Cities where property price falls will hit hardest in 2019

Australia begins 2019 with a property market in absolute disarray — and things are about to get much worse.

Australia begins 2019 with a national property market in disarray.

Thousands of homes that should and normally would have sold during 2018 are instead still in the hands of their owners. All those passed-in auctions are having an effect.

People planning to sell might be getting nervous.

Data from SQM Property Research shows the number of homes on the market in Australia is 328,000. This time in 2018 it was 304,000.

Extra homes on the market should make life easier for buyers. Real estate agents will be eager to see you. Vendors might be willing to bargain. If not, they risk still owning that home this time next year, and the possibility prices will be lower still when that time comes around. This phenomenon is now being called FONGO — Fear Of Not Getting Out. It refers to the worry of hanging on too long when the market is falling.

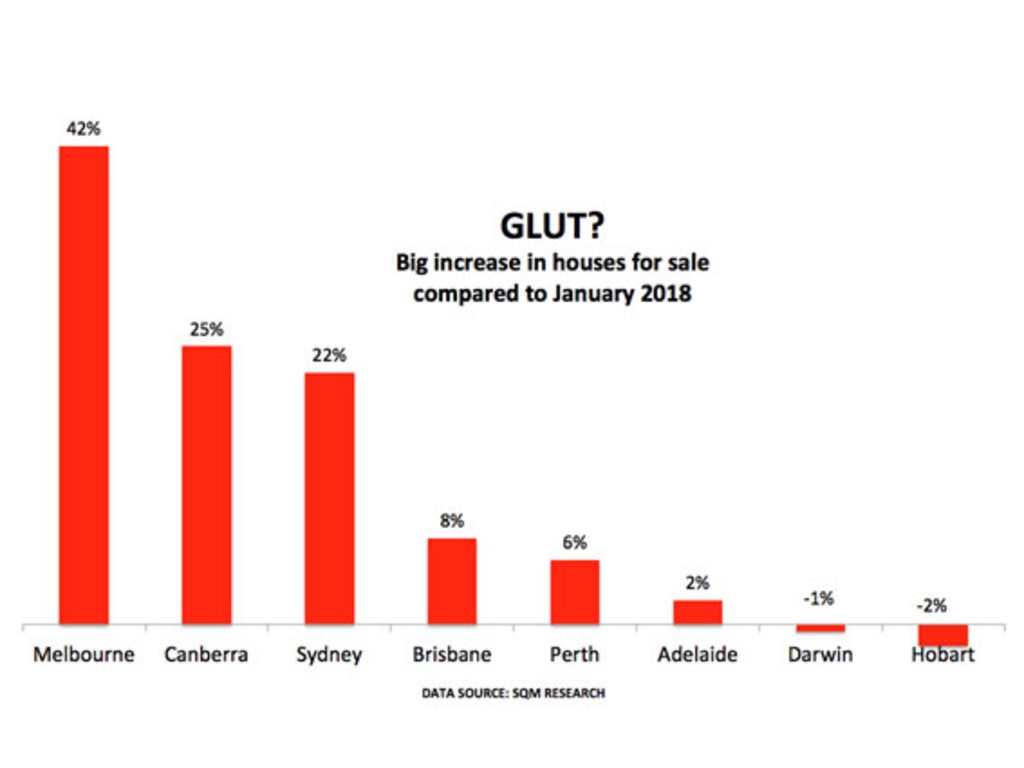

When we look at the data broken down by city, we can see that Hobart actually has fewer homes for sale in 2019 than it did in 2018. The same is true in Darwin. That could be a sign prices in those markets might rise

At the other end of the spectrum, we have Melbourne. Whereas 25,000 homes were on sale in Melbourne in January 2018, 36,000 homes were for sale in January 2019.

That’s a huge 42 per cent increase, as the chart below shows.

Australia’s property prices have fallen — especially in Sydney and Melbourne. What the data on listings build-up show is those discounts have not been enough to clear the stock off the shelves.

More homes are for sale in Melbourne right now than in any other city in Australia. That wasn’t the case in 2018, when Sydney led.

This year, despite its larger size, Sydney has less stock — just 32,000 homes for sale. Melbourne’s property downturn started later than Sydney’s did.

This time last year Sydney was falling and Melbourne was rising. Sydney’s prices have fallen further. That might explain some of the difference between the two cities.

In Brisbane 31,000 homes are for sale, only eight per cent elevated from the year before. Perth — where prices have been falling for years now — has 26,000 homes for sale. Adelaide, where prices have been fairly steady, looks safe for now. It has just 16,000 homes up for grabs — a rise of only two per cent on last year.

Related story: Aussies need at least $160k salary to buy a home in most Sydney and Melbourne suburbs

If the laws of supply and demand are working then Melbourne could be at the epicentre of price falls in 2019.

It makes sense that Melbourne’s property prices would fall further than Sydney’s. The supply and demand dynamics for Sydney are what pushed its prices so high in the first place. It was always less clear why Melbourne followed so closely behind.

Melbourne has far more room to grow into, with suburban greenfield development. Sydney is a wealthier city with higher average pay. It is also arguably more attractive for foreign investors.

Related story: A rate cut is just months away, one expert believes

THE RESERVE BANK

The Reserve Bank of Australia sets policy for the whole country — not just the cities where property prices are falling.

Homeowners who might have hoped the RBA would step in and help prop up the property market got the cold-shoulder on Tuesday.

The board had its regular meeting and did absolutely nothing to stimulate the real estate market and left interest rates right where they have been throughout all the falls seen so far.

And it did not hint that it would cut them soon.

If anything, the RBA played it cool on the severity of what is happening.

“The housing markets in Sydney and Melbourne are going through a period of adjustment, after an earlier large run-up in prices,” RBA Governor Philip Lowe said.

Jason Murphy is an economist and writer. Continue the conversation | @jasemurphy

Originally published as Cities where property price falls will hit hardest in 2019