns to a sensible level.

. If yes to all the above then do the deal.

In the end it’s all about sticking to quality and spreading your investments over a range of companies on the right track.

give away. He reckons Gates will do a better job of using it wisely than him.