Cost of living pressures: Perth dad reveals how he saved more than 50 per cent on his car insurance

A father of one has revealed how he managed to save his family hundreds of dollars by making a savvy change to their car insurance.

Cost of living pressures are continuing to hit many Australians hard, so when Liam Gayner realised he could slash his car insurance fees in half he jumped at the opportunity.

The father of one has two cars — the primary car, which his wife drives, and the less “flashy” secondary vehicle that he uses.

But because the family lives close to a train station in Perth, the secondary car only travels about 6000km per year and Mr Gayner realised he was paying a flat yearly rate for the vehicle that was costing too much.

Mr Gayner was previously paying $61.69 per month for his car insurance with CommInsure, but made the decision to go through all of the family’s finances to find ways to save some cash.

The 32-year-old realised by switching to pay-as-you-drive insurer KOBA, his fees would be slashed to just under $30 per month.

“I heard about KOBA because they were doing a crowdsource fundraiser,” he told NCA NewsWire.

“I had a look at the pricing structure and found for me it was a unique fit ... I fall into their target audience, so I estimate that I’m going to drive about 6000km in a year.

“It ends up being just under $30, so it ends up being a bit over a 50 per cent saving.”

Mr Gayner recommends people do the “fairly boring thing” of reviewing all of their insurance, including life, house and health.

“I basically reviewed it all for my current situation because I think like most people, you set it up and then you forget about it,” he said.

“When I was sorting out my health insurance, it was back when I was at uni, I didn’t really care. I didn’t really understand it.

“Same with life insurance where it just gets chucked onto your superannuation and you’re not really aware that you’ve been docked that money the whole time for a policy that might not be relevant to you.

“For example, I’m an engineer by profession and there’s a couple of life insurance options out there that have special deals for your profession.”

Mr Gayner said for him the appeal of KOBA was that he could pay as he drove.

“I would have had to drive 25,000km a year to have the equivalent that I was paying on my previous account,” he said.

“We can decide that if we‘re doing something on the weekend, or we’re going to go on a car trip, we take the wife’s car and leave my car at home.”

KOBA, which launched in November last year, has seen a 70 per cent surge in usage in the past month.

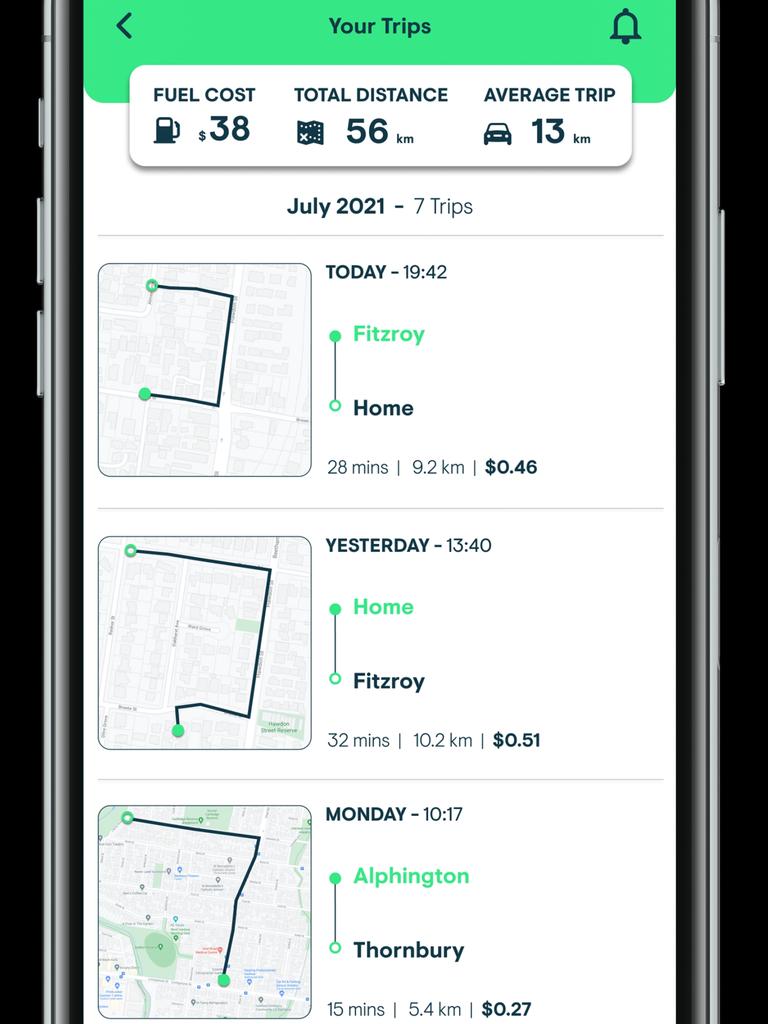

The company uses a small monitoring device that plugs into a user’s car and tracks their distance travelled.

It means that after paying a flat rate for parking insurance, they only pay for what they use.

“It might tell me I drove for nine minutes, 2.1km and it cost 11 cents in insurance. It’s that simple,” KOBA founder Andrew Wong said.

“In the current climate, it’s a great way for people to keep track of their insurance expenses because they can see the cost as it happens.”

Mr Wong said with many people still working hybrid weeks and using their cars less, traditional car insurance did not make sense.

“If you’re driving less and for shorter distances why should you be paying the same for car insurance as everybody else?” he said.

“We’re finding people are using their cars less since the pandemic. Some are still working from home a couple of days a week, others are taking advantage of borders reopening to fly overseas and see loved ones so their car is sitting there unused — and costing money.

“If you are driving 8000km or less a year it’s worth looking at switching over.”

The average car in Australia is driven just over 11,000km per year, according to the latest Australian Bureau of Statistics data.