Telstra’s dire problems affect us all

EVEN if you’re not a customer, you need Telstra to be doing well. And they’re not. This is how their problems affect us all.

AUSTRALIANS are aghast at Telstra’s embarrassing series of recent disasters.

Whether you rely on it for your phone service, a job or your retirement savings, we all have a stake in Telstra. If you feel a bit nervous about its future, there is good reason.

Once of the pillars of our economy — and even more than that, a pillar of our whole national identity — Telstra now stands on a precipice.

The company’s stock price has fallen sharply in the last two years as the reality of 21st century communications catches up with it. The stock price tumbled from over $5 at the start of 2017 to under $3 in late 2018.

Telstra stock has recovered slightly to $3.13 at time of writing, but that price is not impressive. It means anybody who bought Telstra shares when they first floated back in 1997 at $3.30 has seen their share price fall, and is forced to be satisfied with the dividends the company pays.

MORE: Telstra says sorry ahead of AGM pay vote

MORE: Telstra unveils new product suite

Telstra’s share price probably matters more than any other stock in the Australian market. So many people own a slice of it. When the phone company was privatised back in the John Howard era, mum and dad investors bought up massively. Telstra has 1.3 million shareholders, and over a million of them are just regular people owning holdings worth under $15,000.

It’s not just people who own shares directly who have a stake in the share price. Almost all Aussies with superannuation will have super invested in Telstra too. Point is, the fate of this company and the finances of millions of Australians are intertwined. Telstra matters. A lot.

A VERY BAD WEEK INDEED

Which is why the last little while has been such a particular concern.

First came the report from the Telecommunications Ombudsman. They count up all the complaints they get and Telstra came out number one again. Of course, you expect that because Telstra is the biggest company in the industry. But at least you’d like to see signs of improvement.

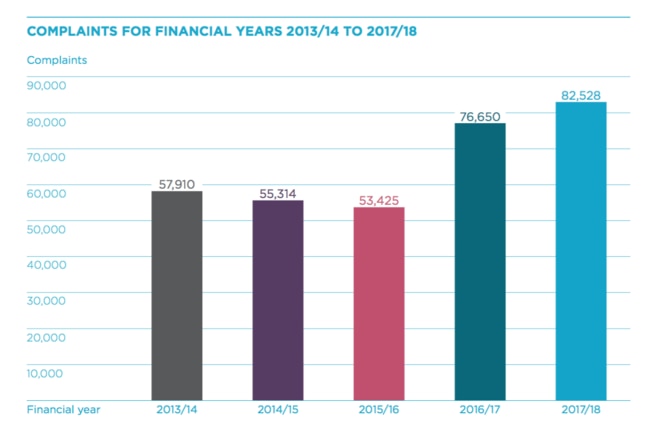

Instead Telstra had a 7.7 per cent rise in complaints, as this next graph shows. Not long ago, complaint levels were much lower and also falling. Something has changed.

Even Dodo and TPG managed to see the number of complaints fall in 2017-18.

Telstra was not as bad as Optus, which had a stunning 35 per cent rise in complaints, but it clearly needs to improve service.

ANNUAL GENERAL EXPLOSION

On Tuesday, Telstra executives and the board gathered to meet shareholders at the annual general meeting. These meetings can be excruciating for executives as they literally face the people they are meant to work for — the shareholders. Shareholders are often angry, but Tuesday was another thing entirely.

In 2017-18, as the stock price plummeted, Telstra Chief executive Andy Penn got paid $2.4 million. And that was just his salary. Total compensation came out at $4.5 million.

Shareholders did not like that. They did not like it one bit.

Now, Telstra made a profit and paid a dividend last year, in a tough market, while putting in place preparations for the future. You could argue CEO Penn did a good job. But apparently that argument was not going to fly.

At an annual general meeting, senior executive pay goes to a vote. Normally this is boring — around 95 per cent of shareholders vote to approve. In Telstra’s case, it was dramatic. Almost 62 per cent of shareholders voted against.

That’s not only an Australian record, but even higher than the proportion of shareholders who voted against executive pay at AMP, the financial company that was so thoroughly dragged through the manure at the banking Royal Commission.

Telstra’s chairman of the board described himself as “deeply, deeply disappointed”.

The vote on Telstra executive pay will now worry them for a whole year. The vote is counted as a ”first strike”. Under Australian law, if a company has strikes two years in a row, the board is spilled. (You only need 25 per cent of shareholders to vote against pay to get a strike, so Telstra really earned their strike.)

UPSIDE

The good news for all Australians is that Telstra has not given up. It is out at sea in heavy weather, but has not stopped swimming. The company has a strategy to get back into Australians’ good books, make a profit, and turn things around.

The company has accepted that its old profits on the Yellow Pages, home phones and global roaming are not coming back, and it is trying its darnedest to get new ones.

They want, so they say, to be like Uber, Amazon or Netflix. Easy to deal with and completely online. A big part of Telstra’s plan is to simplify the number of different mobile plans they offer down to 20 basic options.

The company is also going to cut costs massively — the days of being on hold with Telstra will soon be over as they try to dramatically reduce the 35 million customer calls they get each year, and solve problems online. They are planning to cut lots and lots of jobs, and remove two to four layers of management.

It will be painful. But we as a nation have enough invested in Telstra’s success that we all probably need to hope they succeed.

- Jason Murphy is an economist. Follow him on Twitter @jasemurphy