Accommodation owners slam Victorian Airbnb tax

‘Fed up’ Victorians are furious about the government’s new 7.5 per cent tax on short stay accommodation as confusion reigns over the details.

Short term rental owners have hit out at the Victorian government’s new 7.5 per cent tax on short stay accommodation announced yesterday as part of the Andrews government’s Housing Statement.

Among the criticisms are a lack of detail over how the tax will work, a lack of consideration over how it interacts with other taxes, a lack of understanding of the short term rental industry and questions over whether it will make any impact on the provision of more affordable long term housing in the state.

The tax, which will start on January 1, 2025 is forecast to raise $70 million a year, although sources close to the government told news.com.au that the actual amount could be lower, with government estimates putting the range at between $50-75 million a year.

Carmel Horsfield, a small-business owner from the regional Victorian town of Woodend told news.com.au the Victorian Premier was being “greedy” by introducing the new tax.

Ms Horsfield said she decided to rent her one-bedroom bungalow when her daughter moved to Melbourne for university, and uses the money to help cover her daughter’s city living expenses.

The property rents for around $100-$120 per night, after platform fees.

But she said that it isn’t suitable as a long-term rental as it only has a kitchenette, “therefore will have no effect on housing shortage if I choose to discontinue”.

“I have really been hammered the last few years by, it seems, ever increasing expenses … insurance, interest, power, rates, in fact everything is going up … the bnb was supposed to help with this.”

“I pay GST and income tax on all my Airbnb earnings so can hardly believe they want another bite at it,” Ms Horsfield said.

“Greedy Dan should consider that the reason many people are offering bnb services is to try and earn a living as cost of living rockets.”

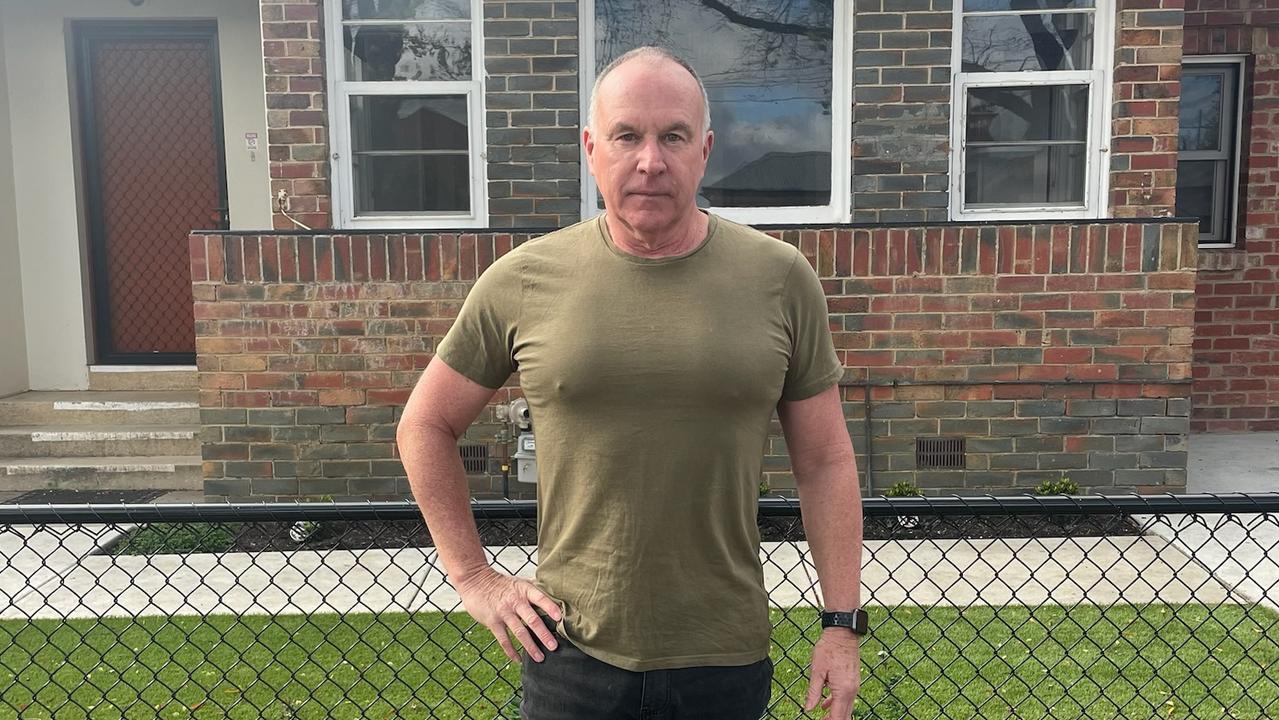

Chris Tuohey owns two properties in regional Bendigo that he has rented as short term accommodation for more than 12 years.

Mr Tuohey told news.com.au he doesn’t think the proposed Airbnb tax will work.

“There are so many rental platforms,” Mr Tuohey said. “How are they going to police it?”

He rents his properties under the 2EasyApartments brand, which has its own website that people can use to book directly, as well as listing them on Airbnb, Stayz and Booking.com.

Mr Tuohey said 36 per cent of his business comes directly from repeat customers, some of whom travel weekly or fortnightly to the area for work.

As the government’s proposal is to collect the tax from booking platforms, not individual owners, the tax would not be collected on these direct bookings.

Mr Tuohey added that another 39 per cent of his bookings come via global giant Booking.com, which has 2.7 million property listings worldwide.

But Booking.com does not actually take payment when a customer books through it, rather it passes on the booking request and customer’s credit card details onto the property owner or manager to process payment.

He said that the plan to collect the tax from booking platforms shows the government doesn’t understand the mechanics of the short term rental sector.

“It needs to be talked through with people in this business,” he added.

Beyond issues with the detail of the proposal, Mr Tuohey also questioned how the tax will help solve the problem of a lack of long term, affordable rental properties.

“Our houses are (like most short-term properties) very well equipped and well appointed. They are not suited to long term tenants other than professionals who can afford such properties.”

He said that if he was forced to stop offering the properties as short term rentals he would sell them, rather than rent them long term, due to the low yields.

“That house won’t go to a struggling couple,” he said.

Mr Tuohey, who employs a cleaner to service his properties, said the new tax could also amount to job losses.

He also questioned whether the government had considered the proposal in the context of other taxes.

“We pay approximately $20,000 per year in GST,” he said. “There will be many operators who will offer discounts for cash. This will see a reduction in income tax, GST and the new 7.5 per cent tax.”

Anne also rents out a property in the seaside town of Ocean Grove as a short term let.

She told news.com.au that if the restrictions become too onerous, she will “completely pull the property from all availability and just only use it ourselves”.

“It will not go into the long term rent market due to the fact of the amount of rights the renters have and less the landlords have,” Anne said.

She cited the example of not being able to evict tenants during Covid, even if an owner needed to use a property themselves or sell it.

“We were in a position where we needed the property and had tenants that both were in full time jobs with no changes to their income and we weren’t allowed to give them notice.”

“The Victorian government is making Victoria the most taxed state and the people are getting fed up.”

“I am just a mum trying to secure assets and income for my family’s future so I do not have to rely on government support later in life – god knows our country can’t afford everyone claiming the pension. But sure, let the government keep taxing the little people and small business.”