‘Buyers are back in the driver’s seat’ because of house price drop

It’s terrifying for homeowners or a glimmer of hope for those dreaming of their own place, but there’s one simple reason behind the house price slump.

For some it’s an ominous sign of the economy slowing down and their most precious asset losing its value, for others it’s a welcome sign that, one day in the not-so-distant future, they will be able to afford their own home.

Which ever way you look at it, the data is clear — house prices in Australia dropping.

According to CoreLogic data released on Friday, house prices fell by 4.8 per cent nationally in 2018 and are expected to continue declining this year.

Now, a property market commentator from the same data provider, Tim Lawless, has a cast a light on what he believes is the crucial, and simple, reason behind the stunning figures.

On 7.30 overnight, he pointed to CoreLogic research which shows there are 115,000 homes currently listed across the country, which is 15 per cent higher than this time last year.

“Properties are being added to the marketplace at a time when conditions are weak,” Mr Lawless he told 7.30.

By “weak conditions”, he means there has been there has been a major increase in how long it is taking to sell properties because of tighter credit rules and pessimism about the future from buyers, meaning sellers are being forced to offer discounts — in turn, bringing house prices down at a national level.

Corelogic data shows the market is slowing down even more in major cities, Sydney and Melbourne.

Over 83 per cent of homes in Sydney and 80 per cent in Melbourne have been on the market for more than 60 days, and it means buyers now have more of a say in the final price.

“Buyers are absolutely back in the driver’s seat,” Mr Lawless told 7.30. “They have plenty of stock to choose from and they can negotiate quite hard on the purchase price.”

His comments come as a new poll of more than 1000 people, taken by Newgate and commissioned by the Property Council of Australia, shows that investors are more likely to ditch their plans to invest in new homes if Labor introduces its crackdown on negative gearing and capital gains tax breaks.

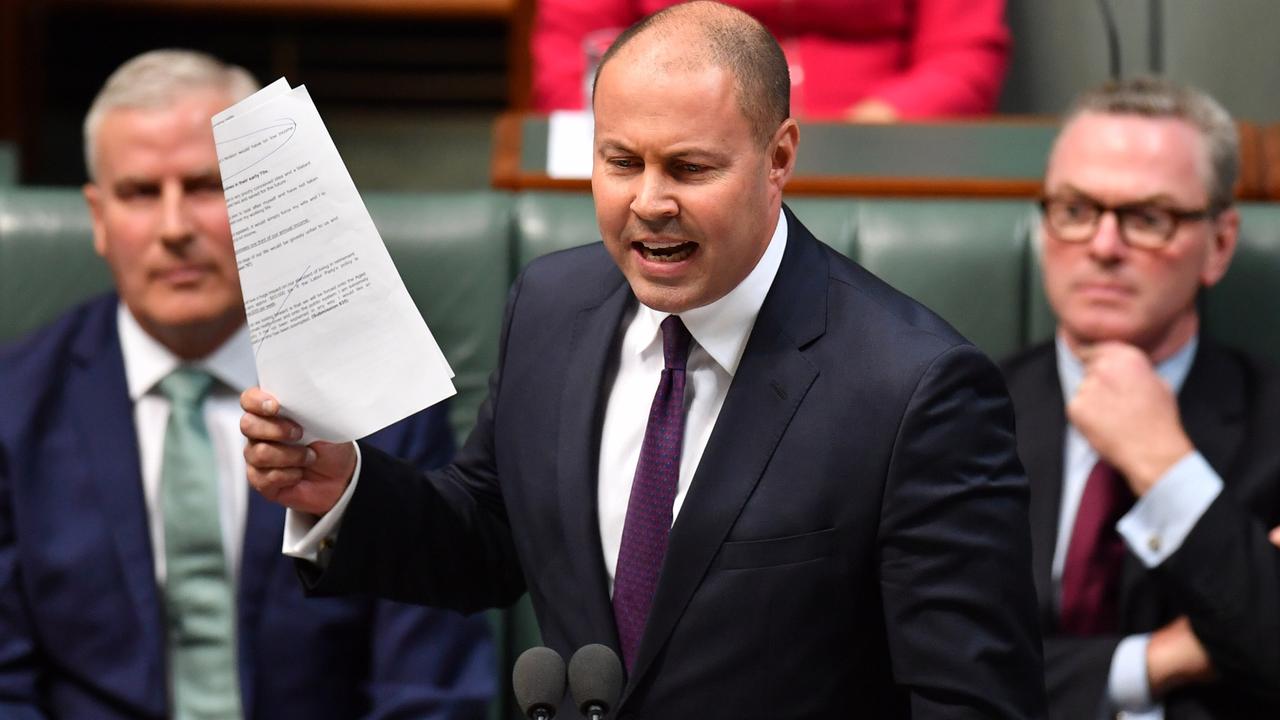

Treasurer Josh Frydenberg told the Today show this morning that the research serves as a “chilling warning” for Australians — no matter which stage of the buying process they are at.

“It will ultimately increase rents for millions of Australians, and decrease construction in the housing sector, costing jobs and lowering economic growth,” he said.

“The Labor Party’s policy is to drive the value of your home down and to increase your rent, and this is coming at exactly the worst time for the housing market when we have already seen a correction in the major markets of Melbourne and Sydney and other parts of the country.”

However, shadow treasurer Chris Bowen told The Australian Financial Review that the Property Council of Australia data, in fact, shows investors will continue to invest despite Labor’s policy changes.

And, he said the biggest winner, under Labor, would be first home buyers — who, he claims, were left out of the research.

“What’s notable is that the report is all about investors and not one mention of first home buyers who will be the big beneficiaries under our plans,” he told the AFR. “Surveying on the attitudes towards Labor’s housing affordability policies without including the views of first home buyers raises serious questions.”

It comes as billionaire apartment mogul Harry Triguboff warned the housing market will continue to slide and Australia will be engulfed with foreign investments unless local banks don’t loosen the straps on lending restrictions.

“We are all talking about the Reserve Bank lowering interest rates, but that is only a minor matter,” Mr Triguboff told The Australian.

“The banks must lend, they do not because they are afraid.”

However, Reserve Bank governor Philip Lowe attempted to play down concerns over declining house prices in Sydney and Melbourne, saying they should not come as a surprise and aren’t all bad news.

The central bank boss also stressed the cooling prices are not expected to derail Australia’s economy.

“It will put our housing markets on more sustainable footings and allow more people to purchase their own home,” he told a parliamentary committee hearing in Sydney on Friday.

“So there is a positive side too.”

Dr Lowe said the RBA will keep a close watch on the impact declining prices may have on household spending and construction activity.

But things must be kept in perspective, with the price drops occurring alongside positive conditions such as low unemployment, low interest rates and strong population growth.

“What we are witnessing is largely the working through of shifts in supply and demand for housing due to structural factors,” he said.

“In both markets, it took a long time for supply to respond to faster population growth, so prices went up. And now that supply has responded, some of the earlier increase in prices has been reversed.

“It shouldn’t be a surprise.”

Treasury secretary Philip Gaetjens told a Senate estimates hearing on Wednesday that as long as prices don’t drop steeply, his department isn’t stressed. “I don’t think from a policy point of view, there’s much concern.”