Western gallium revival begins as miners race to beat China at its own game

Rio Tinto has shown how serious the West is about building an ex-China gallium market, and these ASX juniors are positioning for a share.

Gallium exports have been restricted for over 18 months by China, which controls 98% of the supply chain for the semiconductor ingredient

Rio Tinto has announced plans to produce as much as 40tpa, showing Western companies are serious about building an alternative supply line of the critical mineral

A host of ASX juniors offer purer exposure to the gallium market

After two years of chest-thumping from the West about competing with China in the supply of niche critical minerals, Rio Tinto (ASX:RIO) has taken the most consequential step yet in restoring its competitiveness in gallium.

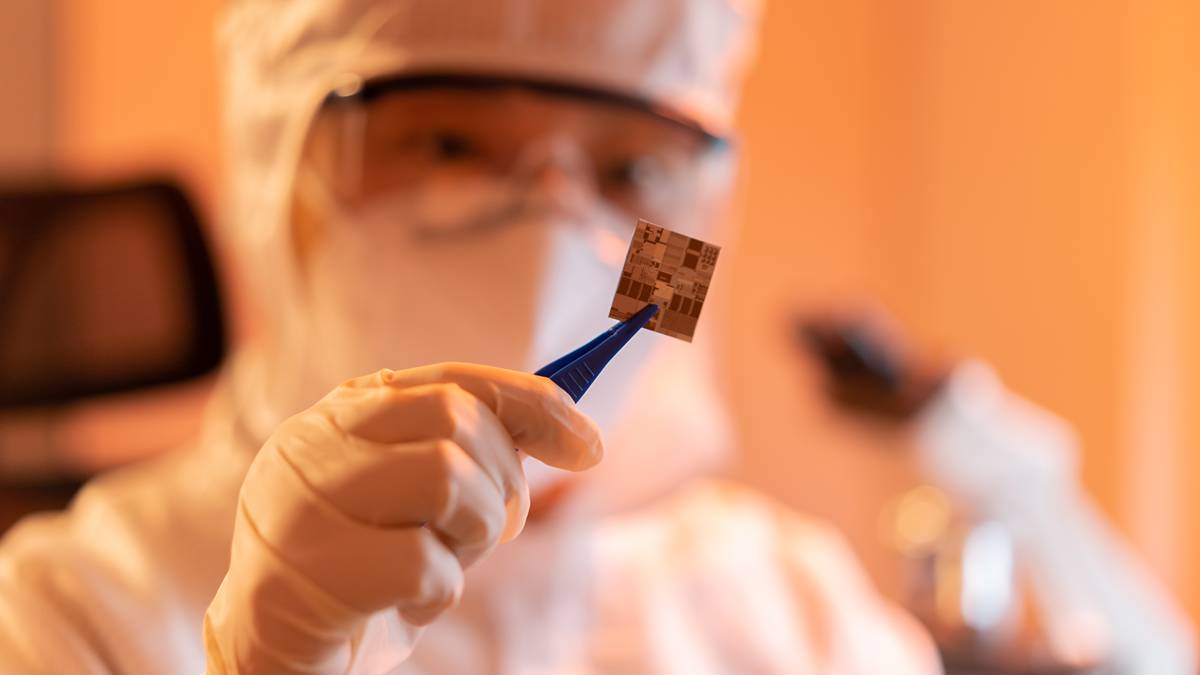

Gallium's low melting point makes it a key ingredient in semi-conductor wafers, with the soft, silver blue metal used in semiconductors, transistors, LEDs, computer chips and defence applications.

The global market is projected to grow from US$2.45 billion in 2024 to US$5.38 billion in 2028 and US$21.53 billion in 2034, representing a compound annual growth rate of 24.3%, the sort of growth rate that would stagger any copper bull.

But some 98% of the supply chain is dominated by China, where gallium is extracted as a by-product of the Bayer Process in alumina refining, as well as from zinc processing.

That status as a by-product has served as a barrier to entry.

But Rio, which runs a global alumina and aluminium business, has taken the first step to plant the West's flag back in the key market, shook by export controls issued by China in 2023 and 2024 that has seen prices rise from around US$200/kg to ~900/kg.

Rio has successfully produced gallium metal in R&D testing at lab scale with New York-based specialty metals supplier Indium Corporation. It's plan is to establish a 3.5tpa demo plant at the Vaudreuil alumina refinery in Quebec which, if successful, could be upgraded to 40tpa, equivalent to between 5-10% of global demand.

While the $165 billion giant is taking a conventional route to gallium production, it has junior upstarts watching closely.

"Rio Tinto’s move into gallium confirms what we’ve long believed for critical metals; that non-Chinese supply has a real future," RareX (ASX:REE) managing director James Durrant said.

His firm has identified some of the highest grade gallium intercepts in Australian exploration history after re-assaying drill core from the Cummins Range rare earths and phosphate project in WA's Kimberley.

"Their approach follows a well-established aluminium-based pathway, but it’s the scale and signal that matter. For explorers like RareX, it reinforces the value of projects like Cummins Range, where gallium is part of a broader critical metals system with real development potential.”

Integration

Rio's investment shows Western companies are positioning to compete with China at its own game, integrating operations so they can supply a suite of critical minerals.

"What’s most significant is the message it sends: that one of the world’s largest resource companies sees a future for non-Chinese sourced gallium and is positioning to meet that demand. That confidence reflects well on the broader gallium space," Durrant told Stockhead.

"At Cummins Range, we’re exploring a different but complementary path, where gallium sits alongside other critical metals, opening up multi-element value and processing optionality.

"Grade remains king, but integration, whether with aluminium or within a broader critical minerals system, is how you unlock true project economics. Rio’s move helps validate that trajectory.”

Australia was, briefly, a gallium supplier, when France's Rhône-Poulenc operated a $50m plant at Pinjarra from 1989-1990, intending to produce as much as 50tpa of gallium 4km down the road from Alcoa's alumina refinery.

But a rare earths facility attached to the plant never materialised and the scale of supply for the market's size at the time meant its very existence tanked prices, making the operation unsustainable.

There are small operators in Germany, while Greece's Metlen is also looking to expand an alumina operation in the country to supply 50tpa from 2028, equivalent to current demand from the European Union.

A standalone gallium mine?

One of those is Nimy Resources (ASX:NIM), which is seeking to establish what it believes will be a "world class" gallium resource at its Mons project in WA.

A greenstone belt only discovered when the company went looking for new nickel and copper discoveries north of Forrestania, located some 370km northeast of Perth, the 90km by 30km wide belt has at its centre the Block 3 discovery.

Covering an area of 3km by 1.5km, Nimy has posted an exploration target there of 9.6-14.3Mt at 39ppm to 78ppm gallium.

Mineralogical assessments by the CSIRO show the mineralisation is likely contained within chlorotised schist, a style of deposit from which gallium has been extracted from one mine in China, according to MD and founder Luke Hampson.

"The fact that Rio Tinto have jumped in I think validates a lot of what people have been thinking about where the gallium market might go," Hampson told Stockhead.

With drilling resuming this week, Nimy's not-so-secret weapon is that drilling so far at Block 3 deposit has shown grades run far higher than they do in bauxite deposits.

The chloritised schist at Block 3 could run between 400-800ppm Ga, according to the CSIRO, presenting the opportunity to upgrade feed from Block 3 in a future production scenario with ore sorting. Metallurgical testing with Curtin University has kicked off.

"If you're producing at 10 or 20ppm, then that's not going to meet a market that's gone from US$2.5 billion to US$20-something billion in terms of value," Hampson said.

"Standalone, we can't see any (in the West). We've had e a look at a couple that were in China.

"They're aluminium-zinc sort of by-product, but we found one that was similar in terms of finding it in the chloride schist, which is a bit of a breakthrough for us because you would have seen that CSIRO was saying the chlorite's holding something estimated between 400 and 800 ppm.

"They're separating it out, getting the chloride separated and then getting the gallium out of that, and the grade obviously goes up significantly."

Nimy is targeting a maiden resource in the next few months at Block 3 and has a collaboration agreement with US-based M2i Global aimed at assuring a supply of gallium to the US Department of Defense.

More juniors target gallium market

They're not the only junior ASX companies engaging in the gallium market.

Over in the United States MTM Critical Metals (ASX:MTM) has its own MoU with Rio's partner Indium Corporation, though it is chasing a different pathway to production.

MTM is planning to use its proprietary Flash Joule Heating technology to process gallium, germanium and indium from scrap running at grades of 15%, 18% and 20% supplied by indium, based on a strategic partnership announced last year.

The firm this week announced a lease on an industrial site in Chambers County, Texas, where it plans to commission a 1tpd demonstration plant later this year.

FJH uses the flash heating of a metal or ore via an electrical current that temporarily heats up the conductor to temperature beyond 3000 degrees Kelvin, vaporising the target metals as chlorides in seconds, then collecting the vapours for refining.

MTM's plan is to process gallium within the United States from Indium's domestic waste stream, supported by a pro-development environment where the Trump Administration is trying to boost domestic minerals production.

Back in WA, Western Yilgarn (ASX:WYX) has also identified high grade gallium results in drilling at its recently acquired Norcia gallium-bauxite project in WA, located around 25km north of its massive Julimar West bauxite resource.

Results have ranged as high as 2m at 134.3g/t Ga2O3 from surface.

Victory Metals (ASX:VTM), meanwhile, has produced gallium successfully in the final mixed rare earth carbonate product from testing at its North Stanmore project in WA.

VTM recently added some 4788t of gallium oxide to North Stanmore, which now has a resource of 247.5Mt at 520ppm total rare earth oxides and scandium plus 26ppm Ga2O3.

"The addition of Gallium to the MRE is an incredible bonus, not a dependency. Our focus remains on developing a world class heavy rare earth project, but the ability to recover Gallium concurrently through our recovery process without additional complexity significantly enhances the value proposition," CEO and executive director Brendan Clark said at the time.

"Gallium is a strategic technology metal with growing global demand, and its inclusion as a by-product positions Victory as an even more attractive partner for downstream and offtake discussions.”

Other companies with gallium prospects include G50 Corp (ASX:G50) at its Golconda project in the US and Axel REE (ASX:AXL), which has engaged SRK Consulting to compile a rare earths and gallium resource for its flagship Caladão project in Brazil.

Its most recent results have included hits of 15m at 60g/t Ga2O3, 6m at 75g/t Ga2O3 and 15m at 58g/t Ga2O3 from surface, alongside REE assays of 17m at 6792ppm TREO, 13m at 5432ppm TREO, 10m at 4500ppm TREO and 4m at 3943ppm TREO.

A maiden resource is due in July.

At Stockhead, we tell it like it is. While Nimy Resources, RareX, Axel Rare Earths, Victory Metals, G50 Corp, Rio Tinto, Western Yilgarn and MTM Critical Metals are Stockhead advertisers, they did not sponsor this article.

Originally published as Western gallium revival begins as miners race to beat China at its own game